THE Genting Group’s ASEAN-listed gaming stocks are set for a winning streak with valuations re-rating to price in business normalisation trends, as countries move gradually towards the COVID-19 endemic phase and re-open their borders.

With the blue skies scenario, UOB Kay Kian Research expects all three Genting ASEAN listed companies – Genting Malaysia Bhd, Genting Bhd and Genting Singapore Ltd – to resume generous dividend pay-outs by end-2022.

“The gaming industry, being a tourism-related sector, is poised to be a key beneficiary of the region’s imminent economic and border re-opening as the world gradually treats the Omicron variant as the onset of the endemic phase for COVID-19,” projected head of research Vincent Khoo in a regional gaming sector update.

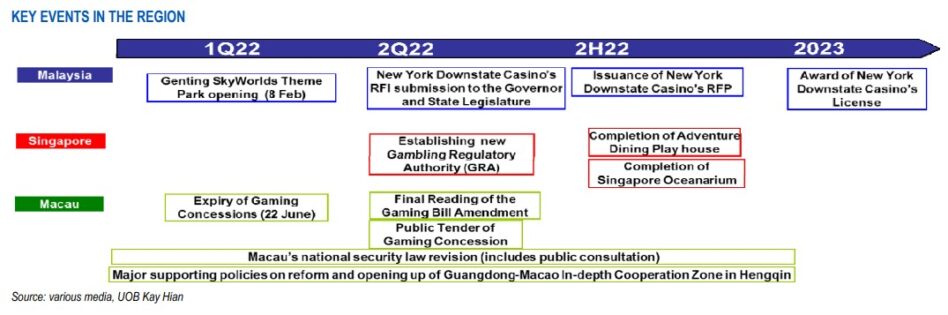

“Key regional event milestones include selective border re-opening from late-1Q 2022 and onwards, more concrete details to Macau’s concession renewal terms in mid-2022 and Resorts World New York City’s RFP (request for proposal) submission for a full-fledged gaming concession by 4Q 2022.”

Very broadly, UOB Kay Hian research retained its “overweight” outlook on the Malaysian gaming sector and “market weight” on the Singapore and Macau gaming sectors.

“The Malaysian gaming sector enjoys a high concentration of re-rating catalysts (ie. Genting Malaysia Bhd’s opening of SkyWorld’s outdoor theme park, Malaysia planning to re-open its borders in March, bidding for a full-fledged New York downstate gaming concession), aside from being less dependent on China VIP gamers,” rationalised the research house.

“Genting Group’s ASEAN gaming listcos (listed companies) are well-poised for sharp dividend recoveries by 2023 combined with low-to-moderate capex requirements relative to balance sheet strength and cash flow generation.”

This suggest that all three Genting companies would be reinstating their generous pre-pandemic dividend policies, according to UOB Kay Hian Research.

“By 2023, Genting Malaysia, Genting Singapore and Genting Bhd should be matching their respective pre-pandemic dividends which suggest prospective dividend yields of 6.7%, 4.7% and 4.4% respectively. – Feb 23, 2022