THE ringgit is expected to face further depreciation against the greenback in the upcoming week due to global economic uncertainty which is causing volatility in the emerging currency market.

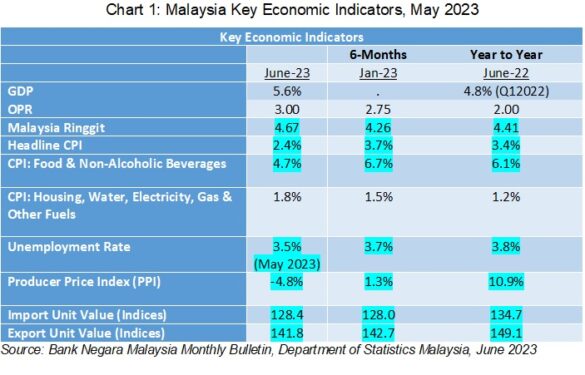

In the past six months, the US$/RM exchange rate has seen a significant increase of 6.21%.

This upward movement implies that the value of the ringgit has depreciated, a trend that can lead to higher import costs, thus making foreign goods and services more expensive for Malaysian consumers, according to Institute of Strategic Analysis and Policy Research (INSAP) deputy chairman Jacob Lee Yee Yuan.

Recent data from the Department of Statistics Malaysia (DOSM) has revealed a significant decline in Malaysia’s total trade since March 2023.

The country’s total trade has fallen by 16.3% to RM222.14 bil, with exports dropping by 14.1% to RM123.98 bil while imports are experiencing an 18.9% decrease to RM98.16 bil, all in comparison to the previous year.

Moreover, it is anticipated that Bank Negara Malaysia (BNM) will raise the overnight policy rate (OPR) later this year, aligning with the expected increases in the OPR by the US Federal Reserve Bank.

This projection implies that Malaysia should brace for continued price surges, affecting essential commodities like food which are predicted to persist until the year’s end.

“BNM claimed that a weaker currency was considered advantageous for the nation, supposedly boosting the competitiveness of its goods and services in global markets.

“However, the interplay between currency strength and economic prosperity has become increasingly intricate, primarily due to the waning impact of exports and the alarming surge in food imports,” cautioned Lee.

The declining impact of exports and the surging food imports challenge the traditional narrative that a weak currency is inherently beneficial for Malaysia.

Lee asserted that the reliance on a depreciated exchange rate as a primary strategy to maintain competitiveness requires re-consideration. Competitiveness is influenced by multiple factors, including policy stability, infrastructure and tax rates – not solely cheap exports.

In the long run, solely depending on a weak exchange rate could lead to adverse consequences, thwarting the goal of elevating the country’s position in the value chain and potentially hampering development.

Moreover, Lee claimed that the increasing OPR rates reveal the true struggles faced by many Malaysians.

“For example, in January 2021, with an OPR of 1.75%, a working parent with three dependent children with a RM300,000 home loan on a 30-year tenure, earning a monthly income of RM5,000 faces numerous expenses, including housing (RM1,500) and car loan repayments (RM700), groceries (RM850), utilities including water, electricity and internet (RM450), education costs (RM400), and miscellaneous expenses (RM300).

“After fulfilling these obligations, they were left with a mere RM400 for savings and investments.”

The last two years have brought no increase in wages for many working Malaysians, leaving them grappling with financial strains. The recent decision by BNM to elevate the OPR by 125 basis points to 3.00% has added further burden to this situation.

The impact on working parents has been particularly profound with the escalated OPR causing a startling surge in monthly housing loan installments. This increase of 1.25% has translated into an astounding RM350–RM400 rise in the monthly payment for home loans spanning a 30-year tenure.

“Consequently, the working parent is forced to allocate a larger portion of their income towards housing expenses, crippling their monthly budget and depleting their hard-earned savings.

“This distressing situation clearly exemplifies how economic decisions surrounding the OPR can negatively impact the common Malaysian, exacerbating their financial hardships and impeding their ability to save for a better future,” revealed Lee.

Addressing these concerns, Lee emphasised that the current prevailing concern among Malaysians revolves around the need for effective measures to raise income levels for every citizen and to combat income inequality.

Furthermore, Lee raised queries about the potential strategies that could be enacted to enhance the income levels of Malaysians from various socio-economic segments.

He also inquired about the concrete measures and tactics that could be utilised to invigorate economic growth, restore business confidence and encourage increased investment in Malaysia. – Aug 10, 2023