TO recap, in Aug 2024, Telekom Malaysia (TM), Celcom Digi (CDB), MAXIS and YTLPOWR, submitted their tenders to develop the second network.

U Mobile’s win comes as a surprise, as Kenanga Research (Kenanga) had postulated that the development of the second 5G network (NW2) will be spearheaded by a single major telco leading a consortium of smaller players.

“This is based on our understanding that the collective subscriber base count of the first 5G network (NW1) and NW2 should be comparable,” said Kenanga in the recent Sector Update report.

Hence, one network does not have an unfair advantage over the other, and 5G traffic would be evenly distributed.

As of end-2022, U Mobile reported a subscriber base of over 8.6mil, which is notably smaller than CDB (20.1mil) and MAXIS (12.6mil) as of quarter two calendar year 2024.

This disparity suggests that U Mobile might need to partner with one of the larger multinational organisations (MNO)s (that is MAXIS or CDB) to ensure sufficient scale.

According to U Mobile, it is excited to collaborate with various stakeholders, including MCMC and other telco companies such as CDB and TM to deliver world-class 5G-Advanced services to consumers.

Kenanga believes this initiative may extend upon U Mobile’s prior collaborations with CDB.

Recall that in July 2024, the two companies, along with ZTE Corporation, successfully achieved Malaysia’s first live broadcast powered by 5G-Advanced technology.

Additionally, U Mobile and CDB share a Multi-Operator Core Network (MOCN) partnership agreement, which includes 100 MOCN sites across Malaysia, with each party contributing 50 sites.

While this development signifies progress, Kenanga remains neutral until further details emerge that will address ongoing uncertainties. Key areas requiring clarifications include:

1/ Specific MNOs that will collaborate with U Mobile and terms of their partnerships.

2/ Final ownership structure of DNB.

3/ Revised terms of DNB’s 10-year 5G access agreement with other MNOs after NW2 launches.

4/ Coverage and timeline targets for NW2, and (v) state of NW1’s financial and operational health.

Nevertheless, this advancement implies the looming award of NW2 roll-out contracts by U Mobile, which is positive for contractors and tower operators such as OCK, AXIATA, and REDTONE.

On the positive side, given that neither CDB nor MAXIS will lead NW2. Kenanga expects reduced commitments in terms of capital expenditure (capex) and resources (for example, manpower and fundraising efforts) associated with building and maintaining a new network.

However, this capex light model is dependent upon the specific stake the MNO will hold in NW2, and their level of involvement. Conversely, there are potential advantages in leading NW2, including:

1/ Enhanced user experience as NW2 could be optimised to integrate seamlessly with the MNO’s existing 4G network.

2/ Accelerated deployment of 5G services for enterprise clients without needing additional approvals.

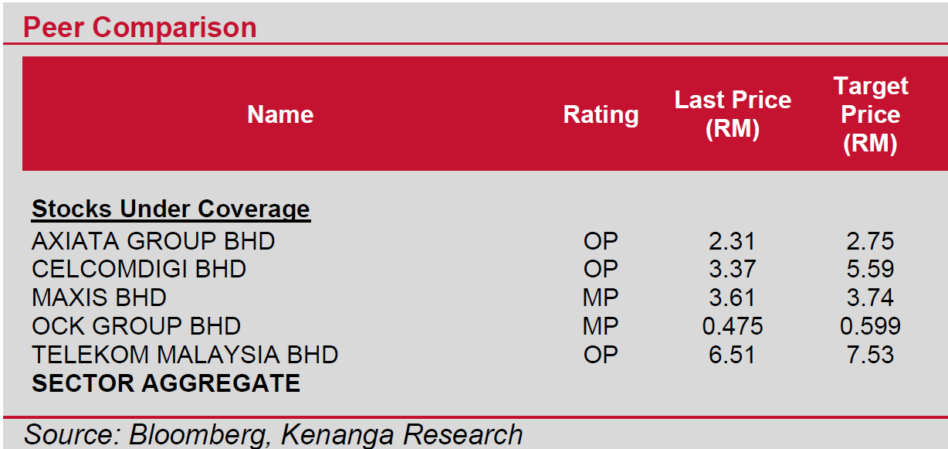

Kenanga maintains the OVERWEIGHT recommendation on the sector, with TM as their top pick. – Nov 4, 2024

Main image: datascientest.com