FITCH Ratings expects ESG sukuk (Islamic bond) to cross US$50 bil outstanding globally within the next two years as issuers aim to meet their funding diversification goals and ESG (environment, social and governance) mandates alongside new regulatory frameworks and government-led sustainability initiatives.

Risks include geopolitical volatilities, surging oil prices that could reduce funding needs in some core sukuk markets, new sharia requirements that could alter sukuk credit risk and the weakening of the sustainability drive in core markets, according to the Big Three credit rating agencies.

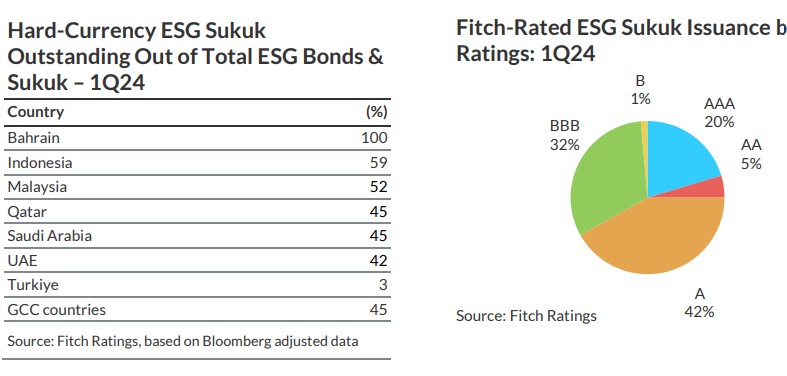

“Almost 99% of all Fitch-rated ESG sukuk are investment-grade. The year started with key regulatory initiatives which could support standardisation, ecosystem development and aid transparency,” revealed Fitch Ratings’ global head of Islamic finance in a non-rating action commentary.

“There is significant ESG sukuk growth potential with continuous efforts and increasing confidence to be key in unlocking this.”

In April, the United Arab Emirates’ (UAE) Securities and Commodities Authority announced the extension of the waiver of registration fees for green or sustainability-linked sukuk and bonds while Saudi Arabia and Oman have introduced Green Financing Frameworks.

The International Capital Market Association, the Islamic Development Bank and London Stock Exchange Group have further published new guidance on the issuance of ESG sukuk. These initiatives further support ESG ecosystem development.

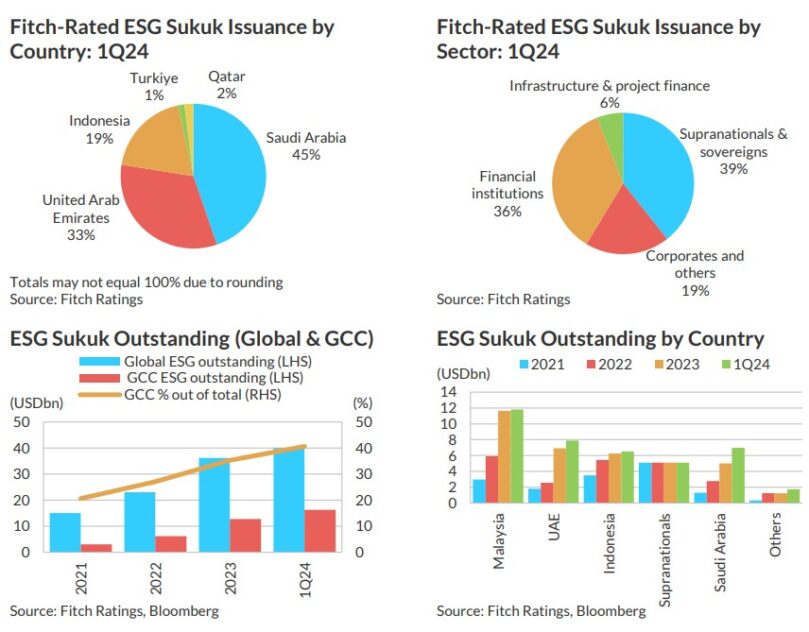

Global ESG sukuk rose by 60.3% year-on-year (yoy) to reach US$40 bil outstanding as of end-1Q 2024 (all currencies) with ESG sukuk making up 12% of global outstanding sukuk during that periof (hard currencies).

Fitch rated about 90% of the global hard-currency ESG sukuk or US$24.7 bil outstanding as of end-1Q 2024 (up 56% yoy). Saudi Arabia has the highest share (45%) of Fitch-rated ESG sukuk followed by the UAE (33%).

Sukuk has significant share of ESG debt in core markets. In the Gulf Cooperation Council (GCC) countries, ESG sukuk reached US$15.9 bil outstanding or 45% of the ESG debt mix with the balance in bonds.

ESG sukuk and bond issuance remains nascent in most Organisation of Islamic Cooperation (OIC) countries. – May 8, 2024