ON April 2, US President Donald Trump said the US would impose specific reciprocal tariffs on roughly 50 “worst offenders” and a baseline tariff of 10% on all countries.

The key global glove manufacturers, who are subject to these customised tariff rates includes Malaysia at 24%.

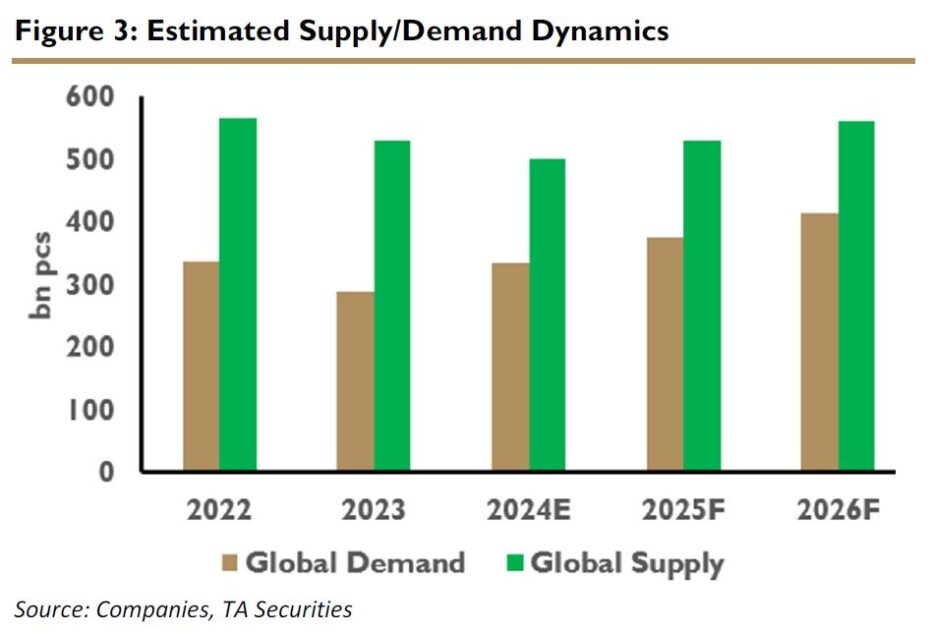

“We note that the US market is the largest consumer of gloves by country, accounting for 30-35% of global glove demand. As a result, the estimated annual consumption of medical gloves in the US is approximately 112 bil to 131 bil gloves in 2025,” said TA Securities (TA) in the recent Thematic Report.

In terms of market share in the US market, TA gathered that Malaysia’s estimated market share of medical gloves in the US is around 44%, while China’s is approximately 42% as of December 2024.

Meanwhile, Thailand accounts for about 8% while Indonesia and Vietnam together make up 6%.

“For gloves manufacturers under our coverage, Hartalega exposure to the US market is the highest at 62.9% of its revenue, followed by Kossan ( 52%), Supermax (28%) and Top Glove (23%),” said TA.

Based on their channel checks with Malaysian gloves manufacturers, they believe that this is beneficial for them, as Malaysia has the lowest reciprocal tariff rates compared to regional peers such as China, Thailand, Vietnam and Indonesia.

Additionally, it would enhance pricing competitiveness against these peers.

For instance, Malaysian glove manufacturers would be able to price their gloves’ average selling price (ASP) slightly higher than Thailand’s, perhaps 8% higher, since Thailand’s reciprocal tariff is 12% higher than Malaysia.

Moreover, some manufacturers believe that there would be no significant change to their ASP, as US customers would be the ones paying for the tariff portion.

The export-import dynamic would remain status quo, in which Malaysian players would only quote the glove ASP, while the tariffs would be added by the US importers.

Thus, US customers are the ones who are paying for the tariffs. Assuming US customers fully bear the tariffs, margins would remain resilient.

The difference in tariffs between China and Malaysia has widened. With an additional 34% tariff added on top of the current 70% tariff on Chinese-imported medical gloves, the total tariff rate would be 104%, compared to the 24% tariff on Malaysia.

Based on the current Malaysia glove ASP to the US markets of about USD19.5-20.5 per 1000 gloves, the ex-tariff ASP would be USD24.2-25.4 per 1000 gloves.

At USD24.2-25.4 per 1000 gloves, the Malaysia gloves ASP is still at least USD3 cheaper than Chinese producers. —Apr 4, 2025

Main image: The Malaysian Reserve