PETRONAS recently posted its best ever performance in FY2022 with net profits soaring 100% compared to that of the previous year. This was mainly due to favourable oil prices.

However, Bursa Malaysia companies providing equipment and/or services to the oil & gas (O&G) sector have yet to see any benefits from the high oil prices. This sector had a very difficult performance over the past 10 years (2013 to 2022).

- The sector median revenue declined at a compounded annual rate of 4.8% while the sector mean PAT (profit after tax) declined at a compounded 185.7% per annum. Accordingly, the sector returns had been declining over the past 10 years. This decline began pre-COVID-19.

- The median SHF (shareholders’ fund) declined at a compounded 2.4% CAGR (compound annual growth rate) per annum while the median debt increased at 2.4% CAGR. The result is that the median debt equity ratio of the sector declined at a 5.2% compounded annual rate.

- Not surprisingly, the median cash from operations also declined at a compounded annual rate of 1.1% CAGR from 2013 to 2022.

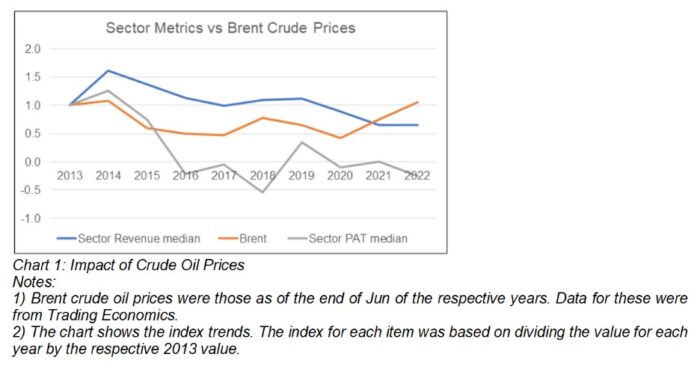

A major reason for the revenue decline over the past 10 years was the changes in oil prices. Chart 1 illustrates how the sector median revenue changed with the Brent crude oil prices. The interesting part is that while the Brent prices in 2021 and 2022 have increased relative to that in 2020, the sector revenue did not follow suit.

Given the declining revenue, you should not be surprised that the PAT of the sector also declined from 2013 to 2022. Looking at Chart 1, you will see that the changes in crude oil prices had a bigger impact on the sector PAT than the sector revenue.

The correlation between the Brent prices and the sector metrics were:

- 0.06 between oil prices and sector revenue.

- 0.44 between oil prices and sector PAT.

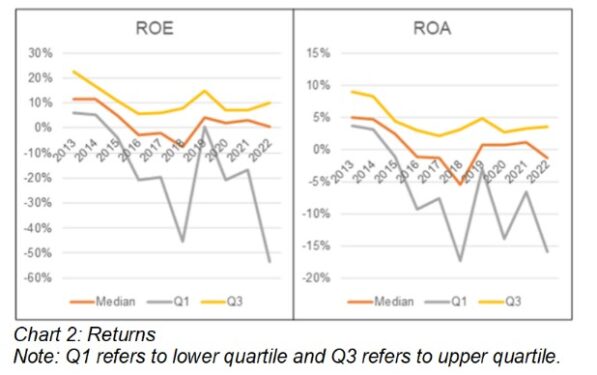

When looking at returns, I considered two metrics – ROE (return on equity) and ROA (return on assets) (refer to Chart 2). The values in 2022 for both the ROE and ROA were lower than the respective values in 2013. It did not matter whether you are looking at the median or quartiles.

You can see that the lower quartile returns were more volatile than those of the upper quartiles or medians. I interpret this as the performance of the smaller companies were more sensitive to oil prices.

A DuPont analysis showed that the declining ROE was due to the decline in the profit margin (linked to oil prices), asset turnover and leverage. In other words, the performance was not just dependent on oil prices but also the companies’ efficiencies and/or productivities.

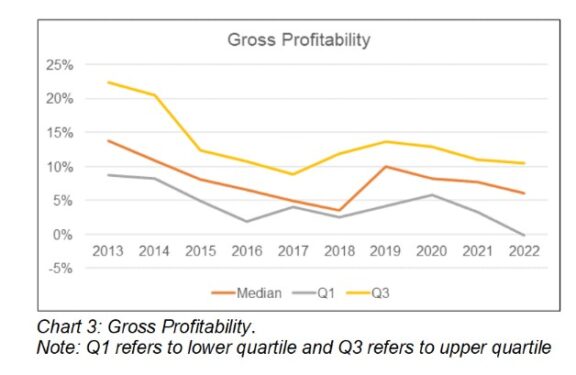

What does the immediate future look like then? One clue is to look at gross profitability which is defined as gross profit divided by total assets.

Professor Robert Novy-Max of University of Rochester has done considerable research into this metric. According to him, gross profitability has roughly the same power as market price to book value in predicting the cross-section of mean returns.

Over the period 2013 to 2022, the sector had a declining gross profitability (refer to Chart 3). This pattern applies to the median as well as quartiles. I found that changes in assets had a bigger contribution here than declining gross profits. Again, it is not just oil prices but also capital efficiency.

If you follow the Novy-Max concept, this meant that the industry returns in the immediate future are not going to be rosy.

The above findings seem to be in contrast with that by the Malaysia Petroleum Resources Corporation (MRPC). According to its latest report, “… Malaysia’s O&G services and equipment (OGSE) industry is showing a gradual recovery following headwinds of recent years ….”

But that MRPC report was based on FY2021 and covered a larger base with both listed and privately owned companies. My analysis is just for 24 listed companies in the sector and I covered till FY2022 (based on the TTM results).

There are two takeaways from my analysis:

- The sector recovery may take longer than expected. I defined a full recovery as when gross profitability uptrends and reaches the 2013 levels. Looking at Chart 3, it will take a few more years.

- Do not be fixated on the O&G prices. The sector recovery is also dependent on companies improving their efficiencies and/or productivities. – March 24, 2023

The data for this article was extracted from “Are there opportunities in the Bursa Energy Services sector?” published on i4value.asia. While there were over 30 companies in this sector, the analysis was based on 24 companies that had data from 2013. Kindly refer to the article for further details on the list of panel companies and methods.

A self-taught value investor who has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of i-Bhd as non-independent non-executive director on Jan 1, 2022.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia