WHEN the Tun Razak Exchange (TRX) first opened its doors in November 2023, the mall created a buzz, attracting a phenomenal crowd of shoppers flocking there to explore the newly launched luxury shopping destination.

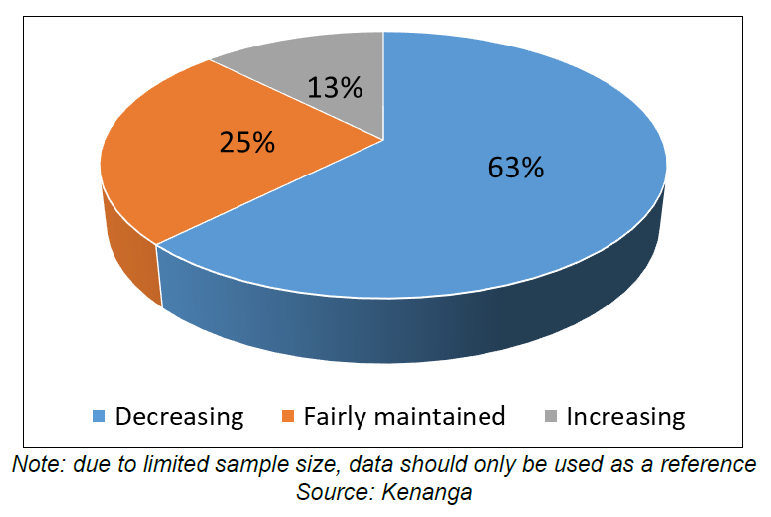

“However, the hype is now gradually fading, leading to a drop of in-store shoppers, according to most retailers we surveyed. Based on our survey, only 13% of respondents is seeing increasing shoppers compared to the beginning of the year,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Kenanga’s observation also revealed that the mall is busy during lunch hours, particularly at the lower ground floor where most F&B outlets are located.

However, retailers said the crowd does not translate to meaningful sales for luxury brands.

The results of the survey indicated that luxury sales at TRX have been on a downward trend since mid-2024, partly due to seasonal factors, such as the absence of major festivals like Chinese New Year or Hari Raya, which typically boost spending.

Interestingly, some retailers have observed that affluent locals are opting to shop abroad, taking advantage of the strengthening MYR to purchase luxury goods at more favourable prices, further contributing to the dip in local sales.

“Although larger brands seemed to be able to command commendable traffic, we also hear from several retailers that they are still struggling to meet their sales target,” said Kenanga.

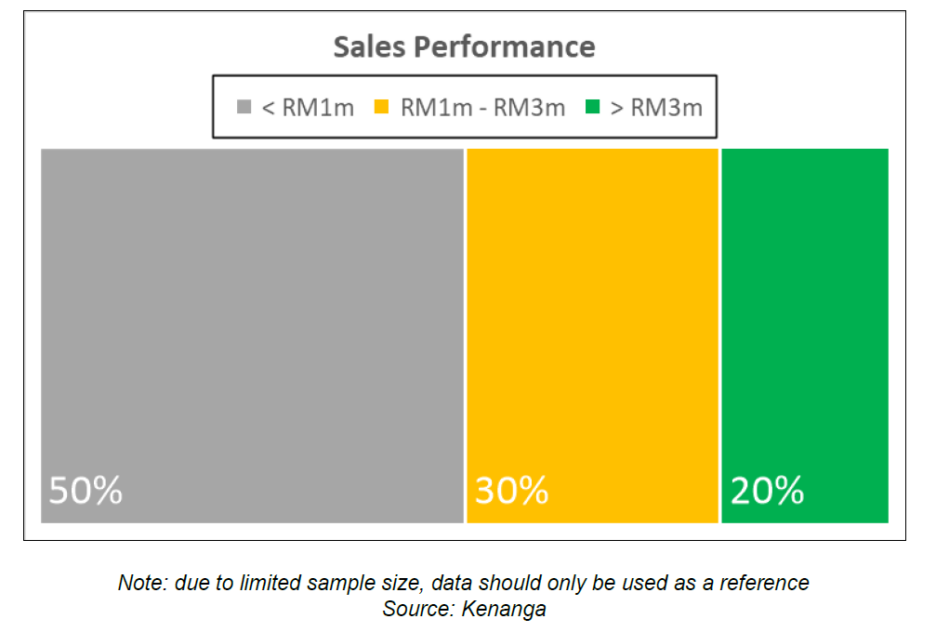

From the data Kenanga compiled (based on 25 samples), the majority are recording turnover of below RM1mil, and they observed that approximately 30% of luxury brands are generating a higher monthly revenue between RM1mil and RM3mil while a smaller 20% of them that can exceed the RM3mil mark.

Despite the growing pie for the luxury market over the years, it is still noteworthy that the immediate effect of TRX’s opening seemed to be a marginal decline in the performance of luxury stores in established neighbouring malls, according to a handful of retailers and respondents.

From a pricing perspective, most luxury brands that Kenanga spoke to have either kept their prices unchanged or implemented modest annual increases.

However, Kenanga encountered some that are slowing down their usual price hikes, adopting a more cautious approach to remain competitive and attract more sales in the current economic climate.

Per their survey, the majority of respondents hiked prices in the lower 0 to 5% range.

Kenanga came to learn that certain brands have set up their flagship store in TRX mall (that is Jimmy Choo, Gentle Monster).

Coupled with the fact that Apple opened its first Malaysian flagship store in TRX also helps to give the mall an edge over competitors.

“On that note, while Pavilion KL and Suria KLCC remain at the top in the market for luxury goods, we are pleasantly surprised that a handful of brands in TRX are doing better than their outlets at The Gardens Mall in Mid Valley, and Genting Premium Outlet in terms of monthly sales,” said Kenanga.

Convenience, in terms of accessibility, was one of the positive feedback we received from shoppers, highlighting both road connectivity and an MRT station directly accessible from the mall.

The TRX mall also holds potential for further growth on the back of government’s initiatives and efforts to transform the area into the country’s next financial hub.

“Nevertheless, we hold the view that TRX’s impact on the existing players in Malaysia’s luxury landscape is not overly concerning. Neither does it diminish the pull-factor of nearby malls,” said Kenanga.

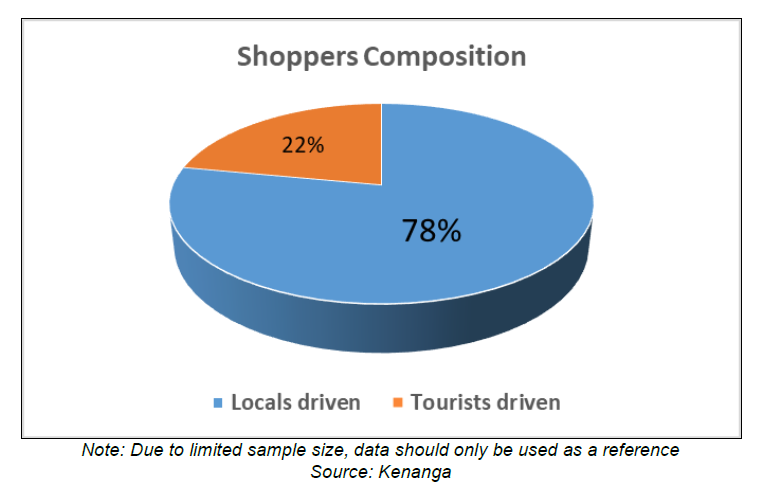

Kenanga reckon that a majority of tourists will still spend their shopping hours in Suria KLCC, drawn by the iconic landmark of Petronas Twin Towers.

In addition, many high-net-worth individuals within Klang Valley would still prefer shopping in the heart of Bukit Bintang where malls like Pavilion KL are situated.

Post-market survey, Kenanga continues to believe that PAVREIT and KLCC which have exposure to luxury malls in the KL city centre that is Pavilion KL and Suria KLCC will give positive risk reward to investor portfolios as the potential impact from TRX is likely already priced into the market. – Oct 23, 2024

Main image: landart.com