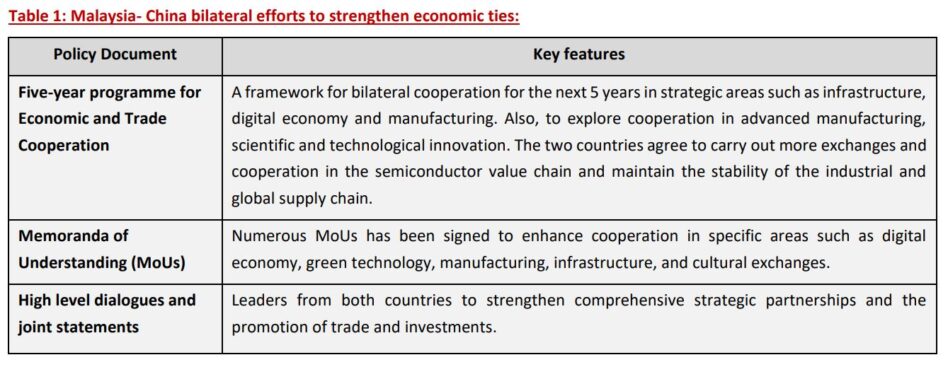

CHINESE President Xi Jinping’s visit is particularly significant as Malaysia currently chairs the Association of Southeast Asian Nations (ASEAN) and serves as the country coordinator for ASEAN-China Dialogue Relations.

President Xi Jinping’s visit to Malaysia comes at a critical time, as trade tariffs and global economic tensions are impacting bilateral and regional trade dynamics.

Malaysia, as the current chair of ASEAN, is uniquely positioned to facilitate discussions on trade cooperation and tariff-related challenges.

It is expected that President Xi is expected to address concerns about the impact of US-China trade tariffs on Malaysia’s economy and explore ways to strengthen economic ties between the two nations.

China remains Malaysia’s second-largest trading partners. In 2024, China continues to play a pivotal role in Malaysia’s external trade landscape, firmly holding its position as the country’s second-largest trading partner, with total trade amounting to RM484.1 bil—accounting for 17% of the country’s overall trade.

This marks a strong recovery with a 7.5% growth, reversing the -7.4% decline experienced in 2023.

Exports to China accounted for 12% of Malaysia’s total exports, compared to 29% to ASEAN countries, 13% to the United States, 8.0% to the EU, and 4.0% to Taiwan.

Malaysia’s exports to China slightly dropped by -2.2% during the year. The slower pace of decline indicates early signs of stabilisation in export performance to China.

In 2024, imports from China accounted for 22% of Malaysia’s total imports. Other major import sources included ASEAN (24%), the United States (9%), Taiwan (8%), and Japan (5%).

Imports from China rebounded strongly during the year, rising by 14.6% compared to a decline of -6.2% in 2023.

This sharp recovery underscores renewed demand for Chinese goods and potentially reflects improving industrial and consumer activity within Malaysia.

Looking ahead, China’s continued importance as a trade partner is evident, particularly in imports, which now constitute 22.0% of Malaysia’s total import bill.

Despite ongoing global trade tensions, Malaysia’s trade engagement with China is expected to deepen—particularly if both countries choose to expand bilateral trade as part of a diversification strategy in response to US tariffs and a gradual shift away from reliance on the US market.

Overall, the Malaysia–China trade relationship remains resilient and is poised for further growth, underpinned by improving economic conditions and deepening bilateral cooperation.

Between 2018 and 2024, Malaysia’s trade with China grew steadily, from RM1,883.4 bil to RM2,878.8 bil, despite a dip in 2020 due to the pandemic.

However, the trade deficit widened from RM-35.8 bil to RM -108.8 bil, as imports from China grew faster than exports.

This shows rising dependence on Chinese goods and highlights the need for Malaysia to diversify exports and improve competitiveness.

Malaysia mainly exports manufactured goods to China (82.7%), followed by mining (11.7%) and agriculture (5.4%).

Key export products include Electrical & Electronic (E&E) Products (36.3%), Chemicals (9.7%), LNG (8.2%), and Metal Products (7.1%).

The rest (39%) includes various other products, indicating export to China are well diversified. On the import side, 95.6% of goods from China are manufactured items, showing Malaysia’s heavy reliance on these products.

Major imports are E&E Products (40.3%), Machinery & Parts (12.5%), Chemicals (8.1%), and Metal Products (6.3%). Others account for 32.8%.

The high share of E&E imports supports Malaysia’s role in the global electronics supply chain, especially in packaging and testing.

Despite the trade gap, Malaysia can benefit from global trade shifts, especially in backend E&E services, as trade tensions persist between major economies.

Malaysia experienced a record high of MYR15.73 bil in Foreign Direct Investment (FDI) inflows from China during 2023, subsequently moderating slightly in 2024 to RM13.3 bil.

This surge from 2020 to 2024 was largely attributed to the diversification of supply chains by multinational corporations seeking alternatives amidst US-China trade tensions, with Malaysia’s robust semiconductor and electronics sectors proving particularly attractive.

Malaysia has benefitted from the trade tension which saw US and Chinese firms seeking alternative manufacturing locations.

On top of that, Malaysia has played a significant role in the global tech supply chain, particularly in the semiconductor and electronics sector, attracting Chinese investments.

A strong positive correlation was observed between overall Malaysian FDI growth and Chinese investments during this period, specifically from 2020 to 2023, which saw strong positive net inflows.

However, 2024 marked a reversal, with net outflows recorded due to moderated Chinese investment into Malaysia combined with a continued increase in Malaysian outward FDI to China, a trend that began in 2023 and represents the first instance of net outflows since 2011. —Apr 15, 2025

Main image: AP