I REFER to statement and media conference made by Tasek Gelugor MP Wan Saiful Wan Jan on the issue of income contingent loan repayments (ICLR) for the National Higher Education Fund (PTPTN) loans that was raised by Prime Minister Anwar Ibrahim on Oct 23.

For the record, I served as a board member of PTPTN from June 2018 to January 2020. I was appointed as a board member of PTPTN before I took up the position as deputy minister of international trade and industry in July 2018.

I was appointed because of my knowledge on the financial and policy positions of PTPTN. When I was the Penang Institute general manager, I had published a report examining the financial sustainability of PTPTN.

I think Wan Saiful tried his best during this time as PTPTN chairman to find ways of improving PTPTN’s financial position and to bring about some management changes, including the promotion of Ahmad Dasuki Abdul Majid to his current position of CEO.

But his effectiveness was hampered over communication challenges he had with the education minister during Tun Dr Mahathir Mohamad’s administration and the higher education minister during the Tan Sri Muhyiddin Yassin’s and Datuk Seri Ismail Sabri Yaakob’s administrations.

Wan Saiful is right to say that in December 2018, Anwar and the then PKR Youth chief Akmal Nasrullah Mohd Nasir did raise concerns with regard to the income contingent loan repayments (ICLR) that were proposed by himself.

Ideas aplenty

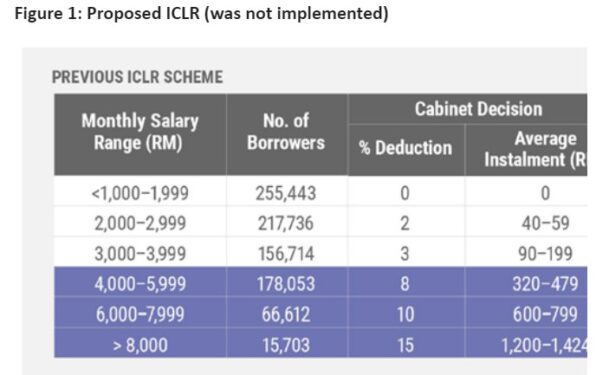

The challenge was not so much objecting to the concept of ICLR but the way it was going to be implemented. The proposal to significantly reduce the amount of loan repayment for those earning below RM2,000/month also included increasing the monthly repayments of those earning higher salaries.

For example, this would have meant a big jump in monthly repayments of those earning above RM4,000/month.

On hindsight, what should have been proposed was an ICLR that was more gradual according to larger income brackets and to have implemented this only for new PTPTN recipients rather than existing borrowers because new borrowers would know about the ICLR right from the start and not be shocked by higher repayment rates if they were to earn a higher salary soon after graduating.

They could then plan their finances accordingly including servicing their car loans, their mortgages (if any) and their other monthly fixed expenses.

There were also discussions on exempting those earning below RM4,000/month from servicing their PTPTN loans but the financial cost to the government would have reached almost RM15 bil for five years, hence this was seen as too prohibitive.

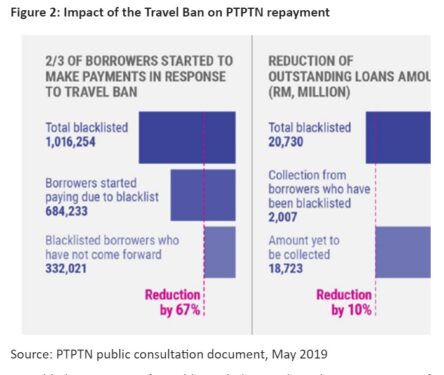

There were other ideas put on the table including mandatory monthly salary deductions; harsher enforcement measures against the hardcore defaulters; passport and driver’s license restrictions (as an alternative to the very successful but not very popular travel ban), requiring a family member to a guarantor; removal of the first-class honours waiver and to replace it with a partial waiver; reduction of loans (with sufficient notice); and discontinue loans to low-rated and non-rated private institutions and courses, to name aa few proposals.

Disagree with Wan Saiful

I would also propose a few additional ideas such as the securitisation of some of the PTPTN loans with higher repayment rates (such as those loans from students who graduated with STEM degrees who are able to secure higher paying jobs) and working with responsible debt collecting agencies such as Collectius and others to increase the repayment rate, especially among the defaulters.

The problems at PTPTN are serious. It has been functioning as a cash flow entity for many years rather than as a P&L (profit and loss) entity.

Its contingent liabilities exceed RM40 bil and the government has to cover its interest payments to the tune of RM2 bil a year (and growing).

I do not quite agree with Wan Saiful that PTPTN should be placed under MOF and act more like a financial institution with more powers to invest its funds from the Skim Simpanan Pendidikan Nasional (SSPN) savings and for it to go out to secure more savings.

This would detract PTPTN from its original purpose as a lender to students for higher education, especially for those in the B40 category.

If Wan Saiful is still serious about PTPTN reforms, he should offer his services and experiences as a pro-bono consultant to PTPTN! – Nov 2, 2023

Former DAP Bangi MP Dr Ong Kian Ming sat on the National Higher Education Fund (PTPTN) board from June 2018 to January 2020.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.