KENANGA Investment Bank has maintained its neutral stance on the consumer sector following the introduction of Employees Provident Fund’s (EPF) Flexible Account (Akaun Fleksibel).

In a sector update on Friday (April 26), the research house said upon the introduction of the last EPF withdrawal scheme back in April 2022, sales of retailers had spiked but tapered off fairly quickly while monthly auto sales were muted.

It believes that the boost to sales of retailers will be more subdued this time around compared to what was seen in April 2022.

“This is because even if we assume full participation in Akaun Fleksibel, the total withdrawals during the first year are estimated at only RM25 bil compared to RM44.6 bil previously,” said Kenanga Research.

“All in, we make no change to our earnings forecasts or stock ratings. With minimal cutback on daily essentials particular food items despite high inflation, we anticipate more stable earnings from consumer staples players vs those of the consumer discretionary sector.”

Kenanga Research’s top picks remain F&N (OP; TP: RM33.80) and MRDIY (OP; TP: RM1.95).

It was reported previously that the EPF is set to undergo significant restructuring, reorganising its members’ existing two accounts into three to include the addition of the much-anticipated flexible account.

From May 11 onwards, EPF CEO Ahmad Zulqarnain Onn said monthly contributions would be split three ways: 75% into Account 1 (Retirement Account), 15% into Account 2 (Sejahtera Account), and 10% into Account 3 (Flexible Account).

According to a statement by EPF, Ahmad Zulqarnain said the introduction of the new flexible account will not affect the EPF’s overall portfolio.

Initially, dividends across all accounts will be uniform, but future variations may occur as liquid assets typically yield lower interest rates and dividends.

If all EPF members choose to opt in, it is projected that RM57 bil could be transferred to the Flexible Account, with about RM25 bil expected to be withdrawn in the first year, followed by annual withdrawals of RM4 bil to RM5 bil.

This compares with RM44.6 bil withdrawals under the previous withdrawal scheme in April 2022.

Minimal impact will also be expected on consumer discretionary and automotive sectors, said Kenanga Research.

“The initial three EPF withdrawal schemes – i-Lestari, i-Sinar, and i-Citra – were implemented to address urgent cash flow needs during Malaysia’s movement control orders and the economic downturn caused by the pandemic, making them incomparable to later schemes,” it said.

“The subsequent Pengeluaran Khas (Special Withdrawal) scheme in April 2022, allowing withdrawals of up to RM10k, is a more apt comparison as it occurred during the economic recovery phase post-pandemic.”

This scheme had attracted 6.6 million applications and facilitated the withdrawal of RM44.6 bil.

Meanwhile, monthly vehicle sales did not rise but actually fell in April and May 2022 after the introduction of the withdrawal scheme.

Assuming a blue-sky scenario where every EPF member opts into the Flexible Account and withdraws RM25 bil in the first year, the economic impact would still only be about half of that seen with the Special Withdrawal scheme.

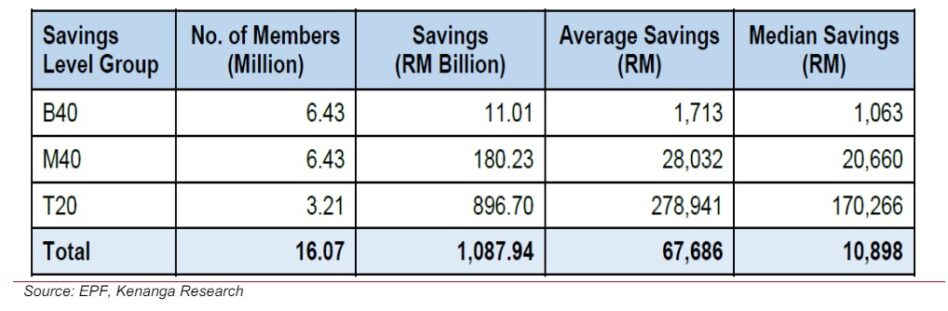

Considering the average EPF savings as of Dec 31, 2023 – RM1.7k for B40 and RM28k for M40 – the projected transfers to the Flexible Account would range between RM1,000 and RM3,000.

“Therefore, the launch of the Flexible Account is unlikely to significantly affect consumer discretionary sectors, including the automotive industry, which showed stable sales and backlog figures (200k-250k units) during the special withdrawal period of April-May 2022,” said Kenanga Research.

“Overall, we are of the view that contributors will allocate funds from the Flexible Account prudently, with minimal expenditure on high-ticket items.” – April 26, 2024

Main pic credit: Reuters