FOR decades, the issue of old age poverty had been left unaddressed for to become a chronic national crisis.

According to Employees Provident Fund (EPF), about 13.6 million of its members cannot afford to retire.

That figure does not include precarious workers and agri-food producers. The rising old age poverty can be address by introducing Golden Age Pension (GAP).

The society needs to weigh the overall benefits of such social advancement policy.

GAP slows down ageing society

According to the World Bank, Malaysia will become a “super-aged society” as 20% of the population will be above the age of 65 years old by 2056.

This megatrend is caused by rising life expectancy microtrend coupled with declining birth rate microtrend. Since the year 2013, Malaysia fertility rate had fallen below the replacement rate of 2.0 child per women.

Young adults born after 1983 are saddled with student loan, rising housing prices, soaring inflation, stagnant wages and job insecurity.

This was direct impact of privatisation and liberalisation during former prime minister Tun Dr Mahathir Mohamad’s first regime. The polices usually takes about one generation (30 years) to impact the national fertility rate.

In Asian culture, children are expected to provide for their financially insecure senior citizens increasing the financial stress.

Henceforth, youths are getting married older and bearing less child to avoid deeper financial stress. The trend of childless couples is rising exponentially not purely because of choice but because of cost.

GAP will ease the financial stress on young adults to allow fertility rates to rise again.

GAP speeds up modernisation

Senior citizens with certain obsolete means of productions resist new technology. One such example is taxi driver assaulting and preventing e-hailing drivers.

Meanwhile, senior citizens who own small businesses resist strategic infrastructure such as widening of roads, realignment of railways and urban redevelopment.

These senior citizens resist progress to protect their sole “bread and butter”.

Small businesses and taxi drivers earn too little to save or invest for old age, so they work their fingers to their bones.

The loss of existing means of production will make their life more miserable and therefore, the senior citizens “stand and fight” against modernisation which does not benefit them because it is “do or die”.

GAP will allow senior citizens to accept progress and speed up modernisation of Malaysia.

GAP reduces food prices

Senior citizens with smallholder agriculture lands and sea-fishing licenses survive by renting out their lands and boats respectively to young people and undocumented migrants.

The senior citizens will neither surrender nor allow new sea-fishing boats or farming land to protect their meagre rental income.

The “rent-to-live” introduces new input cost on agriculture produces increasing food prices. GAP will dismantle the resistances to allow lands and boats to move into the hand of the next generation without rental cost.

GAP reduces inequality

GAP provides income for senior citizens in small towns and rural suburbs. This increases the base disposable income in those towns and rural areas which would increase productive spending on essentials such as foods, groceries and home repairs.

Subsequently, creating and sustaining small business and jobs will narrow the urban-rural inequality.

Rising labour surplus caused by rural-to-urban migration coupled with the absence of collective bargaining stall wage growth, therefore widening the inequality between labour and capital.

GAP creates and sustains small business and jobs in small towns and rural area to reduce rural-to-urban migration putting upward pressure on the wages.

Thus, GAP will narrow labour-capital inequality.

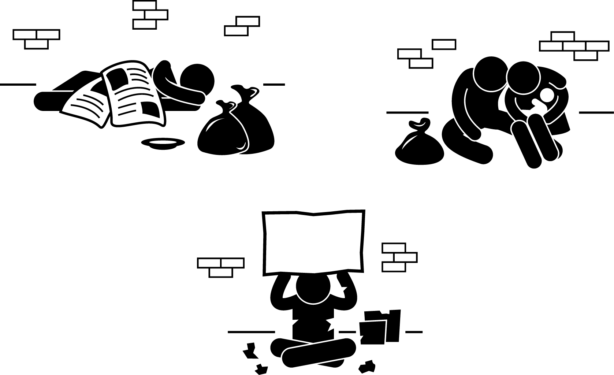

GAP reduce homelessness and begging

Contrary to mainstream narratives, the old-age homelessness and begging are not rooted in laziness.

Since the 1980s, government have forced industrial workers to accept low wages and poor working conditions to allow Malaysia to “get rich first”.

The low salary prevented them from saving for retirement nor purchasing a home. Meanwhile, many of the former high-risk industry workers were unable to bear children due to pollutions and poor working conditions.

These workers had sacrificed their life to make Malaysia the 40th richest country on Earth. Today the senior citizens are left to live and/or beg on streets.

Meanwhile, certain right-wing politicians labelled the senior citizens as lazy to avoid taking responsible. GAP will end old age homelessness and begging for good.

Moving forward

There is need for different intervention such as Golden Age Pension (GAP) to close the income gap between working age and death age.

The discussed benefits of GAP onto our society are merely the tip of the iceberg. The federal government could introduce Golden Age Pension which can be funded by capital gain taxes (CGT) on the ultra-rich.

The World Bank highlighted in its Economic Monitor (December 2021) that Malaysia had achieved the material condition to tax capital gains and inheritances as form of redistributive mechanism.

Capital gain taxes (CGT) does not impact 99% of the population compared to regressive Good & Service Tax (GST). – April 19, 2022

Sharan Raj is human rights activist, environmentalist and infrastructure policy analyst.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.