DESPITE robust interest from DC operators, Tenaga Nasional Berhad has remained relatively conservative in approving the electricity supply requests.

This cautious stance aims to ensure a healthy reserve margin and secure electricity availability.

According to the latest data from Single Buyer, Malaysia’s reserve margin currently stands at 37%, with 7.5GW of excess capacity.

“This is slightly above the International Energy Agency’s (IEA) recommended range of 20%-35%,” said APEX Securities (APEX) in the recent Sector Update Report.

Johor has emerged as a key hub for global digital infrastructure providers, primarily due to land, electricity, water and renewable energy (RE) constraints in Singapore.

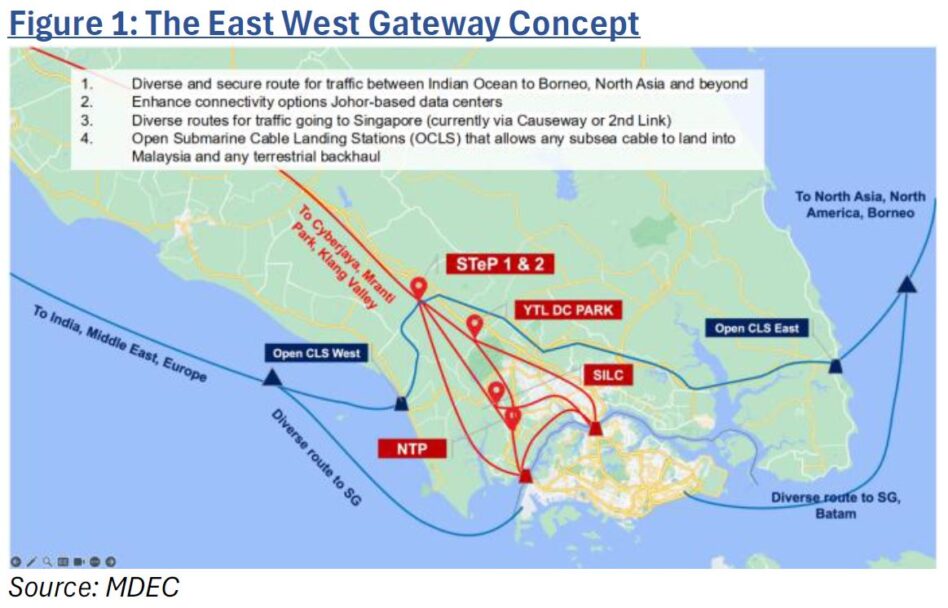

The state’s four major DC clusters are Nusajaya Tech Park, Sedenak Tech Park, YTL DC Park and SiLC Nusajaya, all located in Southwest Johor, aligned with key fibre connectivity routes to Singapore via the southern link bridges.

Despite ongoing demand, Johor has halted new DC approvals over the past three months to undertake an economic reassessment aimed at evaluating whether manufacturing or other sectors should be prioritised.

As a result, interest has begun to shift to other regions. For instance, Negeri Sembilan recently gained traction, with Google appointing GAMUDA to develop a data centre in Port Dickson.

DCs are typically located near international submarine cable landing points, such as Singapore, to benefit from lower latency, cost efficiency, and higher network reliability.

However, due to Singapore’s limited coastal space and high infrastructure density, Johor is increasingly seen as a more flexible and cost-effective alternative.

An East-West gateway concept across Johor has been proposed to boost connectivity and balance digital infrastructure growth.

This could spur new DC developments in Southeast Johor, complementing the existing concentration in Southwest.

According to MDEC, despite concerns over potential slowdown following the introduction of the AI Diffusion Framework and the rise of Deepseek, there have been no cancellations of committed DC projects, and new inquiries remain robust.

While some demand may shift from Johor to Klang Valley or elsewhere due to the moratorium on approvals in Johor, overall momentum is expected to remain intact.

MDEC also notes that Deepseek’s ability to deliver advanced AI capabilities at lower cost and computational requirements could paradoxically result in greater overall demand, consistent with the Jevons paradox.

Meanwhile, recent news reports suggest that the AI diffusion rule will not take effect on 15 May as initially planned, with the Trump administration seeking to revise the chip export policy, though the final scope and stringency of the new rules remain uncertain.

APEX maintains the overweight stance on the sector, supported by the dual engine of energy demand growth: the rapid expansion of DCs and the accelerating electrification of vehicles, along with the ongoing energy transition under the NETR. DCs remain the key contributor to incremental load growth despite policy risks.

According to Bloomberg, the revised chip export policy under the Trump administration is expected to target chip diversion, potentially affecting Malaysia.

“Nevertheless, we believe the impact will mostly be limited to intermediaries or resellers, rather than end users such as AI-focused DCs in Malaysia,” said APEX.

US hyperscalers are likely to remain isolated from any policy changes. Overall, APEX believes DC-driven demand growth is inevitable, powered by the continued digitalisation of the economy.

Peninsular Malaysia is well-positioned to support this demand, offering abundant affordable land, RE potential, and low utility costs. —May 9, 2025

Main image: The Star