WHILE prospects of the Mass Rapid Transit Line 3 (MRT 3) a.k.a. Circle Line project have improved alongside the Mass Rapid Transit Corp Sdn Bhd’s new strategy, execution risks are still abound.

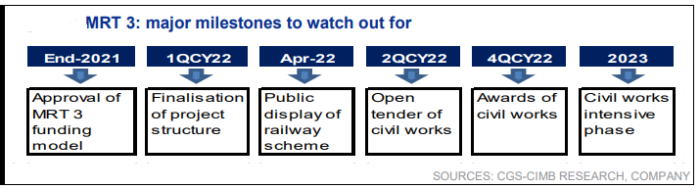

CGS CIMB Research expects the project, which is expected to kick off in stages throughout 2022, to encounter at least three obstacles:

- Delay in Cabinet approval of MRT 3’s hybrid funding model;

- Low take-up by tier 1 contractors who are less willing to take on funding risks; and

- Potential delays in land acquisition (this could hold up site mobilisation and delay construction works).

“That being said, if the MRT 3 progress newsflow regains momentum in the coming months, interest on MRT 3 rail plays could make a comeback in the short-term as investors’ perception of the project has been lukewarm due to delays year-to-date (YTD) and the lack of funding allocations as revealed in the key infra targets of Budget 2022,” opined analyst Sharizan Rosely in a construction sector review.

Under MRT Corp’s new strategy, MRT 3 will not adopt the single turnkey contractor structure as seen in MRT 2 but will likely divide the civil works scope into three to five main packages – each led by tier 1 contractors/consortiums who will undertake private financing for the first two years prior to reverting to full government funding likely in 2024.

“This appears negative for the MMC-Gamuda JV but will likely be compensated by our estimated RM10 bil-RM15 bil (RM1 bil/km cost) single tunneling package, supported by the JV’s track record in MRT 1 & 2,” reckoned CGS-CIMB Research.

“To achieve a higher economic multiplier of three to four times vs the low of two times for MRT 1 and 2, the domestic rail supply chain will be maximised, including higher usage of Industrial Building Systems (IBS) and more work package contractors.”

All-in-all, CGS-CIMB Research reiterated its “neutral” outlook on the sector while preferring Gamuda Bhd and IJM Corp Bhd for their rail credentials and strong balance sheet for MRT 3 private sector funding as well as being potential frontrunners of tier 1 civil works tenders.

“We also prefer HSS Engineers Bhd as the group could secure sizeable engineering consultancy scopes from MRT 3 ahead of the civil works tenders. Key downside risk is further delays in MRT 3’s new targeted milestones,” added the research house. – Dec 10, 2021