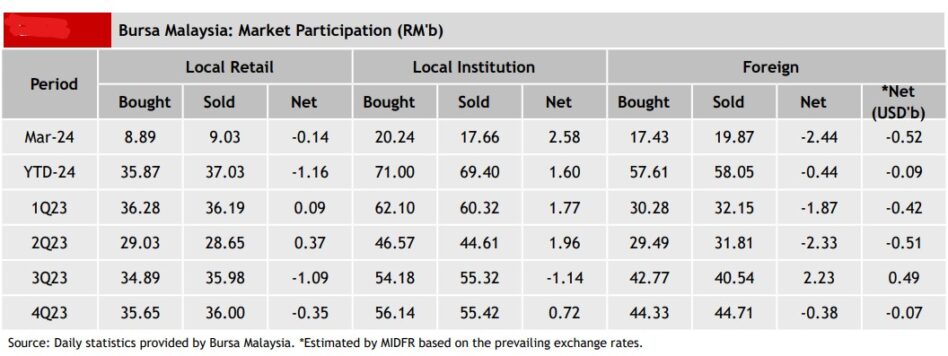

FOREIGN investors maintained their selling momentum on Bursa Malaysia for the fourth consecutive week ended March 22 when they net sold -RM313.8 mil worth of equities which was -24.4% lower than the prior week.

They were net sellers from Monday (March 18) to Wednesday (March 20) totalling -M757.5 mil before having net bought RM443.7 mil on Thursday (March 21) and Friday (March 22) following improved sentiments after the Federal Open Market Committee (FOMC) meeting with three rate cuts still in the pipeline, according to MIDF Research.

“In Malaysia, Bank Negara Malaysia (BNM) has also forecast a growth of 4% to 5% in 2024, supported by resilient domestic demand and an improvement in external demand,” the research house pointed out in its weekly fund flow report.

The sectors with the highest net foreign inflows as of Thursday (March 21) were property (RM100.1 mil), energy (RM21.6 mil) and construction (RM14.1 mil) while the sectors that recorded the highest net foreign outflows were financial services (-RM272.3 mil), consumer products & services (-RM123.8 mil) and utilities (-RM93.2 mil).

On the contrary, local institutions continued their trend of net buying for the fourth consecutive week as they net bought RM442.7 mil.

As opposed to foreign investors, they net bought RM835.3 mil from Monday (March 18) to Wednesday (March 20) but net sold -RM392.6 mil on Thursday (March 22) and Friday (March 23).

However, local retailers retained their net selling stance at -RM128.8 mil last week with every trading session being a net selling session. They have been net sellers for 12 consecutive trading days.

In terms of participation, the average daily trading volume (ADTV) rose among retail and institutional investors by +2.6% and +3.1% respectively while foreign investors saw a decline of -29.2%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia posted net foreign inflow for the third consecutive week at US$136.1 mil followed by the Philippines at US$8.5 mil after foreign investors briefly net sold the week before.

However, Thailand entered another week of net foreign fund outflows as foreign investors net sold for the fourth successive week at -US$1.05 bil while Vietnam recorded its third straight week of net selling at -US$128.2 mil last week.

The top three stocks with the highest net money inflow from foreign investors last week were MISC Bhd (RM36.7 mil), Sime Darby Bhd (RM31.1 mil) and UEM Sunrise Bhd (RM27.7 mil). – March 25, 2024