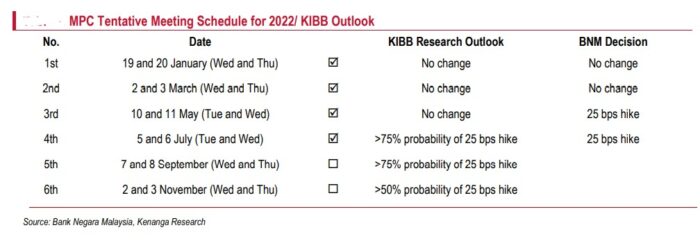

THE much anticipated 75 basis points (bps) key interest hike by the US Federal Reserve will lend credence to Bank Negara Malaysia (BNM) to maintain its hawkish tilt by raising its overnight policy rate (OPR) by at least 25bps each at its remaining two Monetary Policy Meetings (MPC) for 2022.

“Domestically, inflationary pressure is mounting, registering hotter-than-expected 3.4% in June (May: 2.8%) on the back of pent-up demand and tourism-led spending due to the re-opening of international borders and removal of COVID-19 restrictions,” opined Kenanga Research’s chef economist Wan Suhaimie Wan Mohd Saidie and team in an economic update.

“The Fed’s aggressive posturing and obsession to tame inflation indicate that it would continue to sharply raise interest rates at the expense of growth going forward. (Moreover), the International Monetary Fund (IMF) has recently revised down global growth for this year and warned of another recession, albeit mild, after the last one barely two years ago.”

In a post-meeting media conference, Fed chairman Jerome Powell nevertheless quelled concerns by asserting that the US economy is not in recession by citing an unemployment rate that is still near a half-century low and solid wage growth and job gains.

However, AmBank Research’s group chief economist/research head Dr Anthony Dass expressed belief that the Fed’s work is far from over.

“It would be digesting two jobs and inflation reports plus the Fed’s Jackson Hole symposium (August 25-27) before the Sept 21 FOMC (Federal Open Market Committee) meeting. Jackson Hole is when we will get a clearer indication from the Fed,” he pointed out.

“In our view, there are many possibilities. Hence, it is not a surprise for the Fed to be somewhat ‘vague’ in its forward guidance. The Fed chair’s comment on the size of future rate hikes will depend on data and smaller rate hikes will be appropriate at some point make obvious sense.”

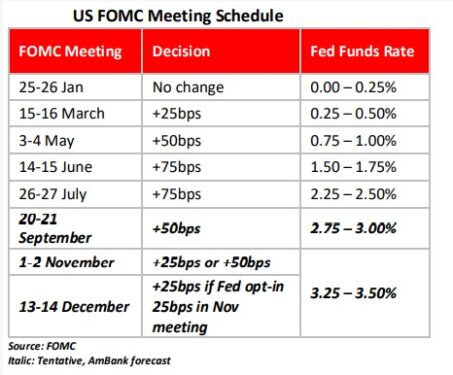

Moving forward, AmBank Research expects a 50bps hike by the Fed in September and 25bps or 50bps in the November FOMC meetings “and much will depend on the data with a final 25bps hike in December”.

“This would mean another 100bps-125bps by end-2022 to normalise at 3.25%-3.50%,” added AmBank Research.

On the forex front, the research house expects the greenback to stay strong due to (i) the Fed’s still hawkish stance and that will continue to strengthen the US dollar at least into September; (ii) instability in risky assets; and (iii) geopolitical risks for the European region due to the Russian gas crunch.

“We expect the US dollar to remain as the safe-haven currency and should retain some strength,” foresees the research house.

“On that note, there is still upside risk for the US$/ringgit to reach the 4.50 levels between now and September. We maintain a 25bps hike by BNM in the September MPC meeting.” – July 28, 2022