THE Bursa Malaysia Technology Index (KLTEC) gave up its year-to-date gains, made particularly over the past two months, as the sector is experiencing short-term headwinds.

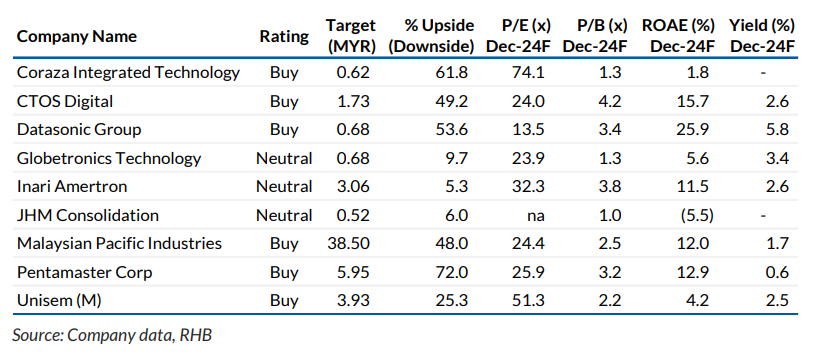

“Still, we advocate investors with a medium-term view to be nimble and build positions amid steep share price corrections to attractive levels. The new semiconductor upcycle has only just begun,” said RHB in the recent Malaysia Sector Update Report.

RHB believes sector demand is showing early phases of recovery, and expects it to gain pace into financial year 2025 (FY25) with stronger growth visibility.

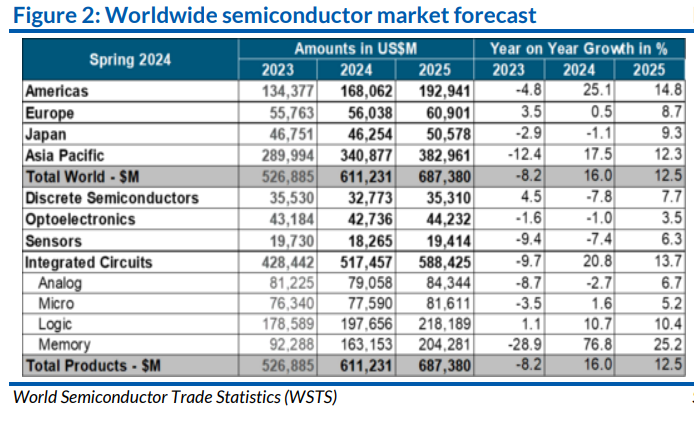

The Semiconductor Industry Association (SIA) has revised its forecasts upward, consecutively to reach USD611.2bil in 2024 (+16%) and another 12.5% growth into 2025.

This uneven recovery is currently supported by the logic and memory chips, thanks to the boom in artificial intelligence (AI)-related servers and equipment.

Going into 2025, a broad-base recovery with growth from all segments is expected.

“Also, early recovery indications in the automated test equipment space, along with traction in the front-end semiconductor space, bolsters our belief for a sustained sector recovery that is expected to gain pace into 2025, where the replacement cycle intensifies,” said RHB.

The second quarter of 2024 (2Q24) results for the sector were largely a miss, mainly on slower-than-expected revenue and margin compression and high expectations.

In fact, aggregate core profit after tax and minority interest sustained the year-on-year (YoY) growth on stronger revenue amid the recovery of the semiconductor space and RHB expects the trend to continue into the second half of 2024 (2H24) and FY25.

Earnings may be underwhelming given the high growth expectation by Street (+66%) for FY24.

“However, we believe the market has factored in the headwinds with downsides now limited amid steep share price corrections over the past months,” said RHB.

Sector headwinds on unfavourable FX could temporarily derail the recovery. Semiconductor players’ earnings should be negatively impacted by the stronger MYR.

Still, it may be partially hedged by their USD purchases, typically 40-50% of cost of goods sold for outsourced semiconductor assembly and test services and 20-40% from equipment makers and those with foreign borrowings.

“We believe the primary earnings drivers are volume loading and margins compression stemming from negative FX movements that can be passed on to customers via renegotiation, revised quotation, and engineering, and process efficiency,” said RHB.

PHLX Semiconductor Sector’s (SOX) surge and KLTEC’s plunge implies the market has mispriced the semiconductor sector’s recovery, which is expected to gain pace into 2025, judging from SOX’s earnings growth expectation.

Besides, a more optimistic tone from the guidance of semiconductor-related companies, albeit uneven, citing volume recovery especially in China, various new opportunities, and clientele from the ongoing trade war.

The beginning of the US Federal Funds Rate cuts should be a boon to the valuation of high-growth sectors like technology.

Downside risks identified by RHB are softer consumer demand, unfavourable FX, obsolescence of technology, loss of clients or contract, and intensifying geopolitical tensions. – Oct 9, 2024

Main image: media.licdn.com