MUAR Ban Lee Group Bhd (MBL) which is renowned for its innovative approach in the palm kernel oil industry is poised to navigate challenges posed by the looming El Niño with strategic foresight and technological prowess.

As El Niño threatens palm oil production in major producers like Indonesia and Malaysia, MBL’s diversification and technological advancements in palm kernel oil processing along with its ventures into the biogas sector showcase the gorup’s resilience and potential as a key player in the evolving market.

A climatic event known for its disruptive impact on agriculture, the looming El Niño is a significant concern for major palm oil-producing nations like Indonesia and Malaysia.

While experts debate the extent of El Niño’s impact in 2024, factors like an increased labour force and mature plantations might mitigate its effects.

Contrary to other analysts who foresee a decline, the Malaysian Palm Oil Board (MPOB) has even projected an increase in local palm oil production for 2024. Nonetheless, the anticipated impact is predicted to be less severe compared to the previous El Niño events in 2015/2016 and 199719/98, mainly due to a milder effect on rainfall.

BMI Industry Research, a division of Fitch Solutions, foresees a rebound in palm oil prices for 2024 to RM3,515/metric tonne from RM3,400/metric tonne.

Similarly, the Malaysian Palm Oil Council (MPOC) expects an average trading price of RM4,000/metric per tonne, influenced by shifting supply and demand dynamics, particularly in Indonesia following the B35 biofuel policy last year as well as China’s additional purchase.

Following the recent visit of Prime Minister Datuk Seri Anwar Ibrahim to China, an agreement was reached, leading to China’s increased imports of palm oil which itself signifies a notable boost to the industry.

Strategic advancements

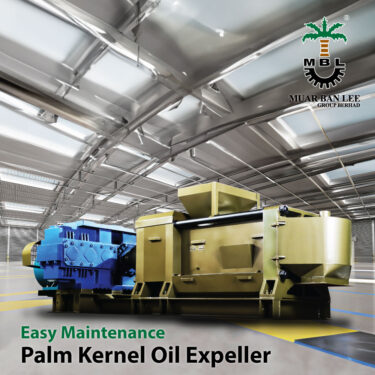

In response to these market dynamics, MBL is leveraging advanced technology in palm kernel oil processing and exploring opportunities in biogas.

The expected rise in palm oil prices presents MBL with the opportunity to increase revenue from its core operations. The group’s involvement in biogas aligns with the global trend towards renewable energy (RE) while offering an alternative application for palm oil, potentially reducing production risks associated with El Niño.

“MBL’s investment in cutting-edge technology is a game-changer, enhancing our efficiency and yield in palm kernel oil processing,” a MBL top management representative told FocusM on condition of anonymity.

“This strategic move positions us to maximise our resources and maintain a competitive edge, especially in times of reduced production.”

The anticipated global upswing in palm oil demand, driven by biogas, positions MBL favourably. As biogas gains prominence in the energy sector, MBL’s involvement could lead to new revenue streams and market opportunities.

MBL’s venture into biogas marks a strategic move, aligning with the global shift towards RE. By converting palm oil production waste into energy, MBL addresses environmental concerns and taps into a burgeoning market. This diversification also provides a buffer against the volatility of palm oil prices and production levels.

Financial resilience

Moreover, MBL’s strategic divestiture of a 51.0% stake in PT. Serdang Jaya Perdana for RM11.0 mil has streamlined its financial portfolio, boosting cash flow and overall financial stability.

By shedding a low-yield asset, such exercise enables the company to focus its efforts on more lucrative ventures. Post-divestment, the group’s revenue normalised to RM74.58 mil in its 3Q FY2023 ended Sept 30, 2023 with its core manufacturing business contributing RM51.97 mil.

Meanwhile profit after tax jumped 62.5% quarter-on-quarter (qoq) to RM4.98 mil during the quarter under review driven by heightened demand in its manufacturing division.

In terms of the business outlook, a substantial order book and a favourable business climate could boost earnings in the near term. The group’s success is underpinned by its diverse product and service offerings in the palm oil industry, notably its commitment to sustainability.

Initiatives like the Empty Fruit Bunch (EFB) biogas plants and palm oil mill effluent (POME) water treatment systems exemplify MBL’s dedication to environmental stewardship, turning waste products into energy and managing wastewater efficiently.

The shift towards RE is a key driver of MBL’s robust earnings growth prospects. This transition not only aligns with global environmental goals but also presents lucrative opportunities for the company.

Attractive valuation

From an investment perspective, MBL presents an attractive valuation. The group’s net asset per share at 95 sen is significantly higher than its current share price of around 45 sen. Prior to the COVID-19 pandemic, MBL had a strong track record of dividend payouts, suggesting potential future dividends as business normalizes.

However, challenges loom on the horizon, particularly concerning the impact of El Niño. This climatic phenomenon poses risks to palm oil production, potentially affecting supply and prices.

MBL must navigate these uncertainties which could affect production volumes and revenue. The company’s response to these challenges will be crucial in maintaining its growth trajectory and fulfilling its commitments to shareholders and clients.

“We are acutely aware of the challenges ahead. Our strategy is to stay nimble, adapt quickly, and leverage our technological and market strengths to weather these uncertainties,” an MBL senior executive told FocusM.

In essence, while MBL is positioned for success with its diversified business model, technological advancements and commitment to sustainability, it must remain vigilant and adaptive to overcome the challenges posed by El Niño and other market fluctuations.

This proactive approach will be key to sustaining its growth and upholding its reputation in the industry.

At the close of today’s trading, MBL was up 1 sen or 2.3% to 44.5 sen with 703,900 shares traded, thus valuing the company at RM111 mil. – Feb 23, 2024