GREY clouds loom for export-oriented sectors like technology, but RHB takes comfort that the semiconductor industry was exempted from tariff impositions, and there are limited direct exports of such from Malaysia to the US.

Also, Malaysia should benefit from the surge in rushed orders and the intensified reallocation of manufacturing activities to ASEAN.

The supply chain has emerged stronger from the first phase of the US-China trade war and valuations are at trough levels.

The majority of the Malaysia-listed technology supply chain companies do not directly export components, integrated circuits, or equipment to the US.

As such, they are largely insulated from the direct tariff effects. Most shipping agreements are based on ex-works terms, meaning any potential effects are likely indirect, arising from possible demand disruptions driven by higher prices of goods due to tariffs.

Furthermore, this trade war’s impact is unlikely to mirror the scale of disruption seen during the COVID-19 era.

Unlike the widespread restrictions and partial shutdowns of global economies that significantly halted manufacturing activities and reduced incomes, the trade war affects only the US’ trade with the rest of the world, which constitutes roughly 10-15% of global trade.

Rushed orders and order reallocation will benefit those with excess capacity.

Export volumes may drop for goods made in China, but the demand for chips from the rest of the world would not be severely affected.

“Nonetheless, we expect a bigger shift in the volume of orders to places like ASEAN. Demand uncertainties loom in the mid-term as the flipflop in the US’ external trade policy remains,” said RHB.

This should hinder any potential major capital expenditure and manufacturing reallocation plan, potentially affecting the demand for equipment and causing excessive inventory build-up.

The tariff war may be positive for Malaysia due to the attractive destination (ecosystem, talent, infrastructure), while it may be hit by a lower tariff vs competing countries.

“Should onshoring activities pick up, we do not expect a massive volume of chip production to be relocated out from Malaysia. The lower value-added manufacturing activities are not exactly economically viable for chips to be produced in the US,” said RHB.

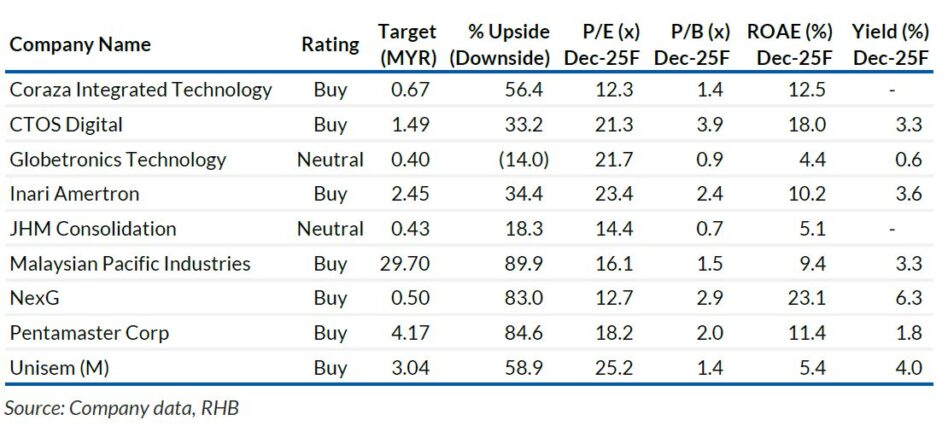

RHB maintains an optimistic outlook, identifying substantial upside potential in positioning on fundamentally strong names with attractive risk-reward profiles. —Apr 25, 2025

Main image: Reuters