ON Monday (March 14), the Hang Seng index (HSI) fell -5% and broke through the psychological 20,000 mark, extending its year-to-date (YTD) loss to more than -16%.

Likewise, growth-oriented Tech stocks bore the brunt of the sell-down with the HSTECH (Hang Seng TECH index) falling more than -6.2% on the day to extend its YTD loss to -32%.

The sell-off was exacerbated this week by the largest wave of COVID-19 cases in China since March 2020 and lockdowns in several Chinese cities such as Shenzhen which signifies China’s continuation of its zero COVID policy.

Markets could be pricing in the negative impact of prolonged lockdowns in China on its economy whether on its domestic demand or production.

HSI was down more than -37% from its Feb 17, 2021 peak to reach the lowest level since 2016. HSTECH was -65.5% from its Feb 17, 2021 peak.

Is the sell-down due to fundamentals or sentiment?

To determine this, we analysed the earnings estimates revisions for the HSI and HSTECH. At this juncture, we have noted slight downgrades to HSI 2022 earnings and 2023 earnings by -1.9% and -1.6% respectively.

Meanwhile, earnings for HSTECH in 2022 and 2023 were upgraded by 1.5% and 1.4% respectively. The minor downgrades do not warrant such a hefty drawdown that we have been witnessing YTD.

In fact, HSTECH fundamentals improved slightly and does not justify the huge retracement at all.

Although we do not rule out further downwards revisions in earnings to reflect the potential economic slowdown, we think markets are overly bearish and have priced in a lot of the negativity.

As such, we believe that the YTD sell-down is mainly sentiment driven as retail investors panic sell amid the increased fear and volatility. We attribute the huge swings to the high retail participation in Hong Kong’s share market (contributing as much as 30% to Hang Seng’s turnover).

HSI and HSTECH valuation has gone from “cheap” to “super cheap”

As mentioned earlier in the article, following the huge retracement, the Hang Seng has fallen to lowest level since 2016 while its fundamentals remain largely intact.

Looking further into the future, HSI stocks are expected to grow earnings by 14.2% and 10.8% in 2023 and 2024 respectively (see Table 1).

As a result, Hang Seng is currently trading more than -1 standard deviation lower than the 10-year historical average P/E (price-to-earnings ratio).

HSI is trading at 9.4 times forward PER2022, 8.2 times forward PER2023, and 7.4 times forward PER2024 which are significantly lower than our in-house fair PE of 12.5 times. In other words, the upside potential for Hang Seng has widened to 69% by end-2024.

Meanwhile, the tech sector is expected to be the main growth driver for HSI with HSTECH expected to see strong earnings growth of 37.1% and 26% in 2023 and 2024 respectively.

In terms of valuations, HSTECH is trading at 19.6 times forward PER2022, 14.3 times PER2023 and 11.3 times PER2024 compared to our in-house fair PE of 30 times which represents an upside potential of 165%.

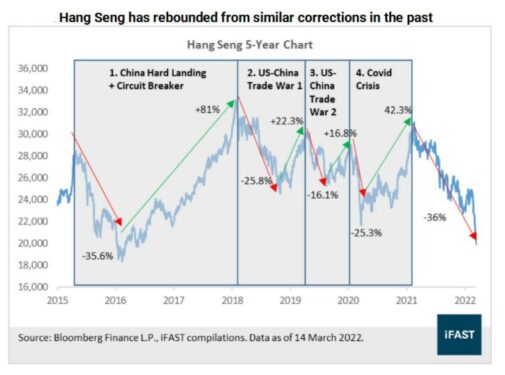

There is light at the end of each tunnel given the HSI 2022 sell-down is reminiscent of past sell-downs. One common outcome is that amid the doom and gloom, the index still managed to see some light at the end of each tunnel and recover:

- China Hard Landing + Circuit Breaker: Amid the slowdown in the Chinese economy in 2015 and the unprecedented Circuit Breaker event in early 2016, HSI retraced as much as -35.6% to 18,319 which is one cheapest levels seen in years in terms of forward P/E. Over the following two years, the HSI rebounded by as much as 81% to 33,154 in early 2018.

- US-China Trade War 1: 2018 was marred by the US-China trade war, and the HSI was not spared, dropping -25.8% to about 24,585 towards end-2019. The start of 2019 saw a strong 22.3% rebound to 30,130 as trade war tensions eased.

- US-China Trade War 2: Towards mid-2019, the US-China trade war resurfaced, prompting the HSI to retrace by -16.1% to 25,281. Eventually, HSI recovered towards end-2019 by +16.8% to 29,056.

- Covid-19 Crisis: In early 2020, global equities were brought down to earth again by the COVID-19 pandemic. HSI fell sharply by -25.3% to the 21,709 level. Subsequently, investors piled into China due to its well-managed COVID-19 situation and the HSI subsequently rebounded +43.3% to 31,084.

As mentioned above, the minor downgrades do not warrant such a hefty drawdown that we have been witnessing YTD. We believe that the YTD sell-down is mainly sentiment driven as retail investors panic sell amid the increased fear and volatility.

As long-term value investors, “the time to buy is when there’s blood in the streets”. We believe that this could be an opportunity to pick up good names at oversold prices.

On the other hand, we advise existing investors to stay invested and, if possible, average down on their positions in order to recover the losses faster.

That said, investors may have to be patient and bear with the volatility while the markets recover as we have seen before many times in the past. – March 17, 2022

iFAST Capital Sdn Bhd provides a comprehensive range of services such as assisting in dealing, investment administration, research support, IT services and backroom functions to financial planners.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.

Main photo credit: Taipei Times