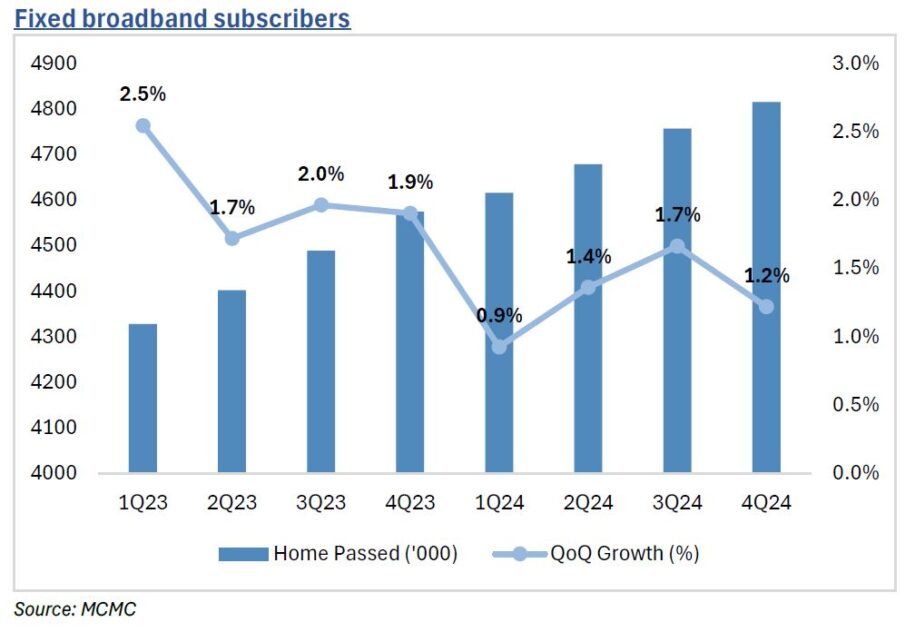

FIXED broadband adoption remained strong, with subscribers rising +5.3% year-on-year (yoy) and +1.2% quarter-on-quarter (qoq) to 4.8 mil, led by increasing demand for high-speed connectivity for remote work, online learning, and streaming.

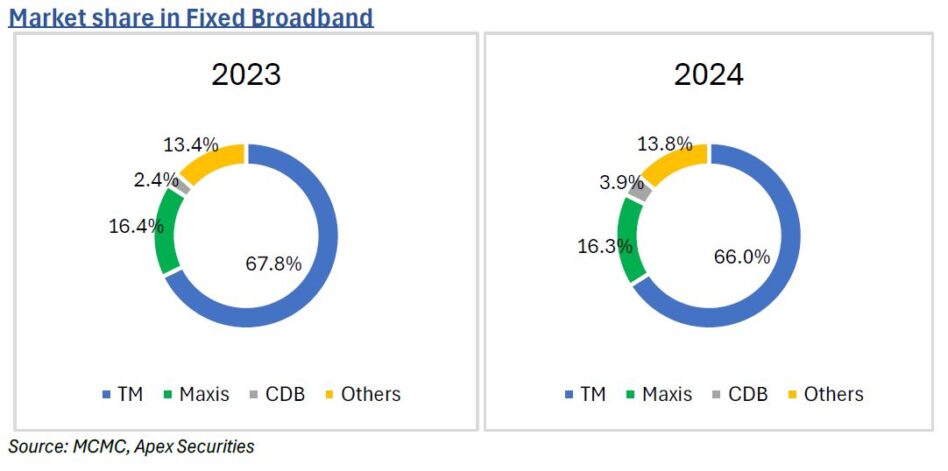

“The Jendela initiative continues to expand fiber coverage, while providers like Telekom, Maxis, and CelcomDigi (CDB) attract customers with affordable plans, unlimited data, and bundled services,” said APEX Securities in the recent Sector Update Report.

5G adoption surged by +119.9% yoy to 18.2 mil subscribers in calendar year 2024 (CY24), while 4G subscriptions declined by 28.1% yoy, reflecting a significant shift in consumer preference.

The transition was boosted by faster speeds, lower latency, and wider 5G network coverage, making it the preferred choice for mobile users.

Telecom providers are accelerating adoption by offering competitive pricing, bundling 5G with postpaid plans, and providing free upgrades, while the increasing availability of affordable 5G smartphones further supports migration.

“We note that CDB’s prepaid subscriber base declined by -4.6% yoy in CY24, in line with the Group’s strategy to reduce reliance on dual SIM customers,” said APEX.

Meanwhile, Maxis prepaid subscribers are relatively more stable, only sliding marginally by -0.9% yoy as part of its pre-to-post migration strategy.

During the quarter, both Maxis and CDB postpaid subscribers have demonstrated healthy growth at +7.9% yoy and +6.9% yoy respectively as both telcos focus on higher-value postpaid customers for stronger revenue stability.

The drop in postpaid Average Revenue Per User (ARPU) for Maxis and CDB is mainly due to increased market competition and aggressive pricing strategies.

Both Mobile Network Operators (MNO) are offering deeper discounts, bundled packages, and more generous data promotions to attract and retain subscribers, which puts downward pressure on ARPU.

The government has identified locations for Jendela Phase 2 and is currently assessing the most suitable technologies for its implementation.

“Although a concrete timeline has yet to be determined, we believe the tender process should commence latest by end-2025,” said APEX.

Furthermore, APEX also notes that contractor performance from Phase 1 will play a crucial role in vendor selection, ensuring that only experienced and reliable contractors are appointed.

This is expected to narrow down competition, favoring players with a strong track record in government projects.

APEX downgraded their rating on the sector to Neutral (previously Overweight), as they expect significant capex for network upgrades to continue squeezing profitability.

“In addition, we believe that stagnant ARPU growth, coupled with fading optimism over the data centre boom, could lead to a de-rating in valuations,” said APEX. —Mar 10, 2025

Main image: KOMPASS