SINCE its AirAsia Group Bhd days, Capital A Bhd has never missed churning out both impressive and lengthy annual reports that depict every inch of its business operations.

Although deciphering the content of its annual report can be painstaking for the eyes and brain, it is sometimes worth the while as there are so many “profound truths” to be unearthed in the so-called “thick forest”.

A case in point was how FocusM had last week exposed co-founders Tan Sri Tony Fernandes and Datuk Kamarudin Meranun bagging fat pay cheques amounting to RM28 mil between them in FY2021 at a time when lesser-salaried AirAsia staff were subject to pay cuts.

Our latest discovery from Capital A’s 333-page thick maiden Annual Report 2021 (after its name change) has unveiled how both gentlemen had emerged as two prominent interested parties in the budget airline operator’s related party transactions (RPTs).

While Capital A deserves kudos for uplifting transparency, it had nevertheless left behind questions marks if it would be better off for the company to find better candidates by calling for tenders for the jobs that form the nature of its RPTs.

Otherwise, this gives the impression that there is no accountability in the execution of the RPTs with money perceived to be flowing from the left to right pocket, so to speak.

Value-for-money or not?

As per highlighted on pages 187–194 of Capital A’s latest annual report, there were altogether 36 RPTs during its FY2021 ended Dec 31, 2021 or an average of three RPTs per month – which is considered a high number considering that Malaysia was embroiled in various stages of the movement control order (including total lockdown) for at least half of the year while international borders were closed.

A scrutiny by FocusM showed that RPTs with AirAsiaX Bhd (AAX) made up 11 or 30.5% of the 36 RPTs while that involving Thai AirAsia X Co Ltd came in second with nine (25%) RPTs.

The remaining RPTs were forged with Tune Protect Group Bhd (four), Tune Talk Sdn Bhd (four), Notel Management Sdn Bhd (three), Indonesia AirAsia Extra (two) and one each with Tune Insurance Malaysia Bhd, Epsom College Malaysia Sdn Bhd and ECML Hotels Sdn Bhd.

In terms of value, the largest RPT was that involving the purchase of AAX’s cargo transportation capacity on routes operated by the airline which was valued at RM152.18 mil (US$36.33 mil) with Fernandes and Kamarudin deemed the interested parties.

The second largest RPT was that involving the provision of information technology system and security services by provided by AirAsia Bhd to Thai AAX which was valued at RM1.73 mil.

The third largest RPT involved the provision of travel insurance by Tune Insurance Malaysia to AirAsia’s customers for journeys originating in Malaysia which resulted in sales commission of RM1.34 mil received by AirAsia.

Interestingly, there were two overseas-oriented RPT executed by AAX and Thailand AAX with AirAsia (Guangzhou) Aviation Service Ltd which were valued at 103,119 yuan (RM67,231) and 1.17 million yuan (RM762,963) respectively.

Altogether, the value of 14 RPTs executed by Capital A throughout its FY2021 totalled around RM158 mil. Another 22 RPTs did not have value attached to them presumably because no monetary transactions took place in view of lockdowns or international border closure.

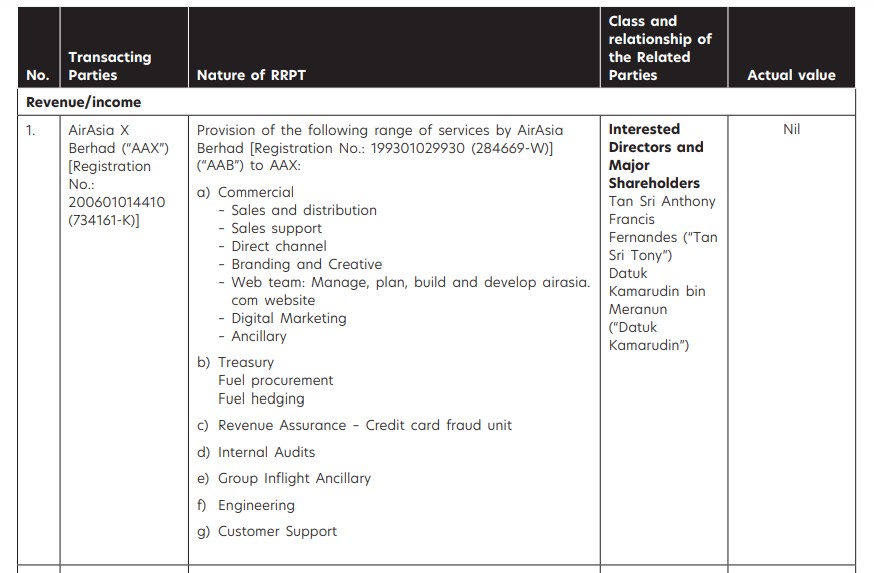

A good example of this would be the RPT involving AAX which entailed provision of the following shared services by AirAsia SEA Sdn Bhd:

- Finance and accounting support operation services;

- People department support operation services;

- Information and technology operation support services; and

- Sourcing and procurement operation support services

Below is another example:

Conclusion

Below is a good wrap-up of what RPT should and shouldn’t entail by legal firm Azmi & Associates’ partner Serina Abdul Samad and her colleague Kate Lock Kah Yan:

“RPTs per se are not banned or illegal. On the positive side, RPTs can offer contracting efficiency, transaction time and cost benefits in view that the complications and delays that often take place in negotiating contracts can be alleviated between related parties.

“On the negative side, RPTs are commonly perceived as red flag in detecting breaches to the arm’s length principle where RPTs may be engaged under the influence of existing business relationships and the agreed-upon price of the transactions may differ from actual fair market value.

“Wealth transfer to related companies via inter-group transactions which deteriorate earnings quality have been widely discussed. Approval requirements and disclosure practices serve as a governing tool to address the risk abusive RPTs.

“It has been criticised as erroneous to assume that RPTs are evidence of defective corporate governance and that stricter regulation of RPTs consequently equates to good law. What is vital is to ensure that RPTs which can present a conflict of interest are performed at arm’s length and in the best interest of the company.”

At 4.47pm, Capital A was up 0.5 sen or 0.72% at 69.5 sen with 6.58 million shares traded, thus valuing the company at RM2.89 bil. – May 20, 2022