KENANGA Research has downgraded Malaysia’s real estate investment trust (REIT) sector to “neutral” from “overweight” on grounds that earnings improvements are not enough to outweigh rising bond yields.

To date, the Malaysian Government Securities (MGS) has climbed from 3.5% at the beginning of the year before rising to a peak of 4.4% in April and is currently at 4.28%, which is is in line with recent surge in US Treasury yields and expectations of the US Federal Reserve’s sizeable rate hikes going forward, according to the research house.

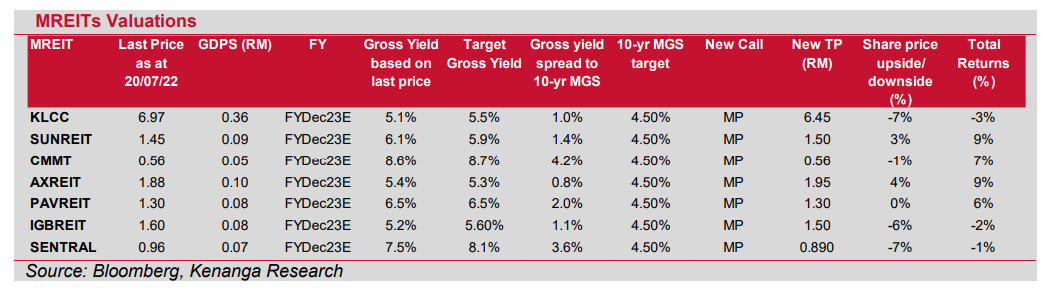

“As such, we have increased our internal 10-year MGS target during the results seasons, and we are pegging Malaysian REITs (MREITs) under our coverage to a 4.50% 10-year MGS target (from 4.15%-4.4% previously),” projected analyst Marie Vaz in a REIT sector update.

“We are comfortable with our 10-year MGS target of 4.50% for now in line with our in-house risk-free rate and as the 10-year MGS appears to be trending sideways in the near term.”

On this note, Kenanga Research said it has rolled forward its valuations to FY2023E to better encapsulate a new normal to earnings as 2022 is poised to be a recovery year, especially for the ailing retail and hospitality segments.

“We are more optimistic on MREIT’s earnings potential going forward, and thus have pegged MREITs to marginally lower spreads to the 10-year MGS target,” justified the research house.

Moving forward, Kenanga Research expects business disruption for malls to be minimal compared to FY2020 and FY2021 as the country has entered the endemic phase while most malls are reporting increased shopper traffic and more importantly tenant sales returning closer to or on par with pre-COVID levels.

“As such, earnings are expected to normalise in FY2022 and improve in FY2023. We are currently expecting year-on-year (yoy) earnings growth of 25% in FY2022 and 10% in FY2023 which is on track to meeting expectations thus far,” noted the research house.

Kenanga Research expects prime malls to benefit the most as (i) their shopper demographic is less affected by the impact of COVID-19 as demand for luxury goods has been increasing post-pandemic; and (ii) they attract tourist who would also be keen to spend in prime malls with the re-opening of international borders this year.

“As such, earnings for these malls have been normalising closer to pre-COVID levels as the economic situation continues to return to the old normal,” opined the research house.

“That said, we do not completely discount the possibility of further economic disruptions from potentially new COVID variants but believe the probability of this happening is low for now.”

Elsewhere, the research house expects the industrial segment to remain stable but not overly optimistic about the office segment save for Kuala Lumpur City Centre (KLCC).

“Over the medium to long run, we believe the office segment may see a decline in demand vs the pre-COVID era, either from shorter lease terms or tenants requiring less office space,” suggested Kenanga Research.

“This is because most companies were able to function seamlessly through work-from-home arrangements during the pandemic. This may also further exacerbate the pre-existing oversupply of offices in the Klang Valley.” – July 21, 2022