LEGACY media in Malaysia face immense competition from new media, including social media, key opinion leaders (KOL), web messaging such as WhatsApp Business Platform (APIs) and others.

With the exception of KOLs, these platforms capitalize on AI-driven programmatic advertising which enables precision targeting, real-time bid optimisation, and cost-efficient ad placements.

By leveraging vast datasets and machine learning algorithms, they dynamically tailor ad delivery to align with user behaviour, engagement patterns, and purchasing intent.

This data-driven approach enables advertisers to achieve superior returns on investment (ROI) compared to traditional media, where ROI is often difficult to measure tangibly.

In addition to advertising efficiency, new media platforms benefit from rapidly expanding user bases, in stark contrast to legacy media such as newspapers and pay-TV, which continue to experience declining circulation and subscriptions.

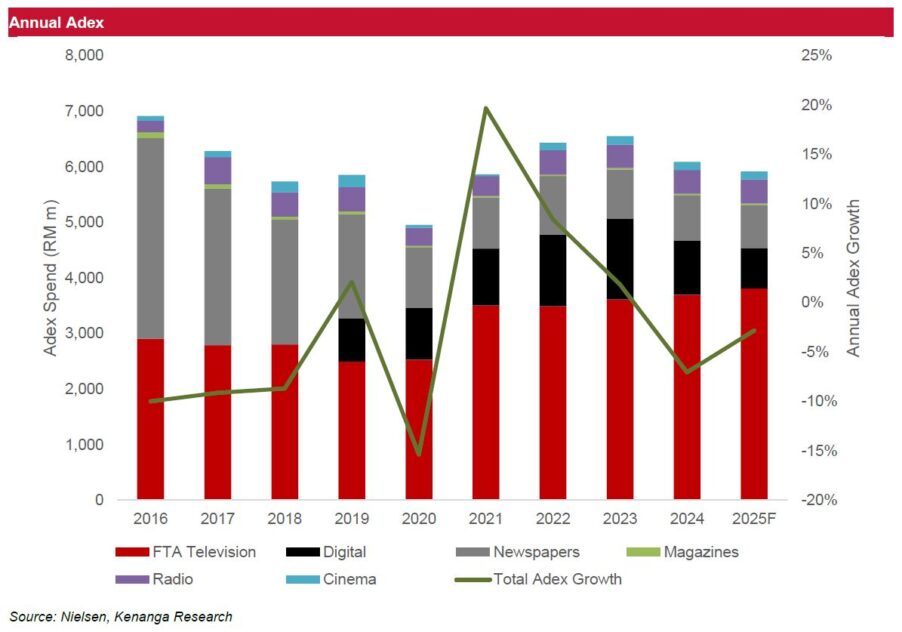

According to Nielsen data, Malaysian newspaper advertising expenditure (adex) has been in persistent decline.

In 2024, newspaper adex plummeted 77% to RM814 mil from RM3.6 bil in 2014. By 2024, it stands at just 23% of its 2016 level – an all-time low.

While radio adex performed better, posting a healthy 8-year CAGR of 9% (2016–24), its market share remained modest at 7% in 2024.

On a positive note, free-to-air (FTA) TV adex demonstrated resilience, achieving a 3% CAGR over the same period.

However, Nielson’s FTA TV adex data likely excludes the significant discounts offered by FTA TV players in Malaysia, driven by intense competition with modern media.

“In our view, traditional media companies, excluding newspapers, must aggressively pivot to stay relevant and viable in Malaysia’s challenging adex landscape,” said Kenanga.

They can be achieved by leveraging on their unique strengths, which include first-party audience data, local content leadership, and strong ties with creative agencies and advertisers.

Key strategies may include:

1/ Geographical expansion: Consolidation with regional players, such as Malay-language media players in Indonesia and Brunei, to unlock new audiences, strengthen regional content distribution and achieve economies of scale.

2/ Diversification into adjacent or new offerings: Provide new offerings to advertisers such as adex analytics, consumer sentiment tracking, AI-driven ad solutions, subscription-based market intelligence services and more.

3/ M&A or strategic exit: Mergers with global players such as media giants, private equity firms, or international telcos, to secure capital, digital expertise and access to a global distribution network.

4/ Additional cost optimisation: Extract efficiencies from current processes via application of technology, such as artificial intelligence, more manpower rightsizing exercises, rationalisation of satellite transponder lease fees and others.

5/ More asset monetisation: Sale of non-core assets and other valuable business units to strengthen the balance sheet, thus ensuring liquidity and financial resilience.

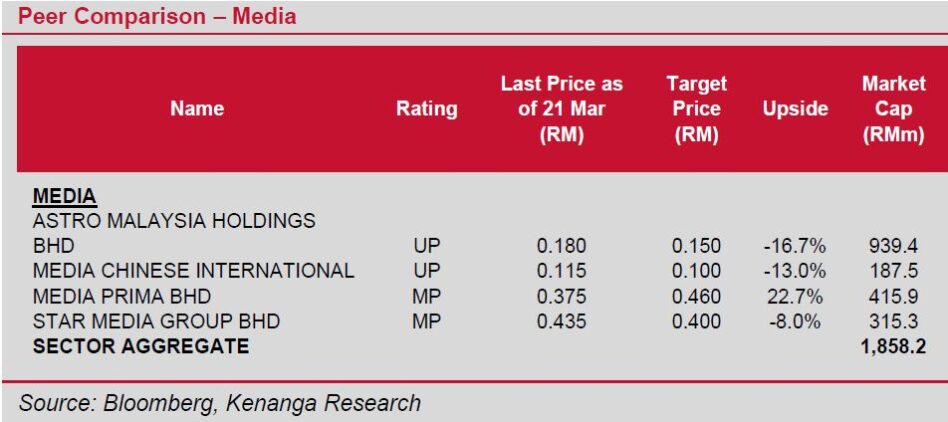

“We maintain our underweight stance on the sector, as persistent competitive pressures weigh on top-line, while structural cost burdens erode profitability,” said Kenanga. —Apr 8, 2025

Main image: AFP Photo