TA Securities (TA) expects the inflation rate in the upcoming months to remain manageable, likely aligning with the long-term average of 2.0% year-on-year (YoY) (based on data from January 2010 to September 2024).

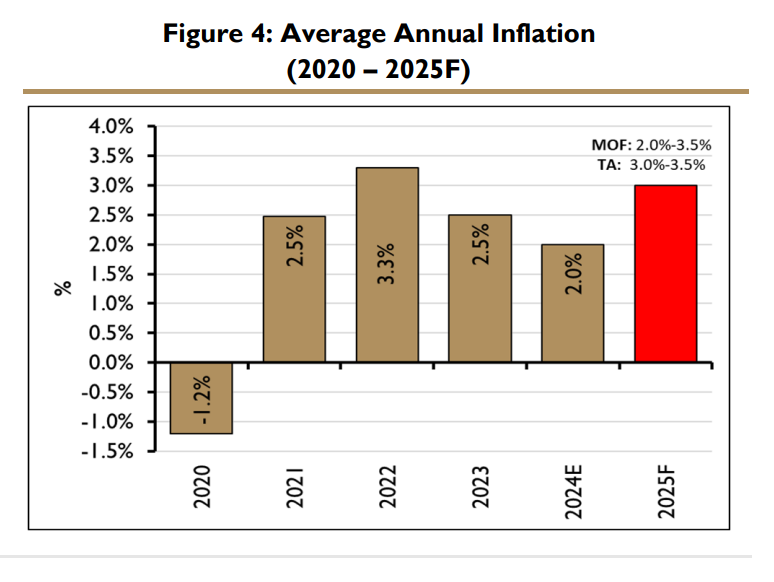

“For 2024, we anticipate inflation to rise by 2.0% YoY, as the prime minister has announced that subsidy rationalisation will only take effect in mid-2025, with further details to be provided at a later stage. Year-to-date, the inflation rate has averaged 1.8% YoY,” said TA in the recent economic update report.

However, the inflationary outlook for Malaysia is expected to accelerate starting next year, driven by the hike in civil servant salaries and the increase in the minimum wage to RM1,700.

Historically, changes in the minimum wage have had a noticeable impact on inflationary trends in Malaysia, and this upcoming increase is likely to follow a similar pattern.

This is primarily because a higher minimum wage leads to increased disposable income for low-wage earners, which boosts consumer demand.

As workers have more spending power, they are likely to spend more on goods and services, creating greater demand within the economy.

This increased demand can result in demand-pull inflation, where the rising consumer demand outstrips the supply of goods and services, pushing prices higher.

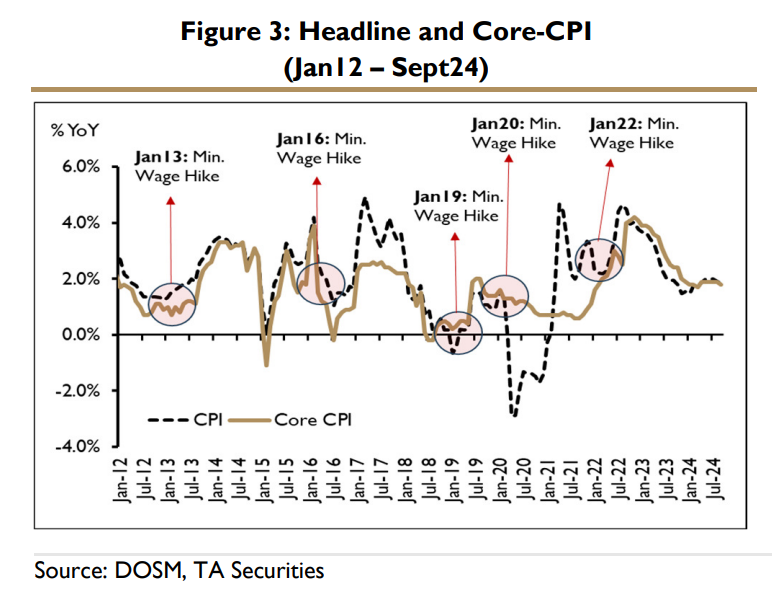

Examining the historical data, it becomes evident that inflation typically rises in tandem with wage hikes.

For example, the inflation rate increased following the minimum wage revisions in 2013, 2019, 2020 and 2022.

However, the exception was in 2016, where inflation remained subdued despite a minimum wage hike.

This anomaly can be attributed to the much lower global crude oil prices during that period, which helped to offset inflationary pressures.

Beyond wage and salary adjustments, inflationary pressures next year may be further exacerbated by other factors such as the potential for global energy prices to recover and the removal of fuel subsidies.

According to the Ministry of Finance (MOF), Malaysia’s headline inflation may accelerate in 2025 to its highest level in eight years, driven by potential price pressures from subsidy rationalisation and external shocks. The consumer price index is projected to rise between 2.0% and 3.5% in 2025.

The inflation risk will largely depend on the extent of knock-on effects from the implementation of policy measures on subsidies and price controls, as well as fluctuations in global commodity prices.

“At this juncture, we anticipate an inflation rate of around 3.0%-3.5% for the upcoming year,” said TA – Oct 25, 2024

Main image: shutterstock