VALUE and growth are two fundamental styles of equity investing. Value stocks represent companies that possess good fundamentals but might be underpriced as their valuations may be lesser than historical average or industry peers.

On the other hand, growth stocks represent companies that are expected to deliver high levels of earnings growth in the future.

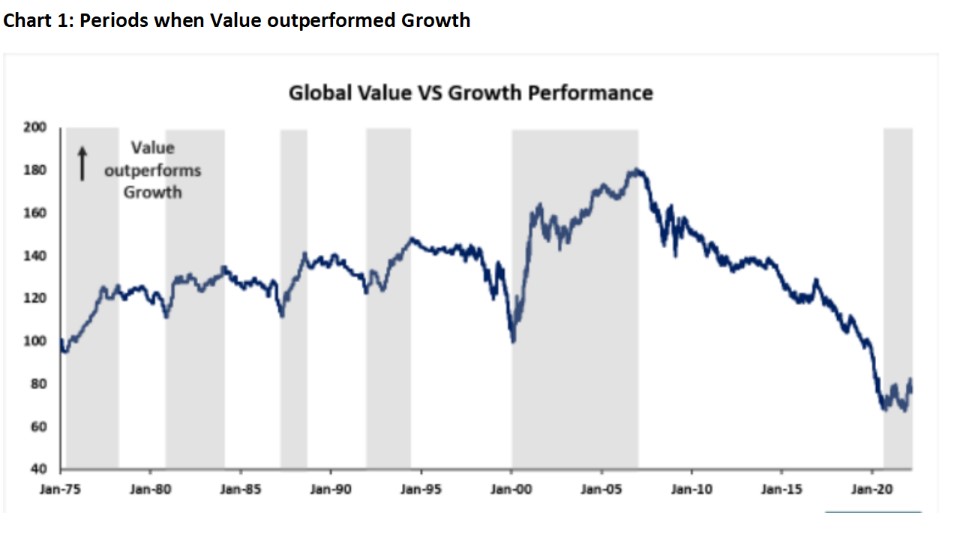

The growth versus value debate has again resurfaced since the start of 2022. The escalating global inflation concern has fuelled a fierce rotation back to value as growth was hit by the prospect of increasing rate hikes.

In the year-to-date (YTD), value indices have outperformed growth indices with Japan and China value indices demonstrating the strongest outperformance.

Despite the solid performance, we continue to see rotation opportunities in value and ongoing headwinds for growth. In this article, we outline the reasons why and strategies to increase exposure to value while diversifying away from growth.

Value composition

The value factor has always shared an intimate relationship with inflation and economic growth. For decades, the value composition has overweighted sectors such as financials, industrials, and energy.

These are inflation-sensitive and cyclical sectors that are highly levered to economic growth. As a result of these exposures, value indices typically excel during periods of rising economic growth and inflation, leading to outperformance against its growth counterpart.

Inflation, the dominant value driver

Inflation is often the by-product of an economy that is growing above potential. However, in this cycle, it has been supercharged by factors such as a monetary-induced demand, supply-chain disruption, and mounting commodity prices.

This has resulted in multi-decade high inflation readings across major economies that have fuelled value performance over the past few quarters.

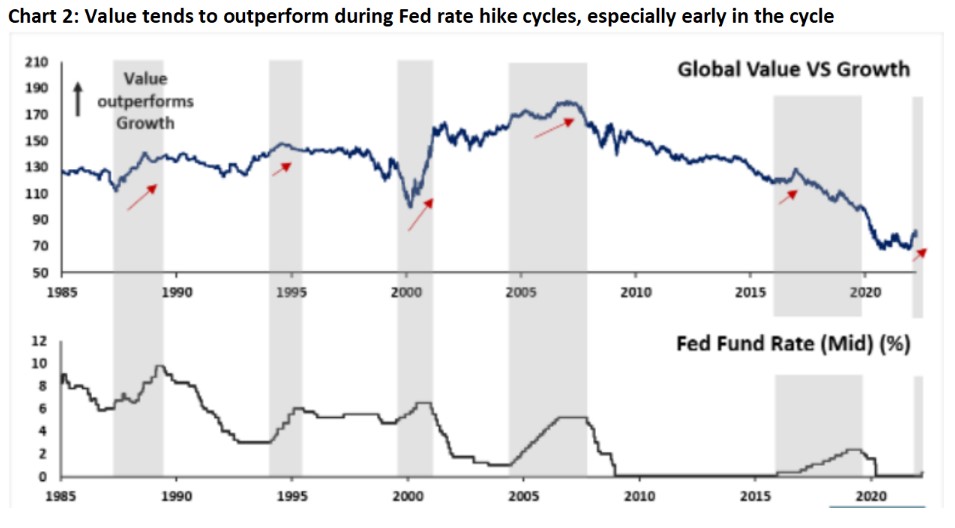

Moving ahead, we expect inflation to remain the dominant driver of value performance given the latter’s tendency to outperform growth (i) during periods of high inflation and (ii) rising policy rates.

Challenging macro backdrop

On the contrary, the prevailing macro backdrop continues to prove challenging for growth. As outlined above, stubbornly elevated inflation levels and the presence of upside risk will likely fortify policymakers’ decision to tighten aggressively, as witnessed in the recent US Federal Reserve (Fed) meeting.

This raises the likelihood of larger and more rate hikes as well as a faster pace of balance sheet reduction, all of which may continue to pressure valuations of growth-style equities.

Supportive global growth

In our view, value will continue to hold up well given the current economic growth backdrop. Recently, concerns have arisen regarding the growth outlook in 2022 due to the potential impact of the Russia-Ukraine war and the Fed rate hike cycle.

While these factors will likely result in a moderation of global growth momentum – especially coming off a robust rebound last year – we expect the global recovery to carry on.

We see several catalysts down the road that could support global growth and in turn, remain conducive for value performance. First, we see room for more fiscal support across major economies.

Policymakers are already facing mounting pressure to reverse their fiscal tightening decisions and increase support amidst rising commodity prices.

Second, and more importantly, we look to the potential re-opening wave in emerging markets (starting with Asia) from 2Q 2022 onwards; the re-opening should also continue to put value in the spotlight.

Fundamentals support

Value (gauged by the MSCI World Value index) has enjoyed consistently positive earnings per share (EPS) revision since 2021 and a 4% upwards revision in the YTD.

On the other hand, growth (gauged by the MSCI World Growth index) has only seen a 1% positive revision to earnings estimates. The improving earnings fundamental of value relative to growth is also pivotal in supporting value outperformance.

Value continues to trade at a wide discount to growth. The MSCI World Value index is trading at a gapping 50% discount to its growth counterpart which is around two standard deviations below the historical average of 30% (discount).

The relative valuation remains attractive in our view. At such an extreme level, we see further room for the value rotation to run and for the discount gap to close.

Considering our view on value and growth, we recommend investors to hold a combination of value and growth stocks.

They should also review their portfolio exposure; if their portfolios are skewed towards growth – especially the unprofitable and over-valued stocks – they should diversify away and add value exposure. This can be implemented on a geographical and sectoral level. – May 25, 2022

iFAST Capital Sdn Bhd provides a comprehensive range of services such as assisting in dealing, investment administration, research support, IT services and backroom functions to financial planners.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.