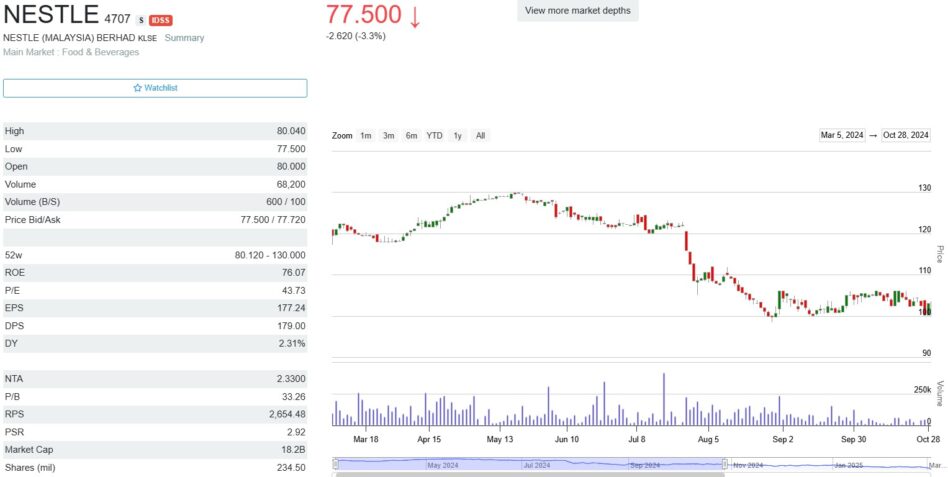

ONCE dubbed “King of Bursa Malaysia stocks” Nestlé (M) Bhd is today a pale shadow of its old self with its share price having nose-dived 40.3% from a 52-week high of RM130 (it hit an all-time high of RM163 on March 13, 2018) to easily a 10-year low of RM77.50 at the close of today’s (March 4) mid-day trading break.

Recall that woes of the assorted food product manufacturer which fell below RM100 for the first time on Aug 27 last year has been further compounded by a 11-year-low profit in its 4Q FY2024 ended Dec 31, 2024.

Its net earnings for that quarter tumbled 72.2% to RM41.1 mil from RM148.10 mil in 4Q FY2023 while the full-year score came in 37% year-on-year (yoy) short at RM415.62 mil (FY2023: RM659.87 mil).

As a defensive stock, Nestlé Malaysia’s reputation also took a beating in that the group declared an interim dividend of 74 sen/share which brought its full FY2024 dividend to 179 sen/share which marks a 15-year low given the significant decline from the 268 sen/share declared in FY2023

Of the two research houses which have a “sell” rating on Nestlé Malaysia, Hong Leong IB (HLIB) Research has revised its target price downward to RM78 (from RM80 previously) while MIDF Research slashed its target price substantially to RM77.90 (from RM101.90).

HLIB Research’s justification is that Nestlé Malaysia currently trades at a premium to its Swiss holding company (18.5x FY20224 PE) which the research house finds difficult to justify given its declining earnings.

“The on-going boycott sentiment and cost pressures will continue to weigh on its profitability,” opined analyst Syifaa’ Mahsuri Ismail in a recent results review.

“We (further) revise our FY2025-FY2026 forecasts downward by -28% to reflect adjustments in margin assumptions.”

Concurring, MIDF Research observed that Nestlé Malaysia’s latest financial performance was impacted by weak domestic sales and rising input costs.

“This marks the third consecutive quarter in which Nestlé’s net profit has fallen below the RM100 mil threshold, underscoring on-going challenges in the domestic market,” noted analyst Eunice Ng Qing Rong.

“We cut our FY2025-FY2026F earnings estimates by -18%/-19% respectively by factoring in weaker domestic demand and sustained cost pressures.”

As for outlook, HLIB Research expects Nestlé Malaysia to face persistent challenges, including commodity price volatility, softening consumer demand and prolonged geopolitical tensions.

“Given the on-going Israel-Gaza conflict, we anticipate that sales normalisation will take time,” projected the research house.

“Nevertheless, the group continues to expand its product portfolio, launching KitKat Dark Borneo, Milo Intense Dark Chocolate, Milo Boost Up, Nescafé Gold Ready-To-Drink, MAGGI Syiok range, KitKat Beverage Mix and re-launch its Nestlé Enercal “

At 2.50pm, Nestlé Malaysia was down RM1.62 or 2.02% to RM78.50 with 88,200 shares traded thus valuing the company at RM18.41 bil. – March 4, 2025