THE quarter two 2024 (2Q24) core results of the telcos were steady on good cost controls, improved CDB merger synergies, and tight competition.

Mobile Network Operators (MNO) continue to slug it out on fibre-mobile bundles with lower ARPU from entry level plans.

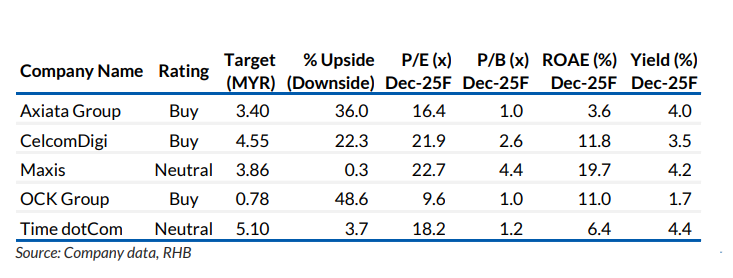

“We lifted our forecasts on CDB and Maxis post results while estimates were lowered for OCK. Key risks are competition, weaker-than-expected earnings, and regulatory setbacks. Maintain NEUTRAL,” said RHB in the latest Malaysia Sector Update Report.

Axiata was the sole outperformer in the June reporting season while OCK fell short of RHB and consensus numbers.

Axiata’s earnings were bolstered by the strong operating performance of its mobile assets in Indonesia, Bangladesh, Cambodia and its towerco unit (edotCo) with first half of 2024 (1H24).

Earnings before interest and tax growth of 40% was ahead of 2024 KPI of mid-teens growth.

OCK’s earnings were crimped by weaker billings from the engineering/contracting segment due to the uncertainties on the 5G second network process with the earnings slack to be partly made up for in 2H24.

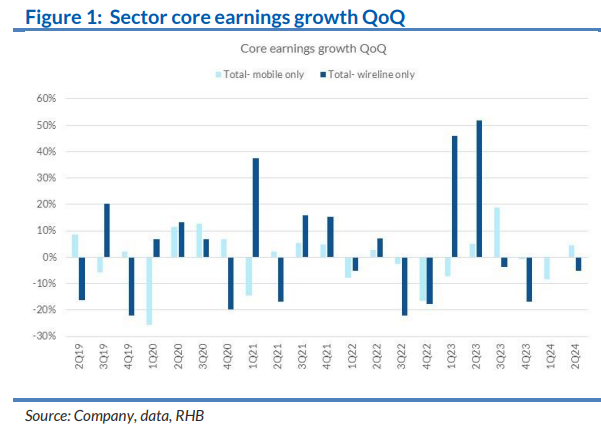

Overall sector core earnings fell 5.4% year-on-year (YoY) in 2Q24, mainly due to the high base of Telekom Malaysia’s (TM MK, NR) earnings in financial year 2023 (FY23) from tax credits and down a marginal 0.4% quarter-on-quarter (QoQ).

Industry mobile revenue (Big-2) ticked up a marginal 0.8% YoY in 1H24. The contraction in industry prepaid revenue persisted on the back of SIM consolidation and pre-to-post migration. This was offset by higher postpaid growth.

Maxis’ MSR share inched higher to 43.7% in 2Q24 from 43.5% in quarter one of 2024 (1Q24), at the expense of CDB whose MSR share narrowed further to 56.3% from 56.5% in 1Q24.

This came from a 2% QoQ decline in prepaid revenue as subs churn more than double sequentially from higher SIM rotation.

On earnings before interest, tax, depreciation and amortisation market share (EMS) (Big-2), Maxis’ EMS improved for the third quarter in a row to 42.8% (1Q24: 41.4%) while CDB’s slipped marginally to 57.2% in 2Q24 from 58.6% in 1Q24.

Based on media reports, 5G subs (4G subs included) have exceeded 14m at end-May or 41% of the population.

With MNOs aggressively upselling/cross-selling FBB packages, TM’s share of industry FBB net-adds have decelerated, with lower net-adds of 10k per quarter on average in 1H24 vs 34k/quarter in FY23.

Four MNOs have submitted their tender for 5G spectrum (TM, Maxis, CDB, and U Mobile).

The outcome is expected by quarter four 2024 with spectrum to be awarded on an apparatus assignment basis.

“We see Maxis as a front-runner for the second 5G network. With TM’s share subscription agreement for Digital Nasional Berhad (DNB) terminated, it is likely that TM’s tender submission will be disqualified,” said RHB.

RHB added that the management believes it can still play a significant role in the nation’s 5G eco-system by being a 5G access seeker.

TM’s non-participation in DNB’s equity and/or the second 5G network is not a concern, as it would be better off providing wholesale 5G fibre backhaul access to 5G network owners, in RHB’s view. – Sept 4, 2024

Main image: kompass.com