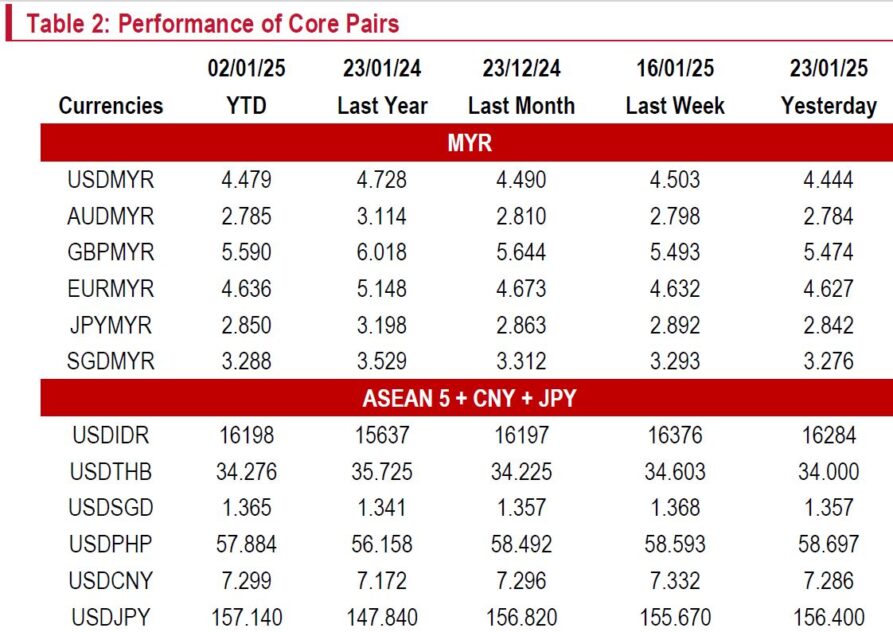

THE ringgit strengthened to around 4.49/USD on Monday, supported by robust external trade data.

The USD Index (DXY) came under pressure as Trump’s Day 1 failed to deliver immediate universal tariffs, triggering a positioning squeeze.

“However, threats of tariffs on Mexico and Canada stabilise the USD’s decline,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

The combination of USD weakness, Malaysia’s stable CPI, and Bank Negara Malaysia (BNM)’s unchanged policy boosted the ringgit to 4.44/USD.

The delay in tariff announcements has injected cautious optimism, though investors remain wary of Trump’s next move.

Despite the market’s strong directional bias, uncertainty over tariff timing has kept USD holdings intact, limiting additional downside pressure.

Market attention now shifts to the US quarter four of 2024 (4Q24) advance GDP release for signs of economic strength.

A potential 25 basis point ECB rate cut could offer support to the DXY, while a possible rate hike by the Bank Of Japan today may cap gains.

With the Fed widely expected to maintain its policy stance, near-term DXY stability is likely.

“We expect the DXY to hold around current levels next week, with key risks tied to Trump’s tariff policies and central bank decisions,” said Kenanga.

A more aggressive stance from the administration could drive USD strength, while a more measured approach may support continued gains for the ringgit.

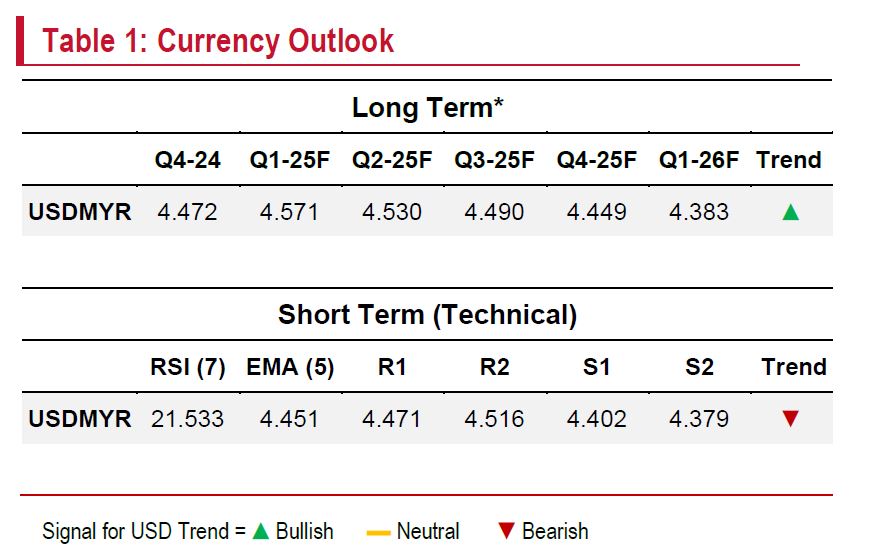

USDMYR is turning bearish, likely to test its five-day exponential moving average at 4.451 as the relative strength index nears oversold territory.

Immediate resistance stands at (R1) 4.471, with a potential move towards (R2) 4.516 if Trump’s policy rhetoric unsettles investors. —Jan 24, 2025

Main image: Reuters