PROPERTY and construction-based Ageson Bhd has returned to a growth trajectory despite current challenging operating environment by having taken proactive measures to shift its businesses towards trading of building materials.

Such move will enable the group to offset adverse impact from the COVID-19 pandemic and slowdown in the property market, according to its executive director Datuk Seri Chin Kok Foong.

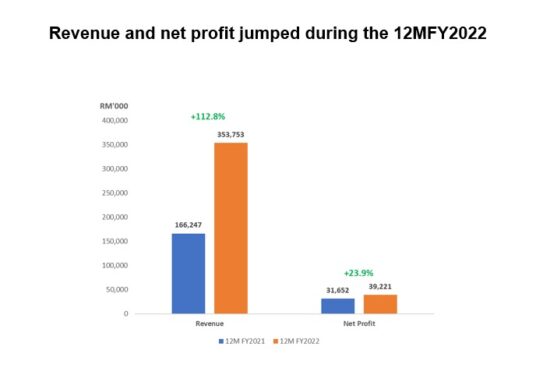

Ageson’s net profit jumped by 23.9% year-on-year (yoy) to RM39.22 mil while its revenue more than doubled to RM353.75 mil for the first 12 months ended June 30, 2022 mainly due to higher billing recognised from the trading of construction material.

The group had on Aug 23 changed its financial year end to Dec 31 from June 30, hence the current financial year will have 18 months. The change is to provide adequate time for new auditors who have yet to be appointed to perform and complete the group’s audit.

According to a Bursa Malaysia filing, the construction division was the sole contributor to Ageson’s revenue as weak market sentiments dampened the property development division.

During the quarter ended June 30, 2022 itself, the group has taken precautions and remained vigilant in in response to the evolving market dynamics and uncertainties due to the external environment.

This is reflected by the group’s impairment of goodwill on consolidation of its subsidiary. For the 12-month in FY2022, the management has booked RM153.8 mil of impairment losses on receivables and goodwill in anticipation of the economic uncertainties.

Going forward, Ageson is cautiously optimistic about the outlook for the remainder of FY2022 as the economic recovery in Malaysia continues at the back of the re-opening of international borders in the region.

“We will continue to expand the business operation based on our core strength which is trading in nature to attract more sales and profits to the group,” stressed Chin. “With the recovery of Malaysia’s economy continuing to gain traction, we believe that consumer and business confidence will gradually recover to pre-pandemic level.”

Given that Bank Negara Malaysia (BNM) has forecasted Malaysia’s domestic economy to grow by 5.3% to 6.3%, this should bode well for Ageson’s business strategy in the near future.

“The resumption of construction works, infrastructure projects and property development will also put the group in a good position to tap into the rising construction activities in Malaysia,” projected Chin.

Moreover, the group is also in a better financial position as seen by the return to positive operating cash flow of RM112.2 mil in the 12-month of FY2022 as compared to a negative operating cash flow of RM76.4 mil in the 12-month of FY2021.

This has helped Ageson to improve its cash and bank balances to RM41.7 mil as of June 30, 2022 from RM9.1 mil a year ago.

Chin, however, noted the downside risks in the remainder of its FY2022 given the ongoing Russia-Ukraine conflict and the recent lockdowns in major cities in China which have led to a sharp rise in inflation, raising commodity and raw material prices both locally and globally.

At 3.57pm, Ageson was down 2.5 sen or 5.43% to 43.5 sen with 2.15 million shares traded, thus valuing the company at RM136 mil. – Sept 2, 2022