KENANGA Research anticipate that mobile network operator (MNO)s will maintain strong subscriber net adds in quarter two of financial year 2025 (2QFY25) – underpinned by sustained demand for competitively priced entry-level plans and improved customer stickiness.

The latter is reinforced by successful convergence efforts, including the onboarding of CDB’s existing mobile users onto bundled service offerings.

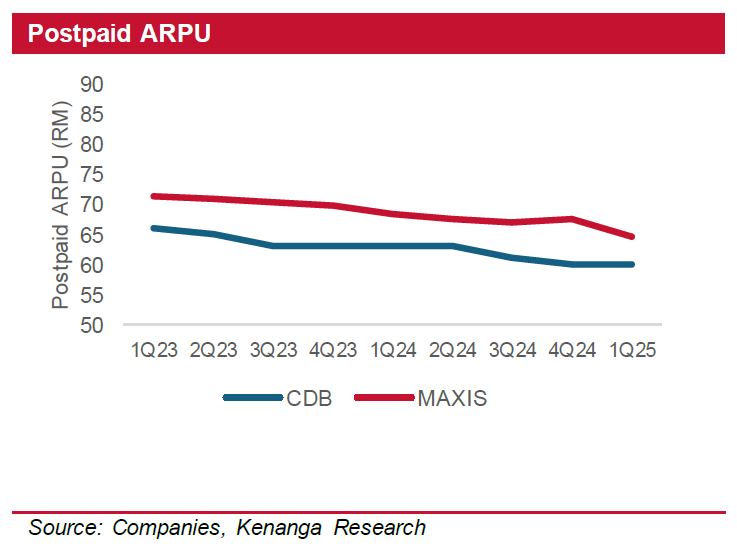

“However, we expect postpaid ARPUs to remain stable quarter-on-quarter (QoQ) as the impact from the change in revenue recognition related to the Maxis Device Care program has already been accounted for,” said Kenanga.

For the prepaid segment, we expect sustained QoQ recovery for CDB’s net adds – supported by the tail end of its ongoing effort to clean up low-value, single-use SIM users.

In contrast, for MAXIS, its net adds remains unpredictable as it continues to fend off competition from aggressive mobile virtual network operators (MVNO) newcomers such as TM.

For the latter, we expect it will continue its push into the mobile market through attractive pricing strategies and bundled device promotions to grow its subscriber base.

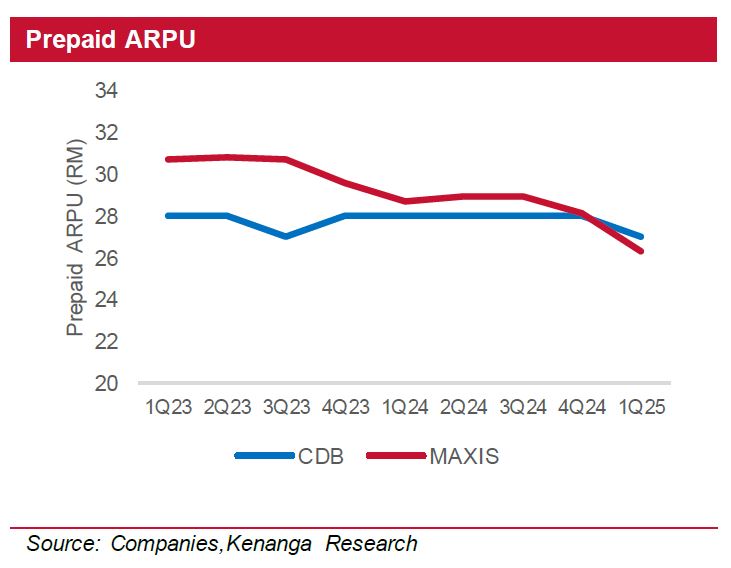

As for prepaid ARPUs, we believe they are likely to stabilise QoQ after the declines seen in 1QFY25 which appear to have reached a floor.

This is especially evident in MAXIS’ ARPU, which has hit a historical low, suggesting that the scope for further price discounting is approaching its limit and likely unsustainable.

Additionally, we believe the trend of prepaid-to-postpaid migration has largely run its course as significant time has lapsed since Maxis introduced its entry-level Hotlink postpaid plans in 2018.

Hence, we believe most price-sensitive subscribers have already shifted over, implying limited incremental impact from this conversion trend going forward.

We expect competitive intensity in the home fibre segment to persist into 3QFY25, though it may ease in subsequent quarters.

This reflects our view that major players (particularly incumbent TM) may likely moderate their aggressive pricing strategies as extended price wars could erode long-term profitability for all players.

In the near term, however, integrated (fixed + mobile) operators are expected to stay aggressive in targeting convergence customers to drive higher 5G traffic volumes.

This urgency is amplified by the looming transition from usage-based billing to fixed minimum 5G access fees, a shift that has already taken effect for TM in 1QFY25.

As competition persists, we anticipate continued pressure on ARPU or ARPA, stemming from steep discounts and increased device subsidies to drive uptake of bundled home-mobile plans.

On the other hand, operators that refrain from participating in the ongoing competition may face subscriber attrition and risk ceding market share.

Over the medium to long term, we see meaningful growth opportunities arising from the continued expansion of digital infrastructure in ASEAN by global hyperscalers and content providers.

These players have already established a strong regional foothold through cloud regions, hyperscale data centers (DC), Points-of-Presence (PoPs), and edge caching infrastructure in key markets such as Singapore, Malaysia, and Thailand.

Looking ahead, we expect further expansion of these digital assets as providers scale to meet rising demand for cloud, content delivery, and AI workloads.

Moreover, the ASEAN region may attract new entrants due to its combination of cost-competitiveness and scalable resources including affordable energy, available land, water access, and strong connectivity infrastructure.

Additionally, ASEAN benefits from a rapidly growing digital population and government policies designed to accelerate development of the digital economy.

To operate effectively, these digital assets require end-to-end, full-circuit connectivity that integrates them into the broader global ecosystem.

While Tier-1 hyperscalers operate their own global internet protocol (IP) backbones, most content providers lacksimilar investments in private submarine cable systems.

Therefore, they rely on local carriers for global internet access and backbone connectivity. This drives rising demand for international connectivity services offered by domestic network operators which are members of global submarine cable consortia.

Key services typically procured include Managed Wavelength, Indefeasible Right of Use (IRU) agreements, Hot Standby Bandwidth Allocation (HSBA) and global IP transit. Despite operating global IP backbones, Tier-1 hyperscalers rarely own terrestrial fiber networks in ASEAN due to strict local licensing regulations.

Moreover, they often outsource the management of terrestrial networks to domestic providers as navigating regional regulatory, operational, and deployment challenges requires localized expertise.

This creates opportunities for local fiber operators to serve as last-mile and interconnection partners. These providers help link hyperscalers’ and content providers’ digital assets with internet exchange points (IXPs), submarine cable systems, and global network ecosystems.

Main terrestrial connectivity solutions include:

(i) half-circuit connectivity (e.g. Singapore to Malaysia cross-border links),

(ii) co-location services at submarine cable landing stations (SCLS),

(iii) DC-to-DC connectivity.

These solutions are supported by a suite of services, including:

(i) fiber leasing (dark and lit),

(ii) managed wavelength,

(iii) IRU agreements,

(iv) HSBA.

We retain our NEUTRAL view on the telecommunications sector – as we await greater clarity on the execution of 5GDN policy.

The eventual alignment of MNOs to either NW2 or DNB’s existing network will be a key determinant of the sector’s earnings trajectory, capex commitments, and dividend-paying ability. —July 1, 2025

Main image: Simon-Kucher