AS of Feb 2025, Ringgit has shown a moderate appreciation against the US dollar, trading at approximately 4.46 MYR per USD.

“This marks an improvement from its position earlier in the year, when it reached a low of 4.51 MYR per USD,” said APEX Securities in the recent Economic Update Report.

The MYR’s trajectory remains influenced by key macroeconomic drivers, including US Federal Reserve monetary policy, US economic data, Malaysia’s economic fundamentals, and broader market sentiment.

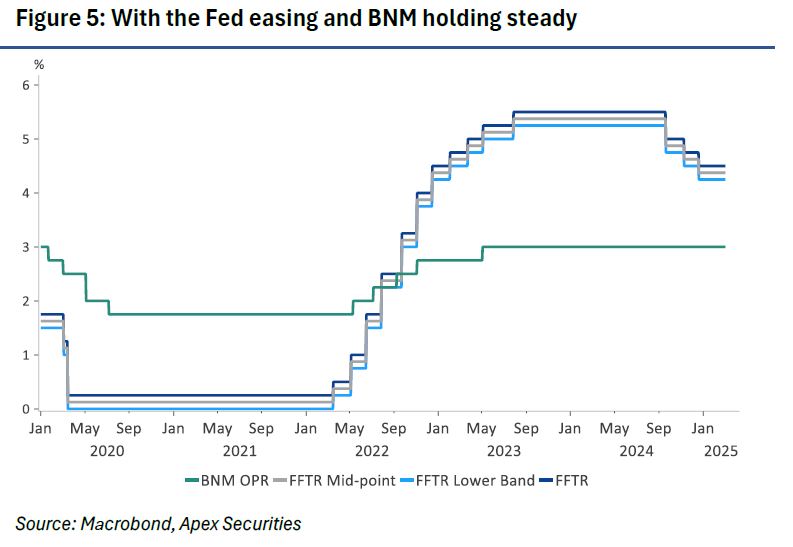

The Fed has maintained the federal funds rate within the 4.25%-4.50% range during its Jan 2025 meeting, aligning with market expectations.

Federal Reserve officials, including Beth Hammack, have indicated that interest rates are likely to remain on hold for the foreseeable future, emphasising a patient approach as inflation pressures ease towards the 2% target and the job market remains stable.

Financial markets currently expect at least two rate cuts by the Fed before year-end, but uncertainty remains about the exact timing and extent of these cuts.

In Jan 2025, the US Personal Consumption Expenditures (PCE) price index— the Fed’s preferred inflation gauge—rose 2.5% year-on-year, slightly easing from 2.6% in December 2024.

Meanwhile, consumer spending declined by 0.2%, signalling potential demand weakness despite a strong labour market.

The US 10-year Treasury yield has hovered around 3.8%, reflecting cautious optimism regarding inflation and rate-cut expectations.

The combination of easing inflation and softer consumer spending strengthens the case for Fed rate cuts, which could weigh on the USD and support MYR appreciation in the coming months.

The DXY Index, has fluctuated within a range of 102.7 to 104.5 in early 2025.

The DXY Index, has fluctuated within a range of 102.7 to 104.5 in early 2025.

The DXY weakened in late February following dovish Fed commentary and as investors took a step back and assessed President Donald Trump’s latest tariff plans adding lumber and forest products to previously announced plans to impose duties on imported cars, semiconductors and pharmaceuticals.

A stronger DXY generally correlates with a weaker MYR, as seen in late 2024 and early 2025, when Fed rate cut expectations fluctuated.

Malaysia’s economy remains resilient, with quarter four 2024 (4Q24) gross domestic product (GDP) growth at 5.0% year-on-year (yoy), supported by robust domestic consumption, stable exports, and infrastructure spending.

Bank Negara Malaysia (BNM) kept Overnight Policy Rate (OPR) at 3%, with no immediate signs of a rate cut despite moderating inflation.

Meanwhile, the narrowing yield gap between Malaysian Government Securities (MGS) and US Treasuries has helped limit capital outflows, providing support to the MYR.

Additionally, the relatively low share of foreign holdings in Malaysian bonds and equities suggests room for increased foreign inflows, which could further strengthen the MYR.

Should US inflation remain sticky, the Fed may delay rate cuts, potentially resulting in strengthening of the USD and pressuring the MYR.

Additionally, deteriorating global risk sentiment—driven by geopolitical tensions or economic shocks—could trigger capital outflows from Malaysian assets.

As an oil-exporting nation, Malaysia’s trade balance is vulnerable to oil price volatility, with a sharp decline potentially weighing on the MYR.

Domestically, unexpected policy shifts or economic management changes could further dampen investor confidence, adding to currency risks.

Potential Fed rate cuts in mid-to-late 2025 could weaken the USD, supporting MYR appreciation.

Malaysia’s resilient economic growth, stable monetary policy, and strong corporate earnings outlook are likely to attract capital inflows.

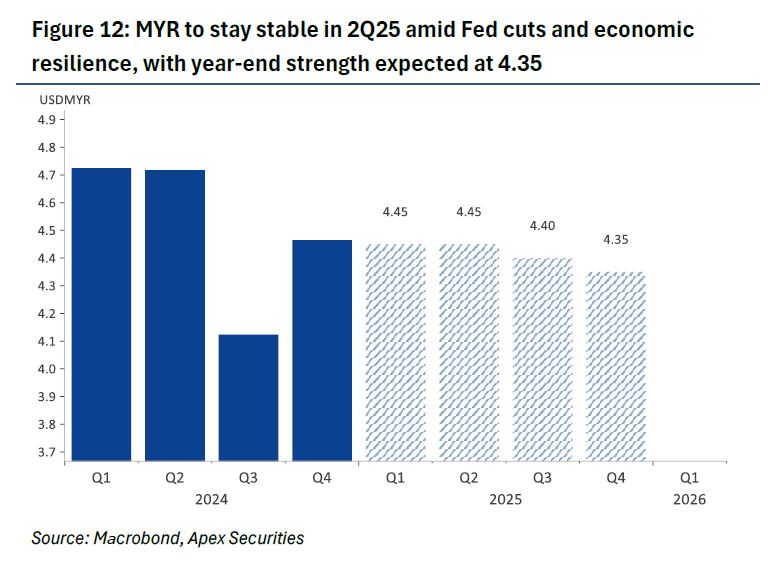

“In the near term (2Q25), we expect the MYR to trade around 4.45 per USD, with limited upside as markets have largely priced in anticipated Fed rate cuts,” said APEX.

However, in the medium term, the MYR could strengthen further, assuming the Fed proceeds with rate cuts and Malaysia continues to draw foreign investment.

While downside risks persist, a gradual appreciation of the MYR is likely toward late 2025, supported by Fed easing, Malaysia’s economic resilience, and improving global risk sentiment.

“Despite short-term volatility, the medium-term outlook remains constructive, and we maintain a cautiously optimistic view on the ringgit’s trajectory, keeping our year-end forecast at 4.35,” said APEX.—Mar 4, 2025

Main image: Reuters