COMPETITIVE pressures and retail fiber average revenue per user (APRU) compression were key standouts in the March quarter, with cost excellence holding up margins.

Axiata’s results were a miss, while mobile network operators (MNO)s chalked numbers that were broadly in line.

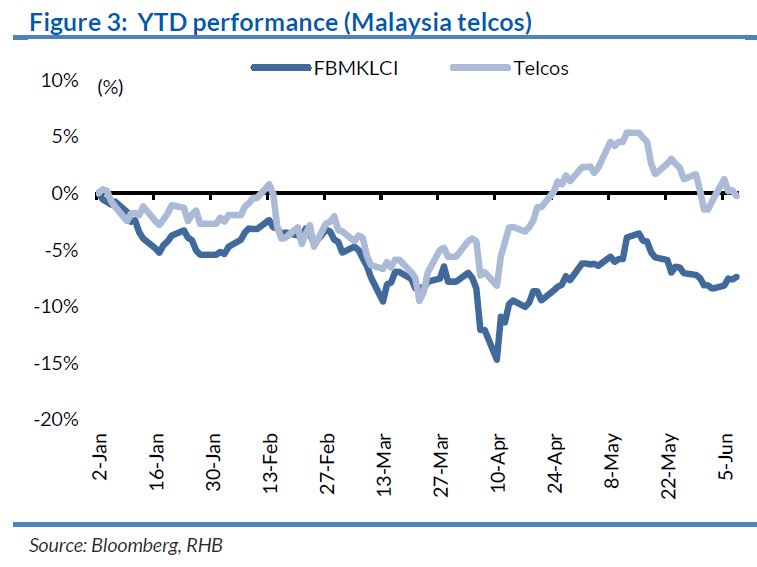

“We still prefer the fixed line plays, over mobile, due to structural catalysts and resilient earnings. Still neutral on the sector,” said RHB in the recent Malaysia Sector Update Report.

Mobile service revenue momentum was tepid, even after accounting for revenue seasonality (shorter quarter), with industry prepaid ARPU at new lows.

Retail fixed broadband (FBB) sub adds contracted further, alluding to saturation in key market centres.

Notably, FBB ARPUs of TM, Maxis, and CDB fell 4-10% quarter-on-quarter (QoQ) with tactical promotions and heavy rebates.

The positive outlier was TDC whose FBB revenue continued to outperform peers, supported by progressive expansion of its fibre footprint and good inroads made into single-dwelling units, a TM stronghold.

Broadly, telcos remained steadfast on cost excellence, which is a narrative that will continue in the current environment.

Read-throughs from quarter one of 2025 (1Q2025) and management comments suggest a cautious second half of 2025 (2H25) with higher 5G wholesale cost, but dividend payouts should be steady.

CDB expects greater synergies, with integration-related costs tailing off in 2025.

Further policy adjustments to the 5G framework should not be ruled out with the completion of the share subscription agreement and cost rationalisation at Digital Nasional (DNB) with the three MNOs (CDB, Maxis and Yes) coughing out a further MYR320 mil each to acquire DNB’s shareholder loan from the Finance Ministry and equity by end-2025.

Competition, weaker-than-expected earnings and adverse regulatory developments remain key risks for the sector and stocks.

Aggregate sector core earnings, excluding Axiata, dropped by 4% year-on-year (YoY) in 1Q25, with declines in both mobile and fixed line earnings of 4.7% and 2.4%.

Mobile core earnings growth of 10.3% QoQ compares with the 39% decline posted by the fixed line players, with the latter impacted by the high base of tax credits at TM in 4Q24.

Fixed line revenue still grew at a faster pace, at 0.8% YoY in 1Q25 relative to industry mobile revenue which contracted by 1.7%. —June 13, 2025

Main image: Simon Kucher