AS projected in Kenanga Research’s (Kenanga) last FX report, the ringgit traded on the weaker side within a 4.34-4.38 range this week, coming close to breaching the 4.40/USD threshold intraday on October 30, following a spike in the 10-year US Treasury yield above 4.30%.

“This rise was driven by solid US macro data and increased market bets on a Trump win. Nevertheless, the USD index (DXY) softened in the last few days, dipping below 104.0 as JOLTS data hinted at a cooling labour market,” said Kenanga.

Adding to this pressure, euro zone strong macro readings and Bank Of Japan hawkish bias, which contrasted with the market dovish expectations.

While early signs of a softening US labour market are evident, tonight’s payroll data will need to show a below-consensus reading to reinforce market expectations of further Fed easing.

“We maintain our view that the Fed will cut rate two more times this year, starting with a 25 basis point reduction next week, which should weaken the USD and bolster the ringgit,” said Kenanga.

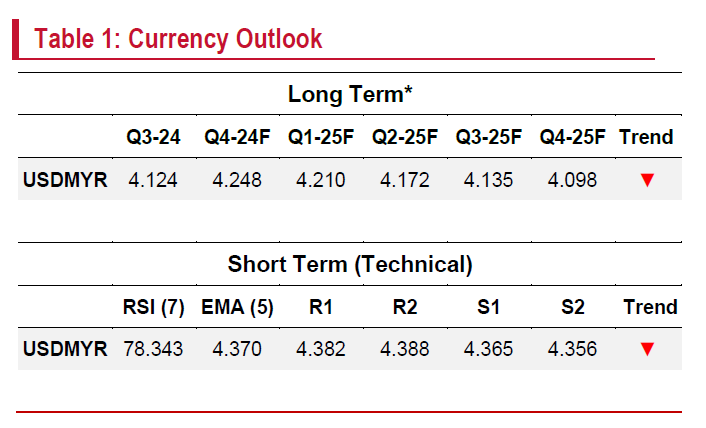

While the DXY could trade stronger toward 104.5-105.0 around election day and push the ringgit to above 4.40/USD, Kenanga’s assumption of a Harris win could prompt a sharp USD correction, potentially pulling the ringgit to 4.30-4.35 by week’s end.

Coupled with supportive domestic macro data and Bank Negara Malaysia’s policy status quo, this outlook favours the ringgit.

With the relative strength index in overbought territory, the pair may exhibit bearish behaviour, consolidating around its 5-day exponential moving average of 4.370.

If the Fed follows through with anticipated rate cut and signals further easing, coupled with a Harris election victory, the ringgit could rebound to 4.365 and potentially dip below 4.356. – Nov 1, 2024

Main image: fifthperson.com