MAYBANK Investment Bank (MIB) maintains positive on the construction sector, but are now pricing in some risk (shaving target prices) as a result of US’ latest rule on AI data centre location.

“We reiterate that our investment thesis on Malaysia Construction remains very much premised on new infra jobs to support the country’s next phase of development, alongside a still robust FDI/DDI landscape,” said MIB in a recent report.

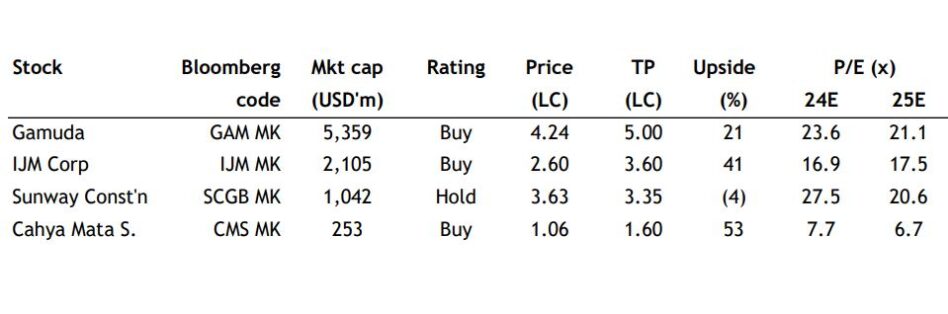

With a narrowed downside potential to our revised target price (TP), MIB upgrade SCGB to HOLD (from SELL); maintain BUY on Gamuda, IJM and CMS.

The US Commerce Department on 13 Jan 2025 issued an Interim Final Rule (IFR) entitled ‘Framework for Artificial Intelligence (AI) Diffusion’ to safeguard US national security while maintaining US’ leadership in advanced AI technologies.

Malaysia is indirectly categorised under ‘Tier 2’ which limits Universal Verified End User (UVEU) data centres’ installed AI computing power in Malaysia to no more than 7% of their total processing power (TPP).

Uncertainty of the impact of this new rule on new AI data centre FDIs has triggered a sell-down on construction stocks with MYR7.48bil in market capitalisation lost, and a 12.4% fall in KLCON Index.

The data centre market in Malaysia has expanded rapidly, supported by cost competitiveness in key infra like land, water and power, and the country’s digital shift.

Concentrated in two locations, that is Klang Valley and Johor, the Klang Valley data centre market is predominantly occupied by local data centre players but it has also, of late, attracted investments by US-based hyperscalers like Google.

Meanwhile, the market in Johor is owned by a mix of foreign and local players like GDS, YTL, UEM/Logos, Yondr and AirTrunk.

Microsoft has also bought a 123-acre industrial land in Kulai, Johor under its USD2.2bil investment commitment to support Malaysia’s digital transformation.

Tenaga estimates 31 data centre projects of total 4.7GW capacity as at Sep 2024, of which 1.7GW have been completed.

CBRE meanwhile estimates 407MW combined IT capacity of existing data centres in Johor (38%) and Greater Kuala Lumpur (62%) as at Jun 2024, with 3.6GW being upcoming and planned (68% in Johor, 32% in Greater KL).

According to DC Byte’s 2024 Global Data Centre Index, Johor is the fastest growing market within Southeast Asia with more than 1.6GW of total supply; the market has evolved to a build-to-suit market with current clusters located in Sedenak Tech Park, Nusajaya Tech Park, and YTL Green Tech Centre Park.

What is not clear at this juncture is the split between cloud data centres and advanced AI data centres (machine learning) in Malaysia, with the latter purportedly the focus of the US new rule on data centre location.

MIB puts forward two observations relating to the new US ruling. Firstly, Malaysia is indirectly categorised under ‘Tier 2’ which limits UVEU data centres’ installed AI computing power in Malaysia to no more than 7% of their total processing power (TPP).

Amid new investment commitments by US-based hyperscalers like Google and Microsoft, the question is how much of their TPPs (that relating to AI) will be located in Malaysia.

Also, what is their existing capacities outside of US and countries of its 18 key partners; have they crossed the 25% cap which necessitates them to take a relook on their investment commitments in Malaysia.

Secondly, Malaysia, which is believed to be in the midst of developing special incentives to attract AI data centre investments, may need to reconfigure its offerings to leverage on this new rule.

This is considering a more ‘competitive’ investment landscape with just 25% of UVEUs’ total AI computing power which can be located outside of the US and the countries of its 18 key partners.

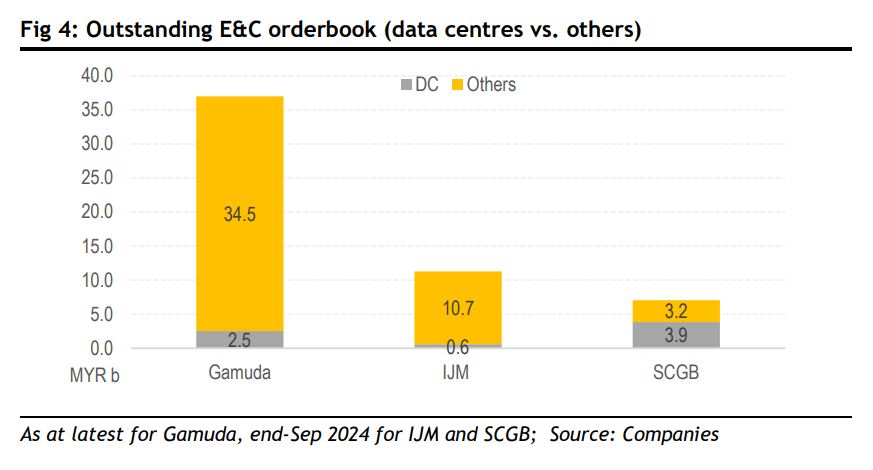

With the exception of Sunway Construction (SCGB), data centre jobs are small relative to the outstanding orderbook size of large engineering & construction (E&C) players under their research coverage

“We remain positive on Malaysia’s data centre market despite the new US cap on AI data centre location outside of UVEUs’ home grounds,” said MIB.

This is premised on the country’s digital shift which requires substantial cloud computing and storage type of data centres.

“We maintain POSITIVE on the sector, which is very much premised on new infrastructure jobs to support the country’s next phase of development,” said MIB.

A still robust FDI/DDI landscape, especially in Penang’s E&E, in the new JS-SEZ, in Sarawak as a regional energy hub, and in the energy transition sectors, will support longer term economic growth, thus creating industrial buildings, logistics and warehousing type of construction jobs.

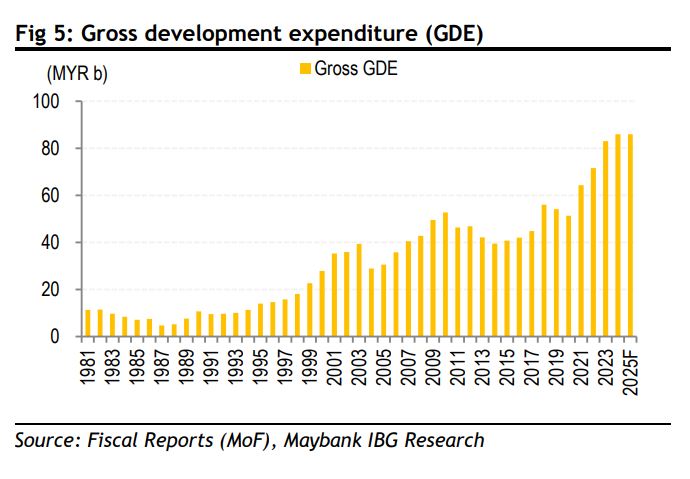

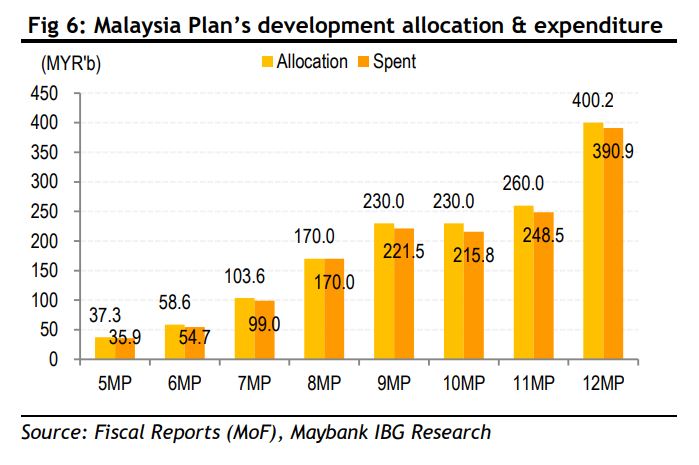

Budget 2025 forecasts the construction sector’s real output to expand by still a robust 9.4%, supported by sustained gross development expenditure (GDE) allocation of MYR86bil, and MYR9bil of public-private partnership (PPP) projects.

Focus will be on projects that directly benefit the people, and on facilities (including infra) that support the industrial areas throughout the country. —Jan 21, 2025

Main image: cisco.com