YNH Property Bhd which prides itself as a premier developer of upscale residential and commercial properties has reaffirmed its commitment to strengthening corporate governance and enhancing transparency following a critical special independent review (SIR) by UHY Advisory (KL) Sdn Bhd.

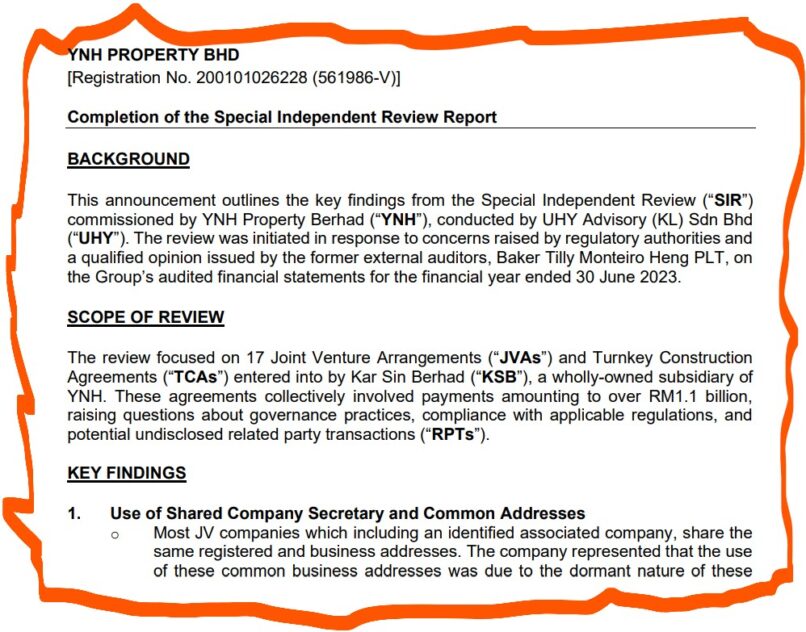

The review which examined the company’s 17 joint venture arrangements (JVA) and turnkey construction arrangements has highlighted areas requiring improvements in governance and internal controls.

This is especially so after UHY claimed that the ensuing projects collectively entailed payments amounting to over RM1.1 bil, thus raising questions about governance practices, compliance with applicable regulations, and potential undisclosed related party transactions (RPTs).

In its response, YNH said it has taken proactive steps to address these findings.

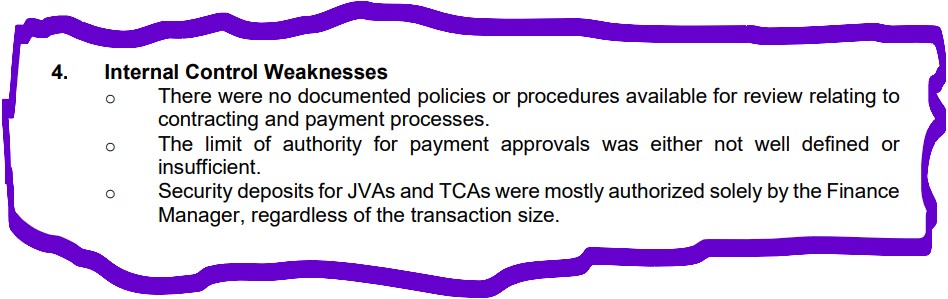

These include the establishment of an investment committee to strengthen oversight of investment activities, the implementation of defined authority limits for payment approvals as well as roll-out of standardised policies and procedures to ensure greater control, accountability and compliance across operations.

“The YNH board remains fully committed to refining governance frameworks and ensuring that all practices align with regulatory expectations and best practices in corporate stewardship,” YNH chairman Datuk Yu Kuan Huat pointed out in a statement.

“Importantly, YNH’s core fundamentals remain intact and continue to show resilience.”

Moving forward, Yu is confident that the group will continue to actively unlock value from its investment properties through strategic disposals “so as to improve cash flows and reduce gearing”.

YNH posted a significant turnaround in financial performance for its 2Q FY6/2025 ended Dec 31, 2024 with a revenue of RM300.3 mil, up sharply from RM14.3 mil a year ago. Elsewhere, the group’s operating profit improved to RM9.0 mil from a loss of RM4.4 mil previously.

Although a net loss of RM684,931 was recorded, YNH said this marks a significant improvement from the RM18.4 mil net loss in the same period of 2Q FY6/2024.

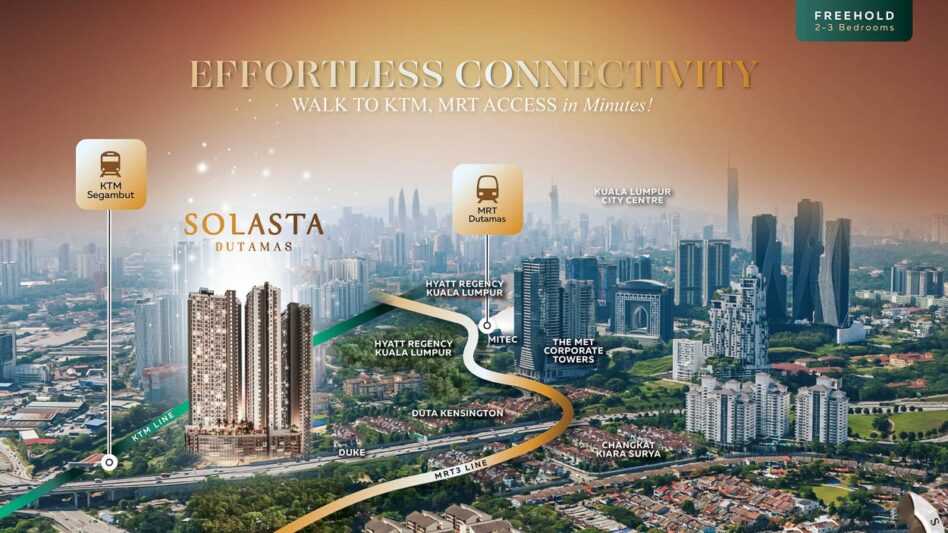

This performance was primarily driven by the disposal of 163 Retail Park, on-going contributions from Solasta Dutamas and property sales from the group’s Manjung Point Seksyen II.

Meanwhile, YNH said Solasta Dutamas, one of its flagship joint venture projects, continues to progress well and remains on track for completion in 2026.

Located on a 3.52-acre freehold parcel in Mont Kiara, the project comprises three residential towers with a gross development value (GDV) of about RM771 mil.]

“The development has received strong market response and the unbilled sales are expected to contribute positively to YNH’s future financial performance,” projected Yu.

“YNH is committed to emerging from this matter with strengthened governance, improved financial discipline and a continued focus on sustainable growth.”

At 3.15pm, YNH was up 4 sen or 10.67% to 41.5 sen with 4.24 million shares traded, thus valuing the company at RM220 mil. – April 11, 2025