THERE is a fascinating discovery to be made if one were to scrutinise carefully the Mass Rapid Transit Corporation Sdn Bhd (MRT Corp) Annual Report 2021.

The very fact that its RM56.66 bil accumulated losses supersedes that of the 1Malaysia Development Bhd (1MDB) and ailing national carrier Malaysia Airlines is astonishing.

Although the actual 1MDB losses cannot be ascertained given its latest audited financial statements had not been finalised – this is excluding what is perceived to be “stolen money” – the Government’s 2021 fiscal outlook report said the fraudulent sovereign wealth fund still has an estimated RM32.3 bil in outstanding debt as of September 2020.

Only an estimation of losses can be derived at this juncture for the 1MDB given its previous auditors, namely KPMG (2010, 2011 and 2012) and Deloitte (2013 and 2014), had withdrawn their reports and opinions on the fund’s financial statements.

As for the Malaysia Aviation Group Bhd (MAG) – the parent of Malaysia Airlines Bhd – it has completed its restructuring scheme on March 22 last year which saw it reducing RM15 bil worth of liabilities and eliminating RM10 bil of its total debts of RM25.7 bil along with RM5.7 bil in total cost savings and cost avoidance. The average haircut on debts its creditors took was 52% (The Edge Weekly, Dec 20-26, 2021 issue).

MRT Corp which prides itself as a developer of Malaysia’s urban rail transport infrastructure incurred loss after tax of RM3.67 bil for its FY2021 ended Dec 31, 2020 (FY2020: RM8.94 bil; FY2019: RM7.3 bil).

As of end-December 2021, MRT Corp’s accumulated losses had ballooned to RM56.65 bil with total assets of RM4.21 bil and total liabilities of RM2.74 bil.

Interestingly, the Finance Ministry (MOF)-owned entity behaves like many other government-linked companies (GLCs) in that despite being in the red since FY2016, its ailing financial state does not seem to affect the remuneration of its top brass.

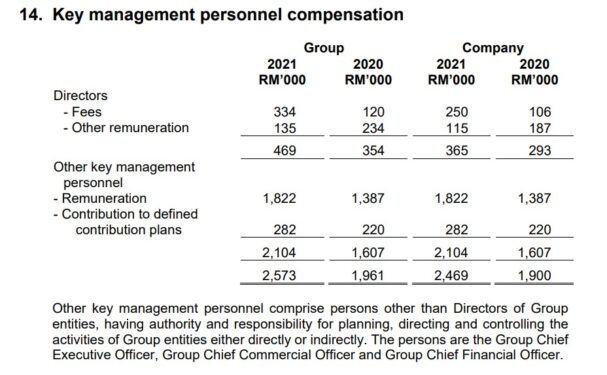

Its key management personnel compensation rose 31% (or RM610,000) to RM2.57 mil from RM1.96 mil previously.

The fees and other remuneration for its directors climbed to RM469,000 (FY2020: RM354,000) while that of other key management personnel – namely, group CEO, group chief commercial officer and group chief financial officer – jumped to RM2.57 mil (FY2020: RM1.96 mil).

The first line to be implemented by MRT Corp was the 46km Kajang Line (previously known as Sungai Buloh-Kajang Line) which runs through the city centre of Kuala Lumpur to Kajang. The line was fully operational in July 2017.

Last week, Prime Minister Datuk Seri Ismail Sabri Yaakob launched Phase One of the 57.7km Putrajaya Line (previously known as the Sungai Buloh-Serdang-Putrajaya Line or MRT2) which runs from Kwasa Damansara to Kampung Batu while Phase Two which will cover the remaining line is expected to be operational in January 2023.

On March 7, MRT Corp chairman and director Datuk Wira Azhar Abdul Hamid was reported to have resigned as chairman and director after having “a difference of opinion” on the implementation of the MRT3 Circle Line project.

Azhar who once helmed MRT Corp as its first CEO from 2011 to 2014 was appointed as MRT Corp chairman in May 2021. – June 21, 2022