BUYING a house should be a happy moment, ideally. It symbolises maturity and commitment to a degree because buying a house is a big-ticket item.

In a way, it signifies “coming of age” especially if it is a young buyer. If the person is older, the decision to buy underscores his positive sentiment because nobody buys a house if he is not confident about the housing market.

Although it should be a happy occasion, statistics from the Housing and Local Government Ministry (KPKT) shows that the occasion has become a nightmare for many.

Analysis of official statistics

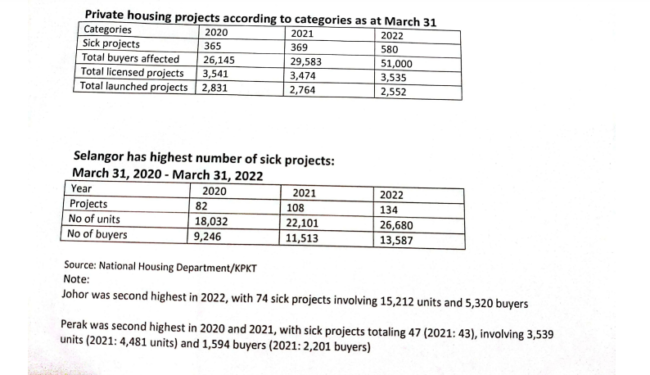

According to Government statistics on private housing as of March 31, the number of “sick” private housing projects have risen to 580 projects from 365 projects, before COVID-19 hit Malaysia in March 2020.

These 580 “sick projects” affected 51,000 house buyers against 26,145 in March 31, 2020, according to the latest statistics.

This represents a 58.9% increase in the number of ailing projects and a 95% rise among affected buyers. The number of housing units affected rose to 102,132 units from 48,826 units two years ago. A two-year comparison from March 2020 to March this year showed that the numbers have been on the rise.

In terms of definition, a “sick housing project” is one that has been delayed by more than 30% compared to its scheduled progress or one whose Sale and Purchase Agreement has lapsed; according to the ministry’s portal vis-à-vis Declaration of “Sick” category.

Some may argue that 2021 was a pandemic year and the various movement control orders (MCOs) would have obviously affected all levels of the economy, including the housing sector.

In reality, the housing market and the broader property sector have been weak even before the pandemic hit the Malaysian shores!

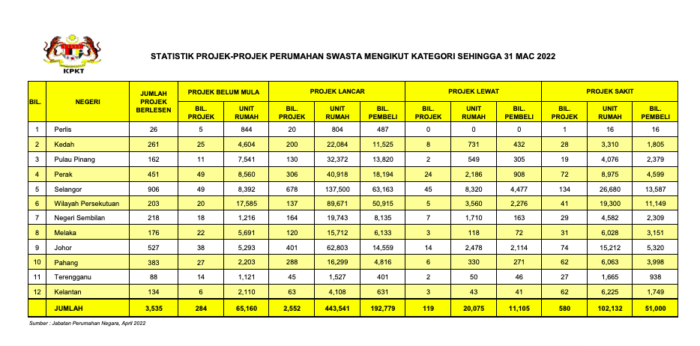

According to statistics “Private Housing Projects according to Categories until March 31, 2022,” the total number of projects licensed by the Government marginally declined to total 3,535 versus 3,541 in the same month two years ago.

The number of projects launched also declined to 2,552 in March this year versus 2,831 for the same period two years ago.

This means that the rate of projects becoming problematic is rising despite a fall in total licensed and launched developments.

“Sick” high rise strata projects

Other KPKT statistics showed that there are a total of 109 “sick” high-rise strata projects involving both Government and private developers at the end of April 14.

This being Syarikat Perumahan Negara Bhd (SPNB) and PR1MA Corporation Malaysia, just to name two Government developers. There may be other Government-linked housing agencies and units linked to Government-linked companies as developers/ contractors; normally creating units for each projects they undertake to build.

One may wish to visit the link: Statistik Projek-Projek Perumahan Swasta Bermasalah (Kategori Sakit) www.kpkt.gov.my for further information.

In a nutshell, Selangor has the most number of “sick” high-rise strata projects at 31, followed by Wilayah Persekutuan at 29 and Johor at 16.

“Sick” landed housing projects

Government statistics also showed that there are 370 ailing landed housing, with Selangor having the highest number at 67, following by Perak (67) and Johor (51). Again, Government-linked corporations are involved.

Consequence of a “sick” project

These tens of thousands of unlucky house buyers are now facing a bleak future. They bought into housing projects that are now categorised as “Sick housing projects” and are suffering at the hands of those errant developers. The devastating effects are as follows:

- The house buyer involved still owes banks the amount that had been drawn down and paid to the rogue developers.

- The house buyer will continue to suffer the faith of a possible abandonment of the project. He may count his blessing if the project is ever successfully resuscitated.

- The house buyer continues to service the partially drawn down housing loan or he faces the consequences if he is unable to do so. He will risk been blacklisted by Bank Negara Malaysia (BNM)

- The buyer continues to stay in his rented house because the dream house that he had bought had turned into a nightmare.

- He, as well as his spouse and their dependents, will continue to suffer emotional stress and financial constraint.

- The buyer blames the Government for allowing such a hazardous and nonsensical ‘Sell then Build’ (STB) system to exist and for being unable to help him. (Remember the Sales and Purchase Agreement is a Government statutory form where not a single word may be altered by either buyer or vendor)

- The end financing bank suffers in that the house buyer does not get his house and is therefore may not likely to be able to service his housing loan. Worst still, the uncompleted house has zero cashable value.

- The Government continues to face the wrath of victims of “sick” projects for allowing such a hazardous system to exist and subsequently for being unable to help them. – June 12, 2022

Datuk Chang Kim Loong is the honorary secretary general of the National House Buyers Association (HBA).

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.