MALAYSIA’S e-commerce market is matured enough to pursue the strategy of progressing into an increasing visible brick and mortar embrace.

This comes about as the omnichannel strategy has been touted as the way forward by which merchants strive to provide customers with a seamless experience across multiple arrays of platforms, namely online, desktop, mobile device and traditional retail store.

In its study, Hong Leong Invest Bank (HLIB) Research observed even e-commerce giants like Amazon and Alibaba have begun to realise that establishing a seamless connection between physical stores and digital interactions is crucial to creating a wholesome customer journey.

“The digital centric lifestyle has given consumers access to ultimate convenience and custom engagements that connect them to the products and services they require, anytime and anywhere,” opined analysts Syifaa’ Mahsuri Ismail and Tan J Young in a consumer sector update with focus on the e-commerce industry.

“Despite this, it cannot be denied that physical stores are the most straightforward way for consumers to directly engage with a brand and their products.”

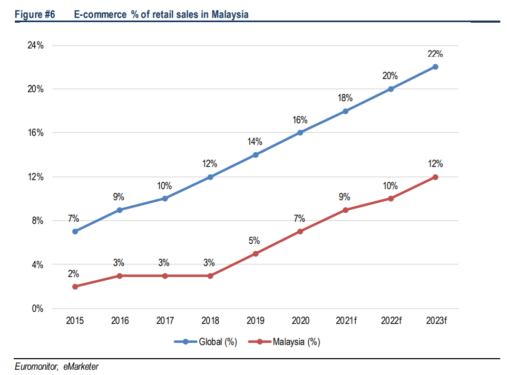

In Malaysia, there is a massive potential for e-commerce growth which is still in its nascent stage. Malaysia’s e-commerce as a percentage share of total retail sales stands at 7% in 2020 and forecasted to grow to 9% in 2021.

“Additionally, we opine there are plenty of room for growth across multiple categories when comparing to other countries,” noted HLIB Research.

“We already see some of this example panning out in terms of physical presence by Lazada pop up store and Taobao retail store in Malaysia, and most recently Grab’s interest in Jaya Grocer and Country Heights collaboration with JD.com.”

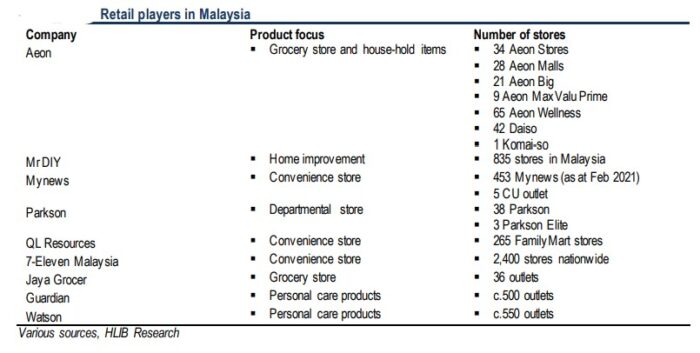

After analysing the listed and non-listed local retail players, HLIB Research identified nine retail spaces which are poised to benefit from the omnichannel venture from e-commerce to brick and mortar:

Having analysed the nine listed and non-listed retailers, the research house said it based its selection on four vital criteria:

- Supplier competitive advantage that could boost up margin: Retail chains are able to buy wide variety of merchandise in large quantity with discounts from suppliers. The discounts substantially lower their cost as compared to costs of single/small retailers. As a result they could set selling prices that are cheaper than those of their small competitors and thereby increasing their market share.

- Entrenched network of stores to facilitate last-mile delivery: Established retailers were able to attract many customers attributable to their convenient locations which made possible by their brand names, financial resources and expertise in selecting locations. This competitive advantage with hundreds of physical locations around Malaysia can double as distribution hubs for e-commerce pickups as well as delivery of products. The last mile delivery is a crucial aspect taking into consideration that necessities such as fresh food items and healthcare supply would require urgent delivery.

- Variation of product categories: Beyond providing nearer delivery location, physical retails can help e-commerce make more of its products visible. In-store shoppers are more inclined to make impulse purchases than online shoppers, a lofty reason for Amazon to keep expanding its brick and mortar presence. According to Bloomberg, a survey found that 69% of customers who entered a store to pick up an item they ordered online bought additional products.

- Large retail space as a warehouse and simultaneously attracts customers to browse through products and act as catalyst to boost up sales: Brick and mortar offers a prime ingredient that e-commerce lacks – human interaction. With the brick and mortar, e-commerce players are able to tap into human experience to connect, engage, and build brand equity with consumer. Furthermore, a large physical stores would gain more in providing comfortable experience for consumers to browse through the products while simultaneously act as a warehouse.

All-in-all, HLIB Research reiterated its “buy” call on Mr DIY Group (M) Bhd (target price: RM4.51) as it expects a steady store expansion and omnichannel strategy (online, Touch ‘n Go collaboration) to shore up the company’s profitability in line with the clearer recovery picture.

“As for Aeon (“hold”, target price: RM1.25), despite the short term uncertainties, we reckon it will be able to brace through another storm with their clear strategy to chart for recovery,” added the research house. – Jan 3, 2021

Pic credit: FLY Malaysia