PROMINENT tax consultant Koong Lin Loong wants the Madani government to extend eligibility of micro, small and medium enterprises (MSMEs) exempted from issuing e-invoices to those earning less than RM500,000 annually from the current RM150,000.

“SMEs with RM500,000 turnover and below should be exempted at this moment … it may be implemented in stages when e-invoicing system runs smoothly,” the treasurer-general-cum-chairman of the Associated Chinese Chambers of Commerce and Industry of Malaysia’s (ACCCIM) small and medium enterprise (SME) committee told FocusM.

“After all, the government is well-aware of challenges that MSMEs face in implementing the e-invoicing mechanism such as higher operating costs, information technology system upgrade and lack of knowledge regarding e-invoicing.”

Koong was commenting on the recent statement by Finance Minister II Datuk Seri Amir Hamzah Azizan that traders with annual sales below RM150,000 are not required to issue e-invoices

“But the government encourages the participation of small traders in the e-invoicing initiative which is in line with the national aspiration of digitalising businesses,” the former Employees Provident Fund (EPF) CEO had revealed during question time in Dewan Rakyat on Tuesday (July 2).

However, MSMEs are still required to issue consolidated e-invoices which is a form of digital receipts that combines all sales transactions on a monthly basis.

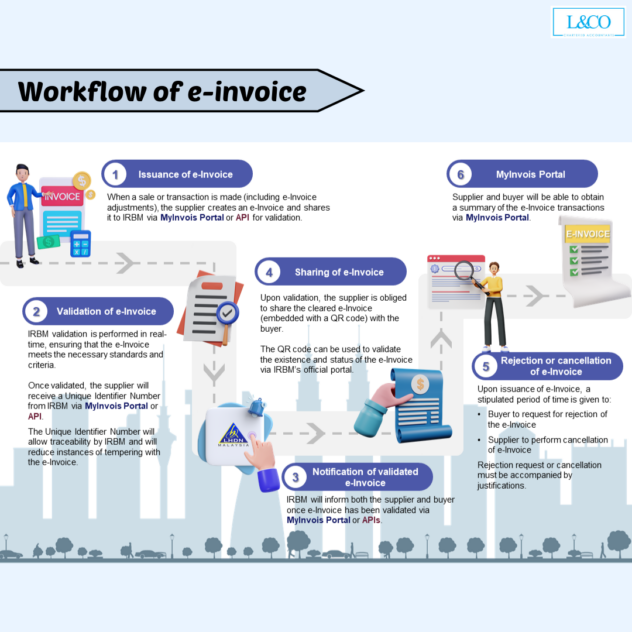

“It (e-invoice) only has to be submitted to the Inland Revenue Board (LHDN) within the first seven days of the month,” he reminded, noting that MSMEs can use the MyInvois portal for e-invoicing purposes without incurring any extra charges.

At the moment, Koong said most developed economies – including neighbouring Singapore – have implemented e-invoicing although such exercise “is not necessarily mandatory”.

“They do but not compulsory … However, China is seemingly pushing hard with its nationwide expansion of its fully-digitalised e-Fapiao programme,” observed the managing partner of chartered accounting firm Reanda LLKG International and executive director of K-Konsult Taxation Sdn Bhd.

With the underlying motive of weeding out tax evasion which has cost the country a staggering RM6.34 bil last year, the Inland Revenue Board of Malaysia (IRBM) had on March 2023 announced the mandatory adoption of e-invoicing through a phased implementation plan.

In the first phase, all businesses with a turnover exceeding RM100 mil must generate e-invoices starting from next month (Aug 1) for transactions encompassing business-to-business (B2B), business-to-government (B2G) and business-to-consumer (B2C). – July 4, 2024