SET amid a high interest rate environment when the real estate sector tends to underperform, 2022 can prove to be yet another tough year to spur property sales in Malaysia.

Reiterating its “underweight” outlook on the sector, UOB Kay Hian Research expressed belief that the market has not fully priced in downside risk from the sector’s challenging earnings outlook.

“The sector is trading at standard deviation (1SD) below its five-year mean price-to-book (P/B) ratio,” analyst Hazmy Hazin pointed out in a sector update.

“While the return on equity (ROE) may be improving (from a low base), it might still be insufficient to re-rate the sector’s valuation without notable near-term catalysts given the lingering structural issues (amid aggressive launches in 2022) and other headwinds such as rising rates, higher materials costs and labour shortage that may pressure growth.”

According to UOB Kay Hian Research, its back-testing suggests that mortgage approval values were lower (or saw negative growth) after rate hikes.

“This led to the sector’s underperformance by falling behind the FBM KLCI after several rate hikes between 2005-2006 while the sector pulled back after outshining the FBM KLCI following rate hikes between 2010 and 2011 subsequent to the Global Financial Crisis (in 2008),” observed the research house.

“We believe the market could start pricing in more rate hikes going forward in tandem with the US bond tapering effect. That said, the sector could underperform as consumers’ sentiments towards big-ticket items may fade.”

On a brighter note, UOB Kay Hian Research expects the sector’s earnings to grow by 38% in 2022 from the low base in 2021, backed by strong unbilled sales and catch-up in construction work in the absence of a lockdown.

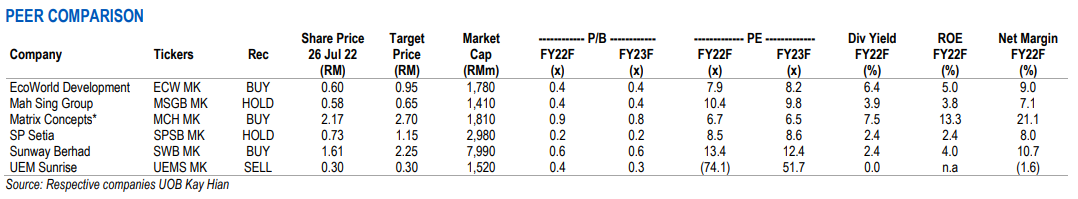

Within its coverage, the research house said Matrix Concepts Holdings Bhd and Sunway Bhd display the most resilient earnings growth going forward, supported by healthy unbilled sales of RM1.3 bil and RM4.2 bil respectively.

“In term of sales, Matrix Concepts and Eco World Development Group Bhd displayed the most promise in hitting their sales target for this year based on their latest quarterly results, while UEM Sunrise Bhd has the weakest sales momentum thus far, hitting only 7% of its full-year target in 1Q 2022,” revealed the research house.

“However, despite any slight easing in labour and materials costs next year, developers’ earnings may still tail off in 2023 due to more rate hikes anticipated ahead, on-going supply gluts, lack of supportive measures and deteriorating affordability.” – July 27, 2022