“HELLO @SPRMMalaysia, when do you want to enter Khazanah?”

Such is the question by social media influencer Roman Akramovich (@SyedAkramin) which encapsulates the anger of Malaysians over Khazanah Nasional Bhd’s recent disposal of early e-commerce pioneer and Malaysian start-up poster-child FashionValet (FV) at a 90% value loss from a post-money valuation of S$104.5 in 2019.

Hello @SPRMMalaysia, bila mahu masuk Khazanah? https://t.co/3IfXvAa7O3

— Roman Akramovich (@SyedAkramin) September 5, 2024

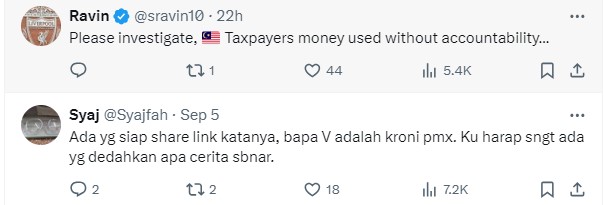

Roman Akramovich was not alone as he found many fans who similarly felt that an investigation by the Malaysian Anti-Corruption Commission (MACC) is warranted following FV’s cheap sale of US$1.1 mil to local investment firm NXBT Partners which is a personal investment vehicle of Time dotCom Bhd’s commander-in-chief Afzal Abdul Rahim.

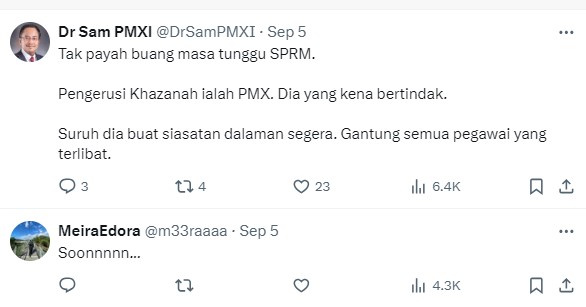

Interestingly, one commenter suggested that “there is no need to wait for MACC’s probe as PMX (Prime Minister Datuk Seri Anwar Ibrahim) who is chairman of the sovereign wealth fund should be the first to act”.

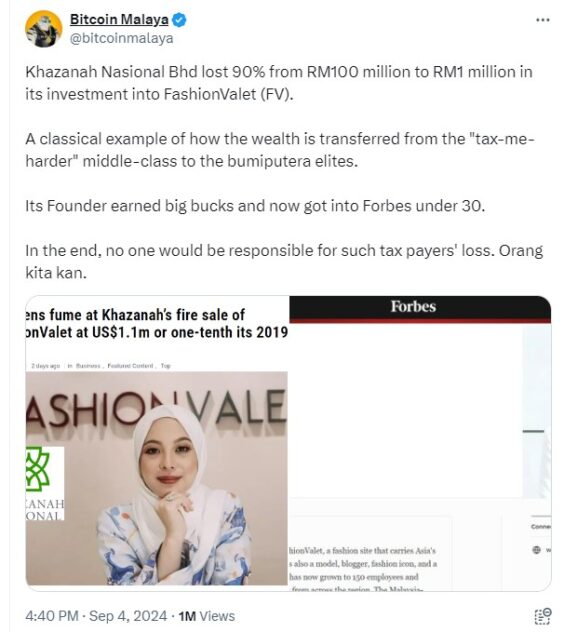

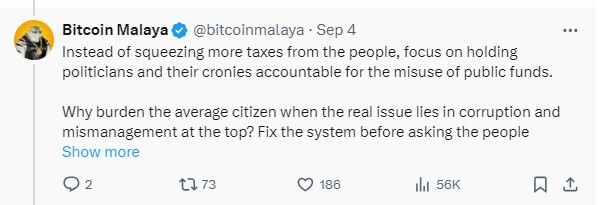

Earlier, another social media influencer Bitcoin Malaya (@bitcoinmalaya) whose view Roman Akramovich has reposted in his tweet has described the entire episode as “a classic example of how the wealth is transferred from the ‘tax-me-harder’ middle-class to the Bumiputera elites”.

“Its founder earned big bucks and now got into Forbes under 30. In the end, no one would be responsible for such taxpayers’ loss. Orang kita kan (literally, our own kind), right?” lamented Bitcoin Malaya.

“Instead of squeezing more taxes from the people, focus on holding politicians and their cronies accountable for the misuse of public funds. Why burden the average citizen when the real issue lies in corruption and mismanagement at the top? Fix the system before asking the people.”

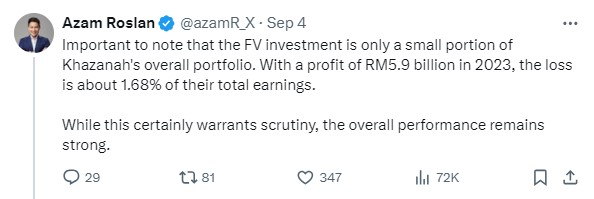

However, one commenter mooted the idea of looking at the bigger picture whereby “the FV investment is only a small portion of Khazanah’s overall portfolio”.

“With a profit of RM5.9 bil 2023, the loss is about 1.68% of their (Khazanah’s) total earnings. While this certainly warrants scrutiny, the overall performance remains strong,” he contended.

“I understand why the replies sound emotional, but let’s take a moment to consider the bigger picture. Anyone with any investment experience knows that not every investment yields positive returns. Losses are inevitable, especially in a large, diversified fund like Khazanah’s.” – Sept 6, 2024

Main image credit: SKALE’s