AS Malcom X once said, “Education is the passport to the future, for tomorrow belongs to those who prepare for it today”.

Paying for the children’s education is probably one of the biggest financial concerns for today’s parents besides mortgages and car loans.

A recent survey by HSBC reveals that Malaysian parents spend an average of RM110,000 on their child’s education – from primary school up to local university undergraduate level.

For overseas universities it would be at least triple. Hence, if it is not planned properly, it may crave into your retirement funds. The followings are the top three ways to save for your child’s education fund:

- Saving

The easiest way to save money is through hardcore savings. Parents can participate in the National Education Savings Scheme (SSPN) which is an educational savings scheme designed by the National Higher Education Fund Corporation (PTPTN) to help Malaysians save for higher education.

The average return is about 4%-5% which is much higher than most fixed deposit rates. On top of that, parents can enjoy a tax relief of up to RM8,000 per year.

A child must also have a SSPN savings before they apply for PTPTN financing for their tertiary education in the future.

- Insurance

Many parents will buy education insurance policies for their children for both protection and for savings towards universities.

There are two types of education insurance: Endowment and investment-linked policies.

Endowment policies resemble a savings account with insurance benefits whereas investment-linked policy is what the term says, it literally “links” to the unit trust funds. You can select the funds that you want to invest and still retain coverage.

With investment-linked education plans, well-performing funds could earn special dividends and bonuses to be paid when the policy reaches maturity. However, it can also be more expensive to maintain whereas endowment policies typically cost less overall.

Finally, once you have chosen a policy, you need to monitor the funds’ performance to ensure that you are on your way to reaching your goal.

Actual returns declared by the insurance company may differ from the initial estimate due to changes in financial markets. In addition, you can also claim tax relief of up to RM3,000 per year for education insurance policy.

- Investment

Investments can be in the form of unit trust or a stock portfolio. While stock portfolio will require much more time and effort, unit trust investment is much easier and passive. The best way is through the Regular Savings Plan (RSP).

A RSP is a monthly subscription plan that enables you to invest a small fixed sum of money into a particular unit trust on a regular basis.

RSP adopts the concept of dollar cost averaging, an effective strategy that avoids trying to time markets. By investing regularly, more units are bought when prices are low and less units when prices are high. As a result, amid rising or fluctuating markets, the average cost for all the units can be lower than the average price during the same period.

Some of the best performing funds consistently outperform the markets and some even offer double digit returns which may reach your education fund goal faster.

There are pros and cons to each savings option, hence the need to weigh one’s options properly along with one’s risk appetite and affordability. Remember to start saving for our children’s education as early as possible as it is a long-term goal and to take advantage of the power of compounding interest.

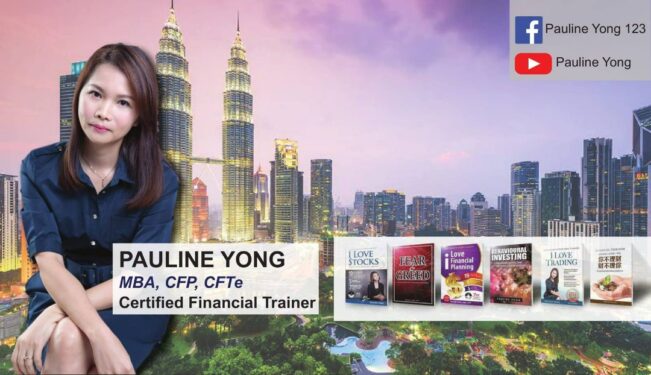

Pauline Yong, CFP is a licensed financial planner with Phillip Wealth Planners Sdn Bhd.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.