US CUSTOMS and Border Protection released an updated list of exclusions over the weekend, which limits the scope of tariffs by exempting key consumer electronics products from Trump’s 145% tariff on imports from China and the baseline 10% global tariff on nearly all other countries.

The exclusions cover smartphones, laptop computers, hard drives, computer processors, memory chips, and even semiconductor equipment.

Although semiconductors were excluded in earlier rounds, this recent development is arguably more impactful because it involves consumer electronics like PCs and smartphones, end-products primarily assembled in China and thus directly at risk of the 145% tariff.

Without these exemptions, the repercussions on pricing and end-demand could have been severe.

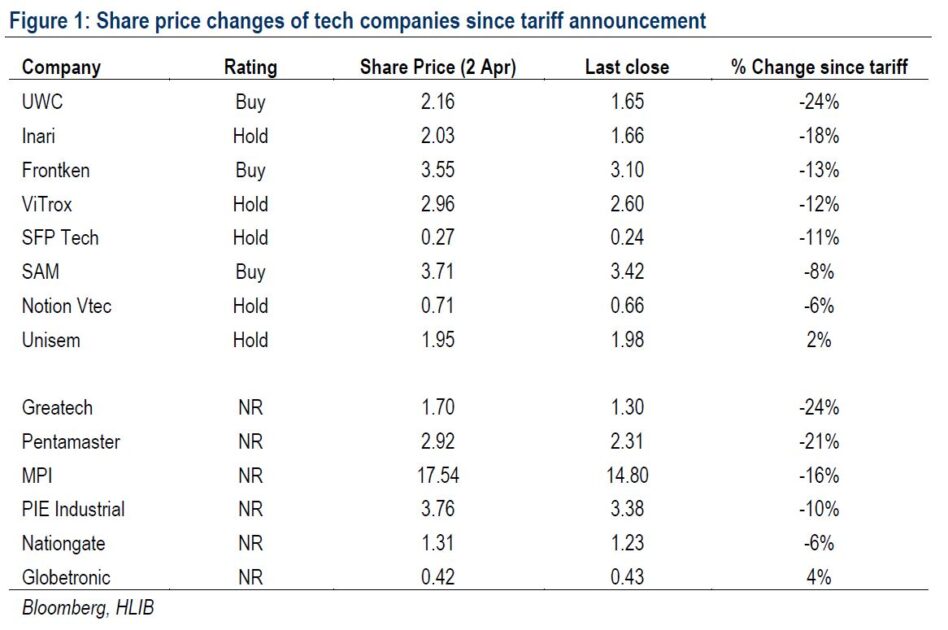

“We believe this recent development opens the door for a near-term relief rally across the Malaysian tech sector, even as we recognise the potential risk of future tariff reinstatements and the likelihood of earnings and target price cut amid softer sector fundamentals,” said Hong Leong Investment Bank (HLIB) in a recent report.

Within the Malaysian tech sector universe, several names have seen significant declines since the April 2 tariff announcement.

In a major regulatory shift with huge implications for the global semiconductor supply chain, China’s General Administration of Customs has revised its rules to determine the country of origin for imported chips based on the wafer fabrication location, rather than the design or packaging origin.

This change strategically benefits US fabless chip designers such as AMD, Nvidia, and Qualcomm that outsource fabrication to Taiwanese foundries like TSMC, effectively shielding their products from China’s newly imposed 125% import tariff on US-origin goods.

Conversely, this rule will penalise IDMs (Integrated Device Manufacturer) such as Intel, Texas Instruments, Analog Devices, and GlobalFoundries whose chips are fabricated within the US, thus subjecting their chips to the full tariff.

Given that these IDMs have integrated facilities and do not outsource significantly, we believe there is little to no impact on Malaysian OSAT players such as Unisem and MPI.

Key RF players integral to the iPhone supply chain, namely Broadcom, Skyworks, and Qorvo, fabricate wafers at their own US facilities.

Under the revised Chinese customs policy, RF chips from these companies are now poised to incur a 125% tariff when imported into China for the final iPhone assembly, even if they are packaged outside the US beforehand.

“For example, we understand Broadcom manufactures its RF FBAR filters at its Fort Collins, Colorado fab before sending them to Malaysia for packaging and final testing,” said HLIB.

While this shift raises potential concerns for Inari’s RF segment (60-70% of sales), several mitigating factors merit consideration.

First, there are no other suitable alternatives to Broadcom’s high-performance FBAR filters, as competing RF suppliers such as Qorvo also fabricated their chips in the US (barring Qualcomm which Apple is strategically replacing).

“Second, we estimate the RF front-end subsystem to constitute only 5–7% of the total bill-of-materials (BOM) for the iPhone,” said HLIB.

Consequently, cost increases stemming from tariffs, though not ideal, would likely remain manageable if unavoidable.

“Finally, recent US tariff exemptions on consumer electronics suggest some goodwill is being built, which hopefully China might reciprocate in our view, for the tech supply chain at the very least,” said HLIB.

HLIB continues to be cautious on the sector, given also mixed fundamentals over the short to mid-term.—Apr 14, 2025

Main image: Crowe