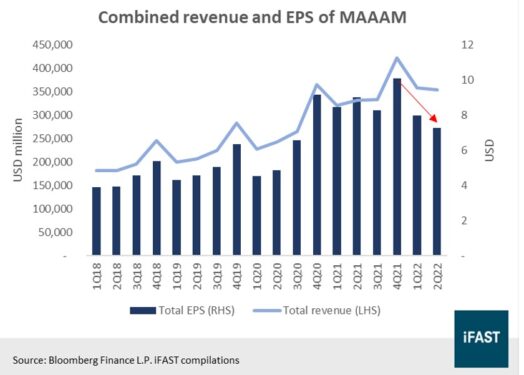

OVER the past couple of weeks, several Big Tech firms reported earnings and their stocks rallied even though their earnings results were not entirely spectacular (Figure 1).

The combined revenue of Microsoft, Amazon, Apple, Alphabet, and Meta (MAAAM) grew just 7% year-on-year in 2Q 2022 as compared to the double-digit growth in 2020 and 2021, while their earnings-per-share (EPS) saw a -20% yoy decline over the same period.

But instead of falling, their share prices rebounded because the results were not as bad as feared. Post the earnings results of the companies, the share price of Amazon jumped over 10%, while Netflix, Microsoft and Google (Alphabet) saw gains of roughly 7% each.

First of all, Microsoft missed expectations – its revenue was 1% lower than expected while its EPS was 1.9% lower than estimated.

However, the stock rallied as investors liked that Microsoft saw strong bookings growth and closed the biggest number of large deals. The positive management guidance of double-digit revenue and profit growth for the next 12 months was also a catalyst for the stock.

Meanwhile, Amazon beat revenue expectations, growing 7% yoy. This strength came as a surprise as markets had feared that Amazon would be hit by a pullback in spending by consumers.

Additionally, the Amazon Web Services division (cloud division) grew 33% yoy, beating expectations and also outperforming the other cloud peers in growth. Although management gave confidence in being able to mitigate the macroeconomic environment, the operating income guide of US$0-3.5 bil for the next quarter was well below expectations.

As for Alphabet, its revenue was in-line with expectations, growing 13% yoy with its search advertising division growing above the digital advertising industry at 14% yoy, driven by the resurgence of travel. This was the good news that investors liked although looking at other data points, such outlook does not look that rosy.

Its earnings missed expectations, declining by -11% yoy, growth at cloud and YouTube slowed while guidance from its management painted a challenging next six months as a cocktail of advertising spend pullback, foreign exchange (FX) headwinds, and tough comparables kick-in.

Apple’s revenue was in-line with consensus with its EPS beating estimates slightly as supply chain constraints were not as bad as expected. The company originally guided a US$4-8 bil impact due to supply chain and COVID-19 disruptions, but the actual impact was less than US$4 bil. Its results were better than expected, however, going forward the company mentioned macro weakness to weigh on performance.

Meta Platforms was the only Big Tech that did not see a rally as the company posted a -1% revenue growth which is the first in its history. But, if we look deeper into the company’s results, the picture looks not bad.

Firstly, Meta grew advertising revenues quarter-on-quarter (qoq) by 4.3% versus Google Search at 2.7% with similar FX headwinds. Secondly, Facebook app users returned to growth at +3% yoy while the Family of apps users grew by +6%, despite having to close the Russia business. Thirdly, Reels is doing well with a 30% increase in time spent on both the Facebook and Instagram apps.

All-in-all, the results across the board had been both good and bad. Even though earnings results were not spectacular, the stocks rallied. This gives a hint that investors are looking to get back into these stocks.

Another catalyst to the share price rally in the past two weeks was the expectation of the rate hike cycle to peak in 1Q 2023. After the last Federal Open Market Committee (FOMC) meeting on July 28 where rates were hiked by 75 basis points (bps) a second time, tech stocks saw a rally.

Just recently, the lower than expected US July inflation print of 8.5% also sent stock prices up.

However, given the challenging macroeconomic environment of inflation and rising interest rates, we see further downside risks including slowing consumption, delayed corporate spending, and a pullback in advertising as the economy slows.

Moreover, if inflation persists and the US Fed continues to hike rates past 1Q 2023, another round of tech sell-off could occur if markets are disappointed.

In conclusion, broadly speaking, given the downside risks and till we see positive catalysts, we recommend for investors to wait before going back into tech stocks. Key indicators investors should look out for the monthly inflation print and earnings resilience of the companies.

Nevertheless, we acknowledge that given the size and moat of Big Tech, these companies should fare better in weathering the storm. Certain segments are also more resilient such as the cloud business with Microsoft and Amazon as strong contenders. – Aug 23, 2022

iFAST Capital Sdn Bhd provides a comprehensive range of services such as assisting in dealing, investment administration, research support, IT services and backroom functions to financial planners.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.