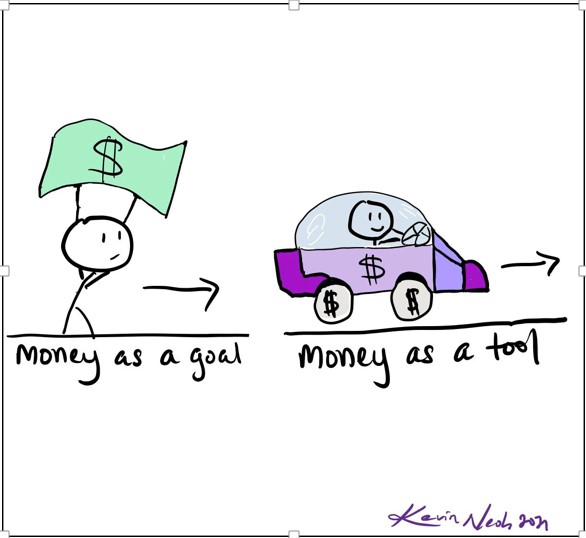

IN the previous article (Part 1), we talked about how putting money in the driver seat can lead us to not being able to live the best life that we wanted to.

If we do not confront this relationship with money early, it may cause us to tie our self-worth to our net worth.

This means that if you don’t feel you are as rich as me, you will convince yourself to believe that you are not as good as me, hence blinding you from seeing your true potential.

Money is important. Don’t get me wrong.

It is important but it should not become that important until we lose our sense of self. Money shouldn’t be the reason we cannot be a caring person or stop us from feeling happy.

Money is only the car, not the driver itself.

For the driver to take back the control, the driver must know where he or she wants to go. But many times, we don’t really have a clear idea on what is our goal.

Solutions

If this is you, don’t feel bad. We haven’t been taught on how to think about what our goals are.

Instead of this, I think we need to first find out what are the things we value most. By understanding the things we treasure the most can help us discover the goals that we wish to achieve in our lives.

If your value is family, you may then find ways where you can use your money to help your family live a better life or protect their financial security. If your value is health, you can then find out how you can use your money to help you live healthier.

I would like to think that it makes little sense to use our money on things we do not value as much because this will deprive our satisfaction on life.

Determining our values on things that we hold very dearly will help us shift the steering wheel to our own hand and help us focus on how to utilise our money to live the life we want.

This will help us to find out how to manage our money accordingly, and to create a spending plan to help us keep our money in the right place – perhaps, a financial plan that has a say in where we want our money to go or what we want it to do for us and not the other way around.

Also, in our quest to have a better relationship with our money, we must understand what kind of relationship we have with it now. And how a mutually supportive relationship would look like.

It makes sense for one to conduct an initial assessment to find out how much money we need to live the best life we want. From there, we can then find out what are the things that need some tweaking so that we can create the kind of future we would like to have.

When our relationship with our money is healthy – as opposed to being toxic – our financial well-being will improve, we will be more at peace with ourselves and our money. We can start living a better today.

Do celebrate a different relationship with your money – the one where you are rightfully in-charge.

Kevin Neoh, CFP, is a certified member of Financial Planning Association Malaysia (FPAM) and the founder of Money Warriors Community.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.