SIME Darby Guthrie has entered into a memorandum of understanding (MOU) with AME Elite Consortium (AME) to jointly plan a green industrial park development which is expected to conclude with a joint venture (JV) agreement around quarter two financial year 2025 (2QFY25).

Kenanga Research (Kenanga) in the recent Company Update Report welcome this development for several reasons:

1/ Good location. SDG’s 5,190-Ha Ladang Kulai (Kulai Estate) is already sandwiched by property projects such as Taman Scientex Kulai (223 Ha) to the north-west and Genting Plantations’ Indahpura (2536 Ha) to its south-east.

YTL Green Data Center is 11km east or 15 minutes drive away while Senai International Airport is just 20 km or 30 minutes drive southbound.

Kulai Estate also runs along the North South Expressway thus offering connectivity to the Port of Tanjung Pelepas, Pasir Gudang and Johor Bahru.

2/ AME is familiar with Johor industrial property. With offerings of development, engineering, construction and property management services under one roof, AME’s one-stop convenience business model has allowed it to launch and develop multiple industrial parks in Johor.

i-Park@SILC at Iskandar Puteri was first launched in 2011 followed soon after by the i-Park@Indahpura (also in 2011) then SME City in 2013 and in 2017 the launch of i-Park@Senai Airport City which is now in its 3rd phase.

“Better return on earnings ahead for SDG. We welcome this MOU to develop SDG Kulai Estate as it should help optimise its asset base and nudge up ROE for investors moving forward. This MOU would be SDG’s third property development announcement this year,” said Kenanga.

In May SDG indicated it is studying the development of a 1,000-acre Kerian Integrated Green Industrial Park with parent, PNB and in Aug, SDG announced its collaboration with TH Properties to develop 464 acres into HALMAS-certified managed industrial park.

4/ Fits into SDG’s RE game plan. SDG estimates that it has enough poorer quality agriculture land of 1,200 Ha which can support up to 1GW of solar installation.

It has leased some of the land out to solar farm operators but is now working on its own 15MW CGPT solar farm which is due to start contributing in the second half of financial year 2025.

Bids are also underway for LSS5 while the KIGIP project is being studied. Kenanga states that there is no change to core FY24-25 forecasts.

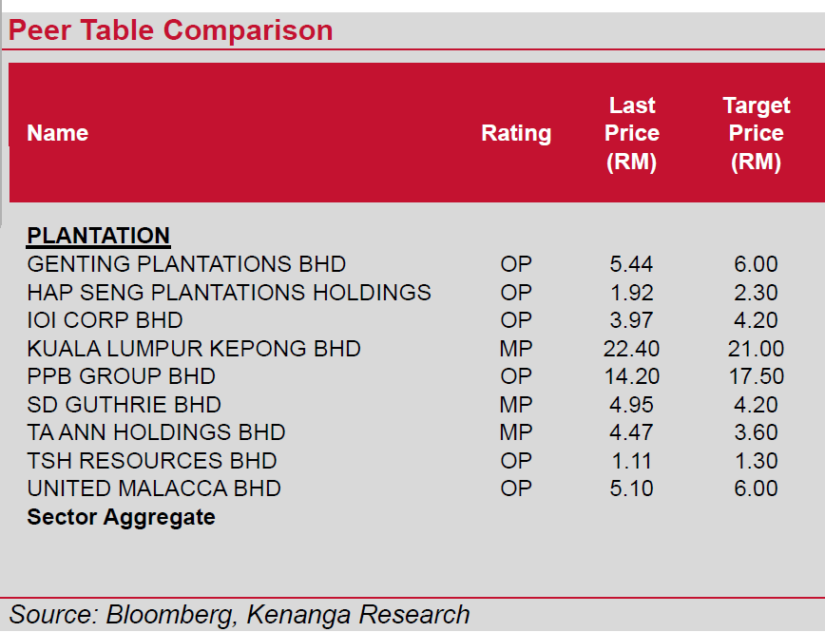

Maintain MARKET PERFORM and target price of RM4.20 based on 1.6x price book value, at a discount to average 2x for large integrated peer due to SDG’s lower 5-year average return on equity of 8% vs 10% of its peers.

SDG’s efforts to improve return is a positive but actual contribution to the bottom line will take time (2-3 years or beyond) and face execution risks.

“There is no adjustment to our target price based on environmental, social and governance given a 3-star rating as appraised by us. With some of its estates ripe for property development, SDG is defensive and underappreciated from an asset point of view and long-term expansion plans and productivity management strategies would be viewed positively,” said Kenanga.

However, the timing and actual impact on earnings are less clear, and Kenanga suspects the group’s property and RE ambitions are probably reflected in current valuation hence their MARKET PERFORM call.

Risks to Kenanga’s call include western hostility towards palm oil on sustainability and bio-diversity issues, impact of weather and labour shortages on production, weak crude palm oil and PK prices, and cost inflation particularly fertilisers. – Nov 5, 2024

Main image: congthuong.vn